Comparing Travel Insurance Plans: A Senior's Side-by-Side Guide

Compare travel insurance plans side-by-side. Evaluate coverage options, policy limits, and deductibles. Find the best plan for your budget and travel needs. A helpful guide for seniors.

So, you're planning a trip – awesome! As a senior, travel can be incredibly rewarding, but it's also smart to be prepared for the unexpected. That's where travel insurance comes in. But with so many options out there, how do you even begin to choose the right plan? Don't worry, we're going to break it down, side-by-side, so you can confidently pick the perfect policy for your adventure.

Understanding Your Travel Insurance Needs as a Senior

Before diving into specific plans, let's think about what's important to *you*. Everyone's different, so a one-size-fits-all approach just won't cut it. Consider these factors:

- Your Health: Do you have any pre-existing conditions? Are you taking any medications? This will significantly impact the type of coverage you need.

- Your Destination: Are you staying within the US, or traveling internationally? Some plans offer limited or no coverage outside the country.

- Your Activities: Are you planning on relaxing on the beach, or going on a challenging hike? More adventurous activities might require specialized coverage.

- Your Budget: Travel insurance can range from relatively inexpensive to quite pricey. Set a budget and stick to it.

- Trip Cost: How much money have you invested in your trip? This will help determine how much trip cancellation/interruption coverage you need.

Key Travel Insurance Coverage Options for Seniors

Now that you know what *you* need, let's look at the different types of coverage you'll encounter:

- Trip Cancellation: Reimburses you for non-refundable trip costs if you have to cancel for a covered reason (illness, injury, death, etc.).

- Trip Interruption: Reimburses you for expenses incurred if your trip is interrupted after it's already started.

- Emergency Medical: Covers medical expenses if you get sick or injured while traveling.

- Emergency Medical Evacuation: Covers the cost of transporting you to a medical facility if you require emergency care. This can be *extremely* expensive without insurance, especially from remote locations.

- Baggage Loss/Delay: Reimburses you for lost, stolen, or delayed baggage.

- Accidental Death & Dismemberment (AD&D): Provides a benefit in the event of accidental death or dismemberment during your trip.

Side-by-Side Comparison of Popular Travel Insurance Plans for Seniors

Okay, let's get to the nitty-gritty! We're going to compare a few popular travel insurance providers, highlighting their strengths and weaknesses. Remember, prices and coverage can change, so always get a quote based on your specific trip details.

Plan 1: Allianz Travel Insurance (AllTrips Premier Plan)

Overview: Allianz is a well-known and reputable provider offering a range of plans. The AllTrips Premier Plan is an annual plan, making it a good option for frequent travelers.

- Pros: Comprehensive coverage, including trip cancellation/interruption, emergency medical, baggage loss/delay, and rental car protection. Offers pre-existing condition waivers under certain circumstances. 24/7 assistance services.

- Cons: Annual plan may not be suitable for infrequent travelers. Can be more expensive than single-trip policies.

- Example Use Case: A senior who takes multiple trips per year, both domestically and internationally, and wants comprehensive protection.

- Approximate Price: Varies greatly based on age, state of residence, and level of coverage. Expect to pay several hundred dollars per year.

Plan 2: World Nomads Explorer Plan

Overview: World Nomads is popular among adventure travelers, but their Explorer Plan can also be a good option for seniors who plan active trips.

- Pros: Covers a wide range of adventure activities. Offers emergency medical and evacuation coverage. Flexible policy options.

- Cons: May not be the best choice for travelers primarily interested in relaxing vacations. Can be more expensive than basic plans. Pre-existing condition coverage is limited.

- Example Use Case: A senior planning a hiking trip in the national parks or a scuba diving vacation.

- Approximate Price: Depends on the length of the trip, destination, and age of the traveler. Could range from $100 to $500+ for a two-week trip.

Plan 3: Travel Guard Essential Plan

Overview: Travel Guard offers a variety of plans, and the Essential Plan is a more budget-friendly option that still provides decent coverage.

- Pros: Affordable. Covers trip cancellation/interruption, emergency medical, and baggage loss/delay.

- Cons: Lower coverage limits compared to more comprehensive plans. May not be suitable for travelers with significant pre-existing conditions.

- Example Use Case: A senior on a limited budget who wants basic coverage for a domestic trip.

- Approximate Price: Generally less expensive than Allianz or World Nomads. A week-long trip within the US could cost under $100.

Plan 4: Travelex Travel Select Plan

Overview: Travelex is another reputable provider with a range of options. The Travel Select plan allows for customization with various add-ons to tailor the coverage to your needs.

- Pros: Customizable coverage with add-ons for things like adventure sports or increased baggage limits. Offers trip cancellation for any reason (CFAR) as an optional upgrade (at an additional cost).

- Cons: Can become expensive if you add many optional coverages. Requires careful consideration of your specific needs to ensure adequate protection.

- Example Use Case: A senior who wants to customize their coverage to include specific activities or who is concerned about needing to cancel their trip for any reason.

- Approximate Price: Varies significantly depending on the base plan and added coverages. Could range from $80 to $400+ for a two-week trip.

Plan 5: Seven Corners RoundTrip Choice Plan

Overview: Seven Corners specializes in international travel insurance and the RoundTrip Choice plan offers robust coverage for medical emergencies and trip interruptions.

- Pros: High limits for medical coverage, including emergency medical evacuation. Offers coverage for pre-existing conditions if purchased within a certain timeframe of the initial trip deposit.

- Cons: May be more expensive than other plans with lower medical limits. May not be necessary for domestic travel.

- Example Use Case: A senior traveling internationally, particularly to a country with high healthcare costs, who wants peace of mind knowing they have ample medical coverage.

- Approximate Price: Can be more expensive than other options due to the high medical limits. Expect to pay $150 to $600+ for a two-week international trip.

Specific Product Recommendations and Comparison Table

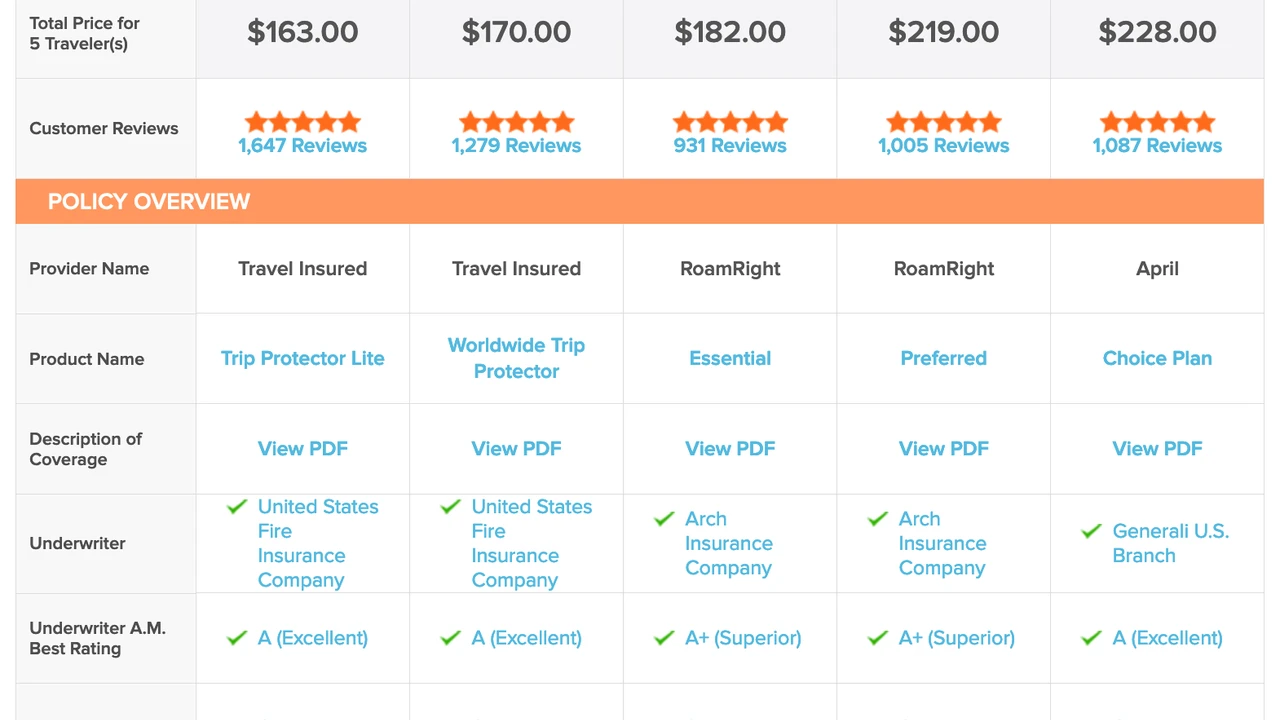

Here's a quick overview of the plans and some key features. Remember, these are just examples, and you should always get a personalized quote!

| Plan | Provider | Key Features | Approximate Price (2 weeks, 70-year-old) | Best For |

|---|---|---|---|---|

| AllTrips Premier | Allianz | Annual plan, comprehensive coverage, pre-existing condition waiver (conditions apply) | $300 - $600 (Annual) | Frequent travelers seeking comprehensive protection |

| Explorer Plan | World Nomads | Adventure activities coverage, emergency medical & evacuation | $150 - $400 | Active seniors planning adventurous trips |

| Essential Plan | Travel Guard | Affordable, basic coverage | $80 - $150 | Budget-conscious seniors on domestic trips |

| Travel Select | Travelex | Customizable coverage, CFAR add-on option | $100 - $300+ | Seniors who want to tailor coverage to their specific needs |

| RoundTrip Choice | Seven Corners | High medical limits, pre-existing condition coverage (conditions apply) | $200 - $500 | Seniors traveling internationally with concerns about medical expenses |

Factors Affecting Travel Insurance Costs for Seniors

Several factors influence the cost of travel insurance for seniors. Understanding these can help you make informed decisions and potentially save money:

- Age: Older travelers generally pay higher premiums due to increased risk of medical issues.

- Destination: Travel to countries with high healthcare costs or higher risk of political instability will typically increase premiums.

- Trip Length: Longer trips naturally require more coverage and will result in higher premiums.

- Coverage Amount: Higher coverage limits for medical expenses, trip cancellation, and other benefits will increase the cost.

- Deductible: Choosing a higher deductible can lower your premium, but you'll need to pay more out-of-pocket if you file a claim.

- Pre-existing Conditions: Coverage for pre-existing conditions can significantly increase premiums, or may even be excluded altogether.

- Type of Plan: Comprehensive plans with more features and higher limits will typically cost more than basic plans.

Tips for Finding the Best Travel Insurance Deals for Seniors

Finding the right travel insurance at the best price requires some research and planning. Here are a few tips to help you save money:

- Compare Quotes: Get quotes from multiple providers to find the best rates and coverage options. Use comparison websites to streamline the process.

- Consider an Annual Plan: If you travel frequently, an annual plan may be more cost-effective than purchasing individual policies for each trip.

- Look for Discounts: Some providers offer discounts for seniors, members of certain organizations, or for purchasing coverage early.

- Adjust Your Deductible: Increasing your deductible can lower your premium, but be sure you're comfortable with the higher out-of-pocket cost.

- Read Reviews: Check online reviews to see what other seniors have to say about their experiences with different providers.

- Purchase Early: Some plans offer pre-existing condition waivers if you purchase coverage within a certain timeframe of making your initial trip deposit.

- Consider a Group Plan: If you're traveling with a group, you may be able to get a discounted rate on a group travel insurance policy.

Understanding Policy Limits and Deductibles

It's crucial to understand the policy limits and deductibles before purchasing travel insurance. The policy limit is the maximum amount the insurance company will pay for a covered loss. Make sure the limits are sufficient to cover potential medical expenses, trip cancellation costs, and other covered benefits. The deductible is the amount you'll need to pay out-of-pocket before the insurance company starts covering expenses. Choosing a higher deductible can lower your premium, but you'll need to be prepared to pay that amount if you file a claim.

The Importance of Reading the Fine Print

Before purchasing any travel insurance policy, carefully read the fine print to understand the terms, conditions, and exclusions. Pay close attention to the following:

- Covered Events: What types of events are covered by the policy? Make sure it includes coverage for things like trip cancellation, trip interruption, medical emergencies, and baggage loss.

- Exclusions: What types of events are *not* covered by the policy? Common exclusions include pre-existing conditions (unless waived), acts of war, and participation in extreme sports.

- Claim Filing Procedures: How do you file a claim? What documentation is required? Make sure you understand the process so you can file a claim correctly if needed.

- Pre-Existing Condition Waivers: If you have pre-existing conditions, look for policies that offer waivers that will cover those conditions under certain circumstances.

- 24/7 Assistance Services: Does the policy offer 24/7 assistance services, such as medical referrals, translation assistance, and emergency travel arrangements? These services can be invaluable in case of an emergency.

Final Thoughts: Choosing the Right Travel Insurance for Your Senior Trip

Selecting the right travel insurance plan is a personal decision that depends on your individual needs, budget, and travel plans. By carefully considering your options, comparing quotes, and understanding the policy terms, you can find a plan that provides the coverage and peace of mind you need to enjoy your trip to the fullest. Don't hesitate to contact a travel insurance agent or broker for personalized advice and assistance.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)