Lost Luggage Nightmare: Travel Insurance to the Rescue for Seniors

Read a story about a senior traveler who lost their luggage. Learn how travel insurance reimbursed them for their lost belongings and saved the day.

Losing your luggage while traveling is a total buzzkill, right? Especially when you're a senior trying to enjoy a well-deserved vacation. It's stressful, inconvenient, and can seriously put a damper on your trip. But hey, that’s where travel insurance steps in, acting like your personal superhero. Let’s dive into a real-life scenario and see how travel insurance can turn a luggage nightmare into a manageable bump in the road.

The Unfortunate Reality of Lost Luggage and Senior Travelers

Okay, picture this: You’ve just landed in Rome after a long flight, ready to explore ancient ruins and indulge in some delicious pasta. You head to the baggage claim, and… nothing. Your bag is nowhere to be found. Panic sets in. This isn't just about clothes; it’s about medications, essential documents, and maybe even sentimental items. For seniors, this situation can be particularly challenging due to potential health needs and mobility issues.

Lost luggage is unfortunately quite common. Airlines misplace bags all the time. Delays, connecting flights, and plain old human error all contribute to the problem. According to recent stats, thousands of bags are mishandled daily. And while most bags are eventually returned, the delay can ruin the first few days (or more!) of your trip.

Meet Martha A Senior's Travel Insurance Success Story

Let's call our senior traveler Martha. Martha, a vibrant 70-year-old, had been planning a trip to Italy for years. She packed carefully, including all her necessary medications, comfortable walking shoes, and a few special outfits for evenings out. She also wisely purchased a comprehensive travel insurance policy before her trip. This is key! Always get insurance before you leave.

Upon arriving in Rome, Martha discovered her luggage was missing. She immediately reported the loss to the airline and obtained a reference number. Then, she contacted her travel insurance provider. This is the second crucial step. Keep all documentation and report the loss ASAP.

How Travel Insurance Saved Martha's Trip Financial Reimbursement

Martha's travel insurance policy included baggage loss and delay coverage. This meant the insurance company would reimburse her for the cost of essential items she needed to purchase while waiting for her luggage to arrive. She was able to buy toiletries, a change of clothes, and even replace her lost medications (with a doctor's prescription, of course!).

The financial reimbursement was a lifesaver. Martha didn't have to dip into her travel budget or worry about unexpected expenses. She could focus on enjoying her vacation despite the initial setback. The policy covered up to a certain limit (let's say $1,000), which was more than enough to cover her immediate needs.

Expedited Luggage Recovery and Assistance for Senior Travelers

Beyond the financial aspect, Martha's travel insurance company also provided assistance in tracking down her luggage. They contacted the airline, followed up on the claim, and kept Martha informed of the progress. This saved her a lot of time and stress. Imagine having to deal with airline bureaucracy in a foreign country – a total headache!

Eventually, Martha's luggage was located and delivered to her hotel. Everything was intact, and she could finally relax and enjoy the rest of her vacation. Without travel insurance, Martha's experience could have been drastically different. She might have had to spend a significant amount of money on replacements, deal with the airline on her own, and potentially have her trip ruined by the stress.

Recommended Travel Insurance Products for Seniors With Baggage Loss Coverage

Okay, so you're convinced travel insurance is a must. But which policy should you choose? Here are a few recommended options, focusing on those with robust baggage loss and delay coverage:

World Nomads Explorer Plan Senior-Friendly Travel Insurance

Overview: World Nomads is popular among adventurous travelers, but their Explorer Plan also offers excellent coverage for baggage loss and delay. It's a solid choice if you plan on doing any outdoor activities.

Baggage Coverage: Offers up to $3,000 in coverage for lost, stolen, or damaged baggage. Also includes coverage for baggage delays.

Pros: Comprehensive coverage, good for active seniors, 24/7 emergency assistance.

Cons: Can be more expensive than other options, not ideal for purely relaxation-focused trips.

Typical Cost: Around $150-$300 for a two-week trip, depending on age and destination.

Best Use Case: Seniors planning active trips involving hiking, skiing, or other outdoor adventures.

Allianz Travel Insurance OneTrip Prime Senior Travel Option

Overview: Allianz is a well-known and reputable travel insurance provider. Their OneTrip Prime plan is a great option for seniors looking for comprehensive coverage at a reasonable price.

Baggage Coverage: Offers up to $1,500 in coverage for lost, stolen, or damaged baggage. Includes a daily allowance for essential items if your luggage is delayed.

Pros: Good value for money, reliable customer service, decent baggage coverage.

Cons: Coverage limits may be lower than some other plans.

Typical Cost: Around $100-$250 for a two-week trip, depending on age and destination.

Best Use Case: Seniors planning more relaxed trips, such as cruises or city tours.

Travel Guard Essential Senior Travel Insurance

Overview: Travel Guard is another popular provider with a range of plans to suit different needs. Their Essential plan offers a balance of coverage and affordability.

Baggage Coverage: Offers up to $1,000 in coverage for lost, stolen, or damaged baggage. Also includes baggage delay coverage.

Pros: Affordable, decent coverage for essential travel needs, 24/7 travel assistance.

Cons: Lower coverage limits than some other plans, may not be suitable for expensive items.

Typical Cost: Around $80-$200 for a two-week trip, depending on age and destination.

Best Use Case: Seniors looking for budget-friendly travel insurance with adequate baggage coverage for essential items.

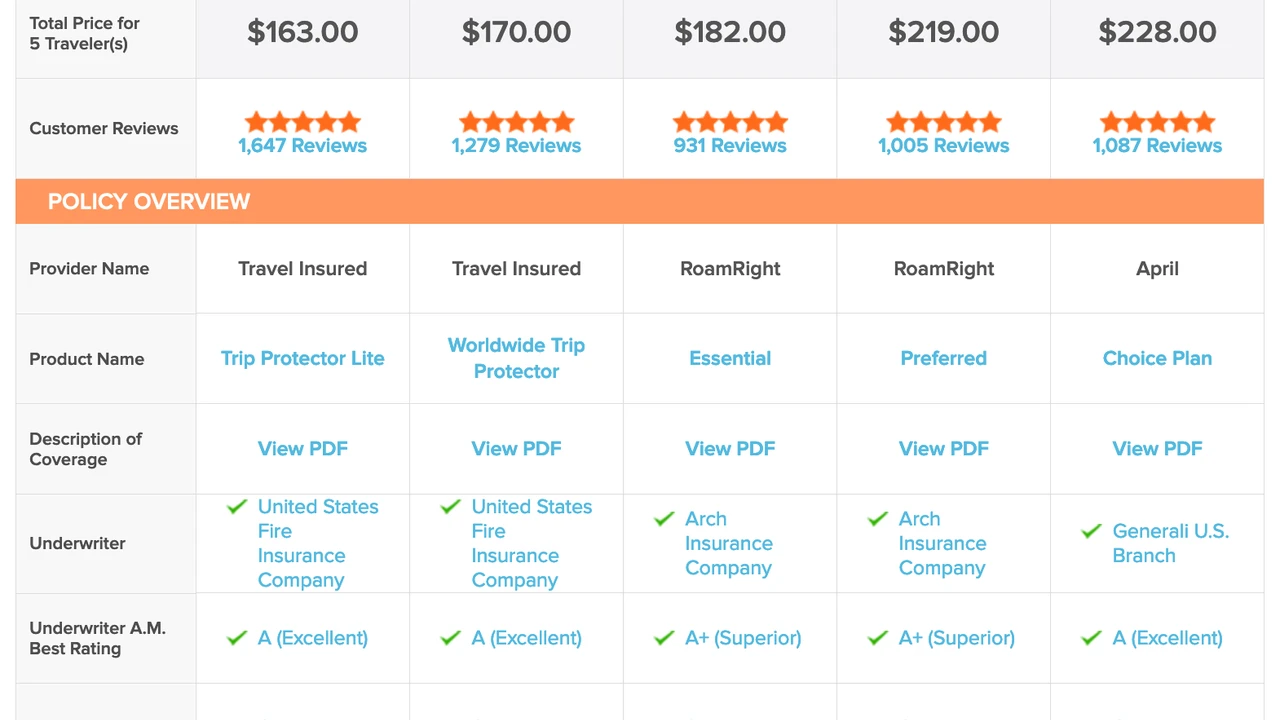

Comparing Travel Insurance Providers For Senior Travelers

Choosing the right travel insurance involves comparing different providers and plans. Here's a quick comparison table:

| Provider | Plan | Baggage Coverage | Typical Cost (2 weeks) | Best For |

|---|---|---|---|---|

| World Nomads | Explorer Plan | Up to $3,000 | $150-$300 | Active Seniors |

| Allianz | OneTrip Prime | Up to $1,500 | $100-$250 | Relaxed Trips |

| Travel Guard | Essential | Up to $1,000 | $80-$200 | Budget Travelers |

Understanding Baggage Loss and Delay Coverage Policy Limits

It's crucial to understand the policy limits of your baggage loss and delay coverage. Most policies have a maximum amount they will reimburse for lost luggage, as well as a daily allowance for essential items if your luggage is delayed. Make sure these limits are sufficient to cover your needs.

Also, be aware of any exclusions. Some policies may not cover certain items, such as jewelry or electronics. Read the fine print carefully to understand what is and isn't covered.

Tips for Preventing Luggage Loss and Dealing with Delays Senior Travel Hacks

While travel insurance can help you recover from a luggage nightmare, it's always best to prevent the problem in the first place. Here are a few tips:

- Pack light: The less you pack, the less likely your luggage is to get lost.

- Use brightly colored luggage tags: Make your bag easily identifiable.

- Take photos of your luggage and its contents: This will help with the claims process if your bag is lost.

- Keep essential items in your carry-on: Medications, important documents, and a change of clothes should always be with you.

- Arrive at the airport early: This gives you more time to check your luggage and reduces the risk of it being misplaced.

- Track your luggage: Use airline apps or tracking devices to monitor your bag's location.

Real-Life Senior Traveler Lost Luggage Scenario Solutions

Let's consider another scenario: You arrive in Paris for a two-week trip, and your luggage is delayed for three days. Your travel insurance policy provides a daily allowance of $50 for essential items. You use this allowance to purchase toiletries, a change of clothes, and some basic necessities.

After three days, your luggage finally arrives. You submit a claim to your travel insurance company for the expenses you incurred during the delay. They reimburse you for the full amount, allowing you to continue enjoying your trip without any financial stress.

Pricing and Purchasing Travel Insurance for Seniors

The cost of travel insurance varies depending on your age, destination, trip length, and coverage options. It's essential to compare quotes from multiple providers to find the best deal. Online comparison tools can be helpful in this process.

When purchasing travel insurance, be sure to disclose any pre-existing medical conditions. This will ensure that you are adequately covered in case of a medical emergency.

The Peace of Mind Travel Insurance Provides Senior Safety

Ultimately, travel insurance provides peace of mind. Knowing that you are protected against unexpected events, such as lost luggage, allows you to relax and enjoy your trip to the fullest. For seniors, this peace of mind is especially valuable.

So, next time you're planning a trip, don't forget to purchase travel insurance. It could be the best investment you make for your vacation.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)