Rental Car Insurance: Do Seniors Need Extra Coverage While Traveling?

Do you need rental car insurance while traveling? Learn about your options and whether your existing insurance covers rentals. Avoid costly surprises at the rental counter.

Understanding Rental Car Insurance Options for Senior Travelers

Renting a car can be a fantastic way for seniors to explore a new destination at their own pace. But before you hop behind the wheel, it's crucial to understand your rental car insurance options. Often, seniors already have some form of car insurance, but whether that extends to rental cars – and to what extent – is a key question. Ignoring this aspect can lead to unexpected and potentially hefty expenses should an accident or damage occur.

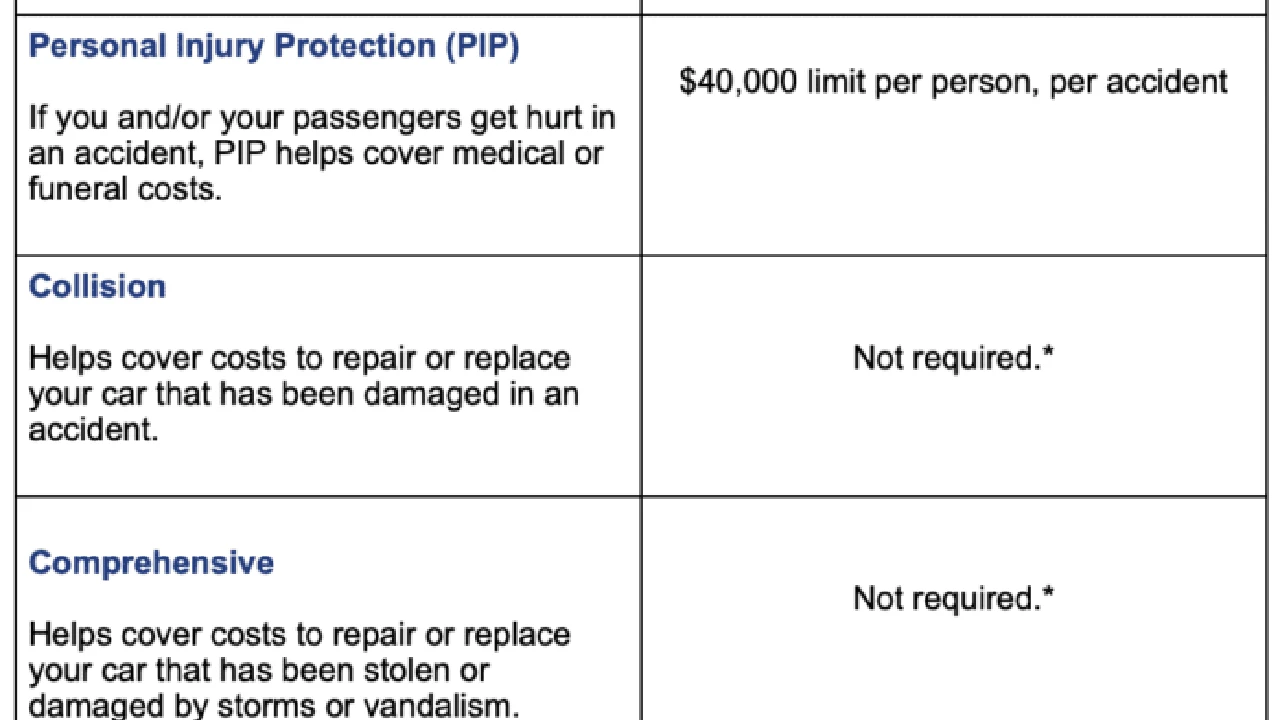

There are typically four main types of rental car insurance to consider:

- Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW): This isn't technically insurance, but it waives your responsibility for damage to the rental car itself, regardless of fault.

- Liability Insurance: This covers damages or injuries you cause to other people or property.

- Uninsured/Underinsured Motorist Protection: This covers your medical expenses and other losses if you're hit by an uninsured or underinsured driver.

- Personal Accident Insurance (PAI): This covers medical expenses for you and your passengers if you're injured in an accident.

Does Your Existing Car Insurance Cover Rental Cars? A Senior's Checklist

The first step is to determine if your existing car insurance policy provides coverage for rental cars. In many cases, your personal auto policy *will* extend to rental cars in the United States. However, there are some important caveats:

- Coverage Limits: Your rental car coverage will typically be subject to the same limits as your personal auto policy. If you have low liability limits, you might want to consider purchasing supplemental coverage.

- Deductibles: You'll likely be responsible for paying your deductible in the event of an accident.

- Type of Vehicle: Some policies may not cover certain types of vehicles, such as SUVs, trucks, or luxury cars.

- Rental Location: Coverage may not extend to rentals outside of the United States. Always check with your insurance provider before renting a car in a foreign country.

- Business Use: If you're renting the car for business purposes, your personal auto policy may not provide coverage.

Action Item: Call your insurance company *before* your trip and confirm the extent of your rental car coverage. Ask specific questions about coverage limits, deductibles, and any exclusions that may apply.

Credit Card Rental Car Insurance: A Senior's Guide to Benefits and Limitations

Many credit cards offer rental car insurance as a perk. This can be a valuable benefit, but it's crucial to understand the terms and conditions. Credit card rental car insurance typically comes in two forms:

- Primary Coverage: This means the credit card insurance pays out *before* your personal auto insurance.

- Secondary Coverage: This means the credit card insurance pays out *after* your personal auto insurance.

Most credit cards offer secondary coverage, which means you'll still have to file a claim with your primary auto insurance provider first. This can affect your premiums and deductibles. Some premium credit cards offer primary coverage, which can be a significant advantage. However, even with primary coverage, there are limitations:

- Coverage Period: Most credit card rental car insurance policies only cover rentals for a limited period, typically 31 days or less.

- Excluded Vehicles: Many policies exclude certain types of vehicles, such as vans, trucks, motorcycles, and exotic cars.

- Excluded Countries: Some policies exclude certain countries, such as Ireland, Italy, and Jamaica.

- Specific Requirements: You'll typically need to decline the rental car company's CDW/LDW to activate the credit card coverage.

Action Item: Review the terms and conditions of your credit card's rental car insurance policy carefully. Call your credit card issuer to confirm the details and ask about any exclusions or limitations.

Weighing the Pros and Cons of Rental Car Company Insurance for Senior Drivers

Rental car companies offer a range of insurance options, including CDW/LDW, liability insurance, and personal accident insurance. These options can provide peace of mind, but they can also be expensive. Here's a breakdown of the pros and cons:

Pros:

- Convenience: It's easy to add coverage at the rental counter.

- No Deductible: CDW/LDW typically has no deductible.

- No Impact on Your Personal Policy: Filing a claim with the rental car company won't affect your personal auto insurance premiums.

- Comprehensive Coverage: Rental car company insurance can provide comprehensive coverage, including protection against theft, vandalism, and damage.

Cons:

- High Cost: Rental car company insurance can be significantly more expensive than other options.

- Duplication of Coverage: You may already have adequate coverage through your personal auto insurance or credit card.

- Pressure to Purchase: Rental car company employees may pressure you to purchase insurance, even if you don't need it.

Action Item: Carefully consider your existing coverage and assess your risk tolerance before purchasing rental car company insurance. Don't feel pressured to buy coverage you don't need.

Specific Rental Car Insurance Products and Scenarios for Seniors

Let's dive into some specific products and scenarios to help you make an informed decision:

Scenario 1: Short Trip Within the US

If you're taking a short trip within the US and your personal auto insurance policy provides adequate coverage, you may not need to purchase additional insurance from the rental car company. However, if you're concerned about paying your deductible or having a claim affect your premiums, you might consider purchasing the CDW/LDW.

Scenario 2: International Travel

If you're traveling internationally, your personal auto insurance policy may not provide coverage. In this case, you'll likely need to purchase insurance from the rental car company or rely on your credit card's rental car insurance. Be sure to check the excluded countries list for your credit card.

Scenario 3: Renting a Luxury Car or SUV

If you're renting a luxury car or SUV, your personal auto insurance policy or credit card may not provide adequate coverage. In this case, you may need to purchase supplemental insurance from the rental car company.

Product Recommendations:

- Allianz Rental Car Damage Protector: This policy offers primary coverage for damage to the rental car, with no deductible. It's a good option if you want to avoid filing a claim with your personal auto insurance. Prices typically range from $9-$12 per day.

- Bonzah Rental Car Insurance: Offers comprehensive coverage, including CDW/LDW and liability protection. Especially useful for international trips. Prices vary based on destination and coverage level, but generally start around $7 per day.

- Amex Premium Car Rental Protection: This is a service offered to American Express cardholders. For a flat fee (around $20-$25) per rental, you get primary coverage for damage or theft, up to $100,000. A solid option for frequent renters.

Comparing Rental Car Insurance Products: Features and Pricing for Seniors

When comparing rental car insurance products, consider the following factors:

- Coverage Limits: Make sure the policy provides adequate coverage for potential damages or injuries.

- Deductibles: Consider the deductible amount and whether you're comfortable paying it in the event of an accident.

- Exclusions: Be aware of any exclusions that may apply, such as certain types of vehicles or countries.

- Price: Compare prices from different providers to find the best value.

- Customer Service: Read reviews and check the provider's customer service ratings.

Here's a sample comparison of some popular rental car insurance products:

| Feature | Allianz Rental Car Damage Protector | Bonzah Rental Car Insurance | Amex Premium Car Rental Protection | |-------------------|--------------------------------------|---------------------------|--------------------------------------| | Coverage Type | Primary | Comprehensive | Primary | | Deductible | $0 | Varies | $0 | | Coverage Limit | Varies | Varies | $100,000 | | Price (per day) | $9-$12 | $7+ | $20-$25 (per rental) | | Best For | Avoiding personal insurance claims | International Travel | Frequent Renters |Tips for Saving Money on Rental Car Insurance for Senior Travelers

Here are some tips for saving money on rental car insurance:

- Check Your Existing Coverage: Make sure you understand your personal auto insurance and credit card coverage before purchasing additional insurance.

- Shop Around: Compare prices from different providers to find the best deal.

- Decline Unnecessary Coverage: Don't feel pressured to buy coverage you don't need.

- Consider an Annual Policy: If you rent cars frequently, an annual rental car insurance policy may be more cost-effective.

- Use Discount Codes: Look for discount codes or coupons online.

The Bottom Line: Making Informed Decisions About Rental Car Insurance as a Senior

Renting a car can be a convenient and enjoyable way to travel, but it's important to understand your rental car insurance options. By carefully considering your existing coverage, assessing your risk tolerance, and comparing prices, you can make an informed decision and protect yourself from unexpected expenses. Always prioritize safety and ensure you have adequate coverage for your specific travel needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)