Do You Need Travel Insurance? A Senior's Checklist

Is travel insurance necessary for your senior trip? Consider pre-existing conditions, trip costs, and potential emergencies. This checklist helps US seniors make informed decisions.

Why Seniors Should Consider Travel Insurance Pre-existing Conditions Coverage

Okay, so you're planning a trip! That's fantastic! But before you pack your bags and dream of sunny beaches or historical landmarks, let's talk about something that might not be as exciting but is incredibly important: travel insurance. As a senior, your needs are different from those of a younger traveler. You might have pre-existing health conditions, be traveling for longer periods, or simply want that extra peace of mind. This article will walk you through a checklist to help you decide if travel insurance is right for you.

Senior Travel Insurance Checklist Item 1 Your Pre-Existing Conditions

This is probably the biggest factor for many seniors. Do you have any pre-existing medical conditions? This could be anything from diabetes or heart disease to arthritis or asthma. If you do, you need to be extra careful about travel insurance. Many policies have clauses about pre-existing conditions, and some might not cover them at all.

What to consider:

- Does your current health insurance cover you while you're traveling? Medicare, for example, generally doesn't cover healthcare outside the US.

- Look for policies that offer waivers for pre-existing conditions. These waivers typically require you to purchase the insurance within a certain timeframe of booking your trip (usually 14-21 days).

- Be honest about your medical history when applying for insurance. Hiding information could invalidate your policy.

Senior Travel Insurance Checklist Item 2 Trip Costs and Potential Losses

Think about how much money you've invested in your trip. This includes flights, accommodation, tours, and any other pre-paid expenses. If something were to happen and you had to cancel your trip, would you be able to afford to lose that money?

What to consider:

- Trip cancellation insurance can reimburse you for non-refundable expenses if you have to cancel your trip for a covered reason (illness, injury, death, etc.).

- Trip interruption insurance can help if your trip is interrupted after it's already started. This could cover things like medical emergencies, natural disasters, or family emergencies.

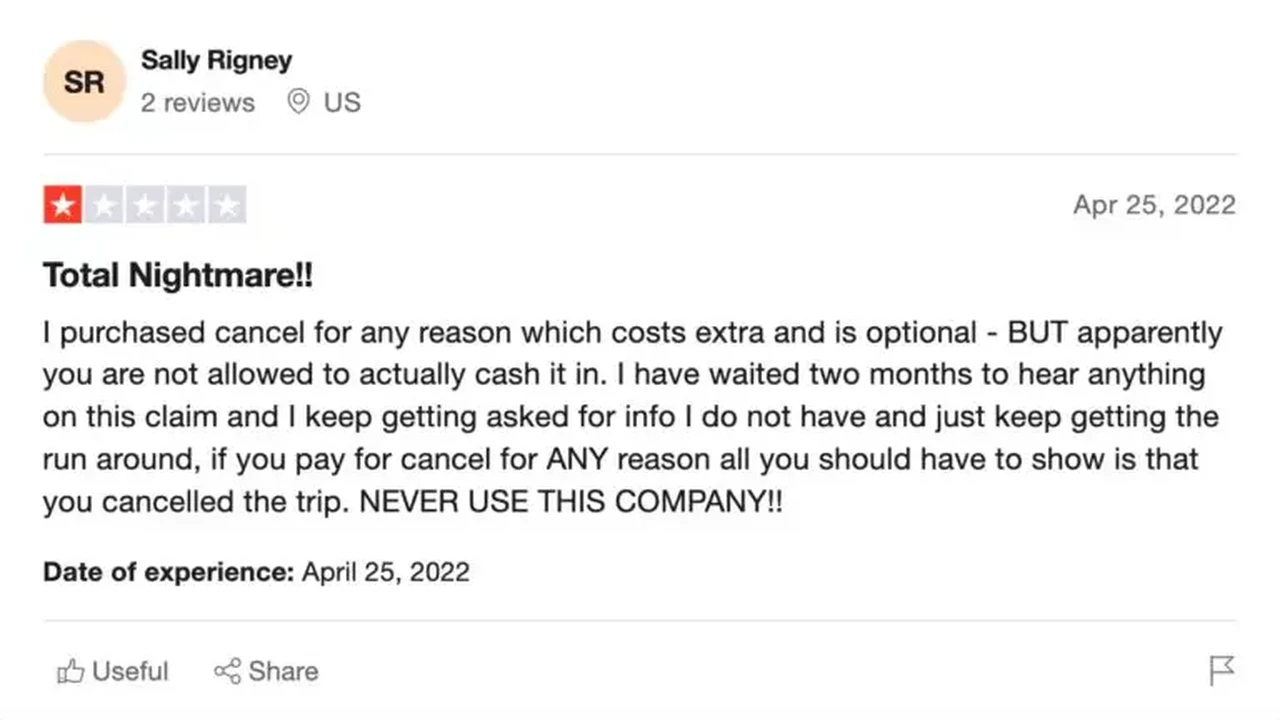

- Consider "Cancel For Any Reason" (CFAR) insurance if you want the flexibility to cancel your trip for any reason, even if it's not covered by a standard policy. CFAR policies are more expensive but offer the most flexibility.

Senior Travel Insurance Checklist Item 3 Potential Medical Emergencies Abroad Medical Coverage

Medical care in other countries can be very expensive, especially in countries like Switzerland or even some Caribbean islands. Your existing health insurance might not cover you, and even if it does, it might not cover the full cost.

What to consider:

- Look for policies that offer comprehensive medical coverage, including emergency medical evacuation.

- Emergency medical evacuation can be incredibly expensive (think tens of thousands of dollars) if you need to be transported to a hospital or back home.

- Make sure the policy covers pre-existing conditions, if applicable, and has adequate coverage limits for medical expenses.

Senior Travel Insurance Checklist Item 4 Considering Your Destination and Activities

Where are you going, and what are you planning to do? Some destinations are riskier than others. Certain activities, like hiking, skiing, or scuba diving, can also increase your risk of injury.

What to consider:

- If you're traveling to a remote area, make sure your policy covers medical evacuation from that location.

- If you're participating in adventure activities, look for policies that specifically cover those activities. Some policies exclude certain high-risk activities.

- Check the US State Department website for travel advisories and warnings for your destination.

Senior Travel Insurance Checklist Item 5 Length of Your Trip Long Stay Insurance Options

Are you going on a short trip or a long stay? The longer you're away from home, the greater the chance that something could go wrong.

What to consider:

- Long-term travel insurance policies are designed for extended trips. These policies often offer more comprehensive coverage and higher limits.

- If you're planning to live abroad for an extended period, you might need a different type of insurance, such as international health insurance.

Senior Travel Insurance Checklist Item 6 Baggage Loss and Personal Belongings Coverage

Losing your luggage or having your personal belongings stolen can be a major hassle, especially when you're traveling.

What to consider:

- Baggage loss and delay coverage can reimburse you for lost or delayed luggage.

- Check the policy limits to make sure they're adequate to cover the value of your belongings.

- Consider purchasing additional coverage for valuable items like jewelry or electronics.

Senior Travel Insurance Checklist Item 7 Age Restrictions and Policy Limitations

Some travel insurance policies have age restrictions or limitations on coverage for older travelers.

What to consider:

- Read the policy carefully to understand any age restrictions or limitations.

- Look for policies that are specifically designed for seniors. These policies often offer more comprehensive coverage and higher limits.

- Don't assume that all policies are the same. Compare quotes and read the fine print before making a decision.

Senior Travel Insurance Checklist Item 8 Cost vs Coverage Finding the Right Balance

Travel insurance can be expensive, but it's important to remember that you're paying for peace of mind. Don't just choose the cheapest policy without considering the coverage it offers.

What to consider:

- Compare quotes from multiple insurance providers.

- Consider raising your deductible to lower your premium.

- Look for discounts for seniors or members of certain organizations (like AARP).

Senior Travel Insurance Product Recommendations and Comparisons

Now that you have a better understanding of what to look for in travel insurance, let's take a look at a few specific products and compare them. Please note that prices can vary depending on your age, destination, trip length, and coverage options. The prices listed below are estimates and should be verified with the insurance provider directly.

Senior Travel Insurance Allianz Travel Insurance Prime Plan

Overview: Allianz Travel Insurance is a well-known and reputable provider offering a variety of plans. The Prime Plan is a comprehensive option suitable for seniors.

Coverage Highlights:

- Trip cancellation and interruption coverage

- Emergency medical and dental coverage

- Emergency medical transportation

- Baggage loss and delay coverage

- 24/7 assistance

Pros:

- Comprehensive coverage

- Good customer service reputation

- Offers waivers for pre-existing conditions (with certain requirements)

Cons:

- Can be more expensive than some other options

Typical Scenarios: Ideal for seniors traveling internationally, especially those with pre-existing conditions who qualify for a waiver.

Estimated Price: $150 - $300 for a 2-week trip to Europe (depending on age and coverage options).

Senior Travel Insurance World Nomads Explorer Plan

Overview: World Nomads is popular among adventurous travelers, but their Explorer Plan can also be a good option for active seniors.

Coverage Highlights:

- Trip cancellation and interruption coverage

- Emergency medical and dental coverage

- Emergency medical transportation

- Coverage for adventure activities

- Baggage loss and delay coverage

Pros:

- Covers a wide range of adventure activities

- Flexible coverage options

- Good for longer trips

Cons:

- May not be the best option for seniors with significant pre-existing conditions

- Can be more expensive than some other options

Typical Scenarios: Ideal for active seniors who plan to participate in activities like hiking, skiing, or cycling while traveling.

Estimated Price: $180 - $350 for a 2-week trip to South America (depending on age and coverage options).

Senior Travel Insurance Travel Guard Gold Plan

Overview: Travel Guard is another reputable provider with a range of plans. The Gold Plan offers a good balance of coverage and price.

Coverage Highlights:

- Trip cancellation and interruption coverage

- Emergency medical and dental coverage

- Emergency medical transportation

- Baggage loss and delay coverage

- 24/7 assistance

Pros:

- Good coverage at a reasonable price

- Offers options for pre-existing condition coverage

- Wide range of add-on options

Cons:

- Customer service ratings can be mixed

Typical Scenarios: Suitable for seniors traveling domestically or internationally who want comprehensive coverage at a reasonable price.

Estimated Price: $120 - $250 for a 2-week trip to the Caribbean (depending on age and coverage options).

Senior Travel Insurance Comparing Allianz vs World Nomads vs Travel Guard

Here's a quick comparison table to help you decide which plan might be right for you:

| Feature | Allianz Prime Plan | World Nomads Explorer Plan | Travel Guard Gold Plan |

|---|---|---|---|

| Pre-existing Conditions | Waivers available (with requirements) | Limited coverage | Options available |

| Adventure Activities | Limited coverage | Good coverage | Limited coverage |

| Price | Higher | Higher | Mid-range |

| Customer Service | Good | Good | Mixed |

| Best For | Seniors with pre-existing conditions | Active seniors | Seniors wanting balanced coverage |

Senior Travel Insurance Important Considerations Before You Buy

- Read the fine print: Always read the policy documents carefully to understand the coverage, exclusions, and limitations.

- Compare quotes: Get quotes from multiple insurance providers to find the best price and coverage for your needs.

- Be honest: Be honest about your medical history and travel plans when applying for insurance.

- Buy early: Purchase your travel insurance as soon as you book your trip to maximize your coverage options.

Senior Travel Insurance Making the Right Choice

Deciding whether or not to buy travel insurance is a personal decision. But hopefully, this checklist has given you a better understanding of the factors to consider. Take your time, do your research, and choose a policy that provides you with the peace of mind you need to enjoy your trip to the fullest. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)