The Best Time to Buy Travel Insurance for Your Senior Trip

Navigate the complexities of senior travel insurance. Understand policy types, coverage options, and pre-existing condition clauses. This guide helps US seniors find the best protection for their travels.

Why Timing Matters When Buying Senior Travel Insurance

Hey there, fellow travelers! So, you're planning a trip? Awesome! As a senior, you know that travel requires a little extra planning, and that includes travel insurance. But here's a question many people overlook: when's the *best* time to actually buy that insurance policy? It's not just about having it; it's about maximizing its benefits and ensuring you're covered from day one of your trip planning, not just the day you hop on the plane.

The Early Bird Gets the Worm: Buying Travel Insurance Early

Think of travel insurance like a safety net. You want it in place *before* you start juggling all those travel arrangements. Buying early, ideally within 14-21 days of making your initial trip deposit or booking your flights, unlocks some crucial benefits. Why? Because many policies offer what's called a "pre-existing condition waiver" if you purchase within a certain timeframe. Let's break that down:

- Pre-Existing Condition Waiver: This is HUGE for seniors. If you have any health conditions (and let's be honest, most of us do!), this waiver can ensure that those conditions are covered if they cause a problem during your trip. Miss the window, and you might find yourself facing some hefty out-of-pocket medical bills.

- Trip Cancellation Coverage: Buying early means you're covered for trip cancellations from the moment you purchase the policy. If you book your trip six months in advance and something happens *before* you travel (like an unexpected illness or family emergency), you're protected.

So, the takeaway here is: don't procrastinate! As soon as you put down a deposit on your trip, start shopping for travel insurance.

Last-Minute Larry: The Risks of Waiting Until the Last Minute

Okay, so what happens if you *do* wait until the last minute? Sure, you'll still have some coverage, but you'll likely miss out on those key benefits we just discussed. Here are some potential downsides:

- No Pre-Existing Condition Waiver: As we mentioned, this is a big one. If you wait too long, you'll lose the opportunity to have your pre-existing conditions covered.

- Limited Trip Cancellation Coverage: Some policies have waiting periods before trip cancellation coverage kicks in. If you buy at the last minute, you might not be covered for cancellations that occur shortly after purchase.

- Increased Risk: The longer you wait, the greater the chance that something could happen that prevents you from traveling. Why take the risk?

Think of it this way: buying travel insurance at the last minute is like driving without a seatbelt. You *might* be okay, but why take the chance?

Specific Scenarios: When to Buy for Different Types of Trips

The ideal time to buy travel insurance can also depend on the type of trip you're taking. Here are a few examples:

- Cruises: Cruises often require booking far in advance. Buy your insurance as soon as you book your cruise to protect your investment and ensure you're covered for pre-departure cancellations.

- International Trips: International trips involve more risk, including potential medical emergencies and travel disruptions. Buy early to ensure you have ample coverage.

- Trips with Non-Refundable Expenses: If you've booked non-refundable flights or hotels, buy travel insurance as soon as possible to protect yourself from financial loss if you have to cancel.

- Road Trips: While the risks may seem lower, road trips can still be subject to unexpected issues like car trouble or sudden illness. Buying coverage before you leave offers peace of mind.

Comparing Travel Insurance Options: Finding the Right Fit for You

Okay, so you know *when* to buy, but *what* should you buy? The world of travel insurance can seem overwhelming, but here are a few reputable companies to consider, along with their pros, cons, and approximate costs:

Allianz Travel Insurance: A Solid Choice for Seniors

Pros: Allianz is a well-known and respected travel insurance provider with a wide range of plans. They offer comprehensive coverage, including medical expenses, trip cancellation, and baggage loss. Their customer service is generally well-regarded.

Cons: Allianz can be a bit pricier than some other options. Their pre-existing condition coverage may have limitations, so be sure to read the fine print.

Typical Cost: A single-trip policy for a 70-year-old traveling for one week might cost between $100 and $250, depending on the level of coverage.

Best Use Case: Allianz is a good choice for seniors who want comprehensive coverage and are willing to pay a bit more for peace of mind.

World Nomads Travel Insurance: Adventure Travel Coverage

Pros: World Nomads is a popular choice for adventure travelers. They offer coverage for a wide range of activities, including hiking, skiing, and scuba diving. They also have a reputation for being flexible and easy to work with.

Cons: World Nomads may not be the best choice for seniors who are primarily interested in traditional travel activities. Their coverage for pre-existing conditions may be limited.

Typical Cost: A single-trip policy for a 70-year-old traveling for one week might cost between $80 and $200, depending on the level of coverage and the activities included.

Best Use Case: World Nomads is a good choice for active seniors who plan to participate in adventure activities.

Travel Guard Travel Insurance: Customizable Coverage Options

Pros: Travel Guard offers a wide range of customizable coverage options, allowing you to tailor your policy to your specific needs. They also have a reputation for strong customer service.

Cons: Travel Guard's pricing can be a bit confusing, as it varies depending on the specific options you choose. Their pre-existing condition coverage may have limitations.

Typical Cost: A single-trip policy for a 70-year-old traveling for one week might cost between $90 and $230, depending on the level of coverage and the options selected.

Best Use Case: Travel Guard is a good choice for seniors who want to customize their coverage and are willing to spend some time comparing options.

Comparing the Key Features: Medical Coverage, Trip Cancellation, and More

When comparing travel insurance policies, pay close attention to the following features:

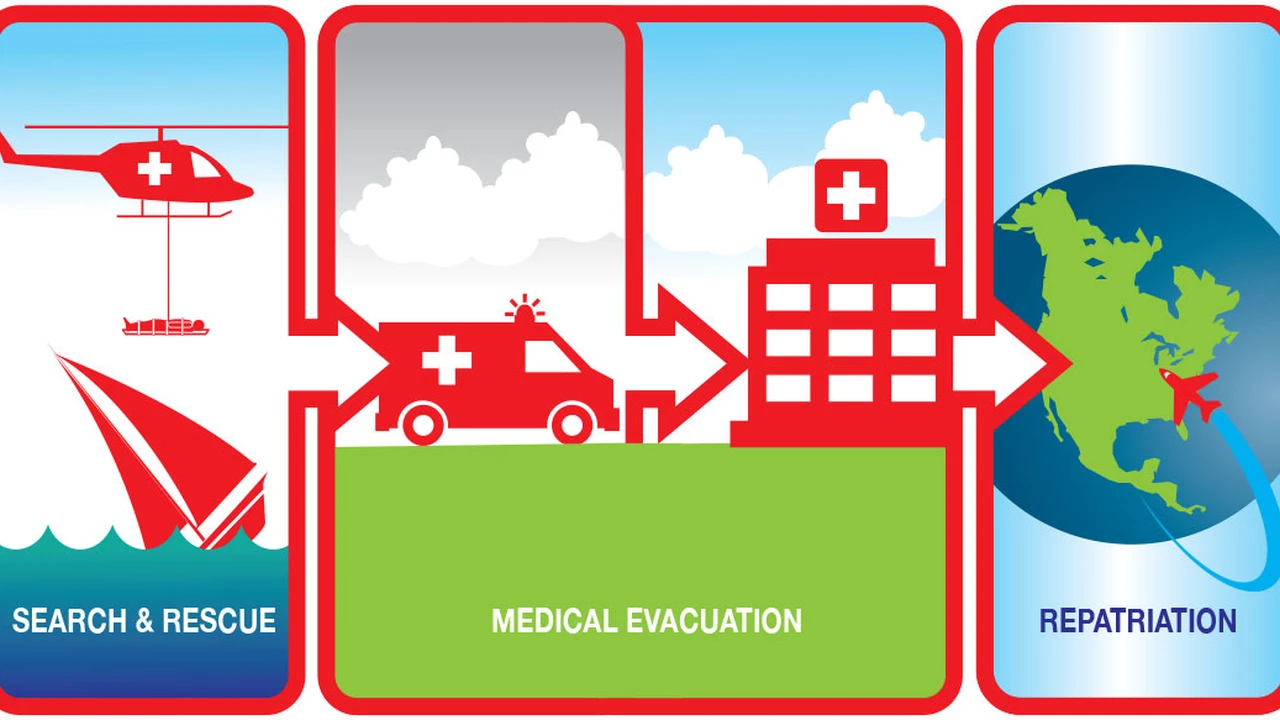

- Medical Coverage: Make sure the policy provides adequate coverage for medical expenses, including doctor visits, hospital stays, and emergency medical evacuation.

- Trip Cancellation Coverage: Check the policy's trip cancellation coverage to see what reasons are covered. Common covered reasons include illness, injury, and family emergencies.

- Baggage Loss and Delay Coverage: If you're traveling with valuable belongings, make sure the policy provides adequate coverage for baggage loss and delay.

- Pre-Existing Condition Coverage: If you have any pre-existing health conditions, make sure the policy offers a pre-existing condition waiver or provides coverage for those conditions.

- 24/7 Assistance: Look for a policy that offers 24/7 assistance services, including medical referrals, translation assistance, and emergency travel arrangements.

Tips for Finding the Best Deals on Senior Travel Insurance

Here are a few tips to help you find the best deals on senior travel insurance:

- Compare Quotes: Get quotes from multiple insurance providers to compare coverage options and prices.

- Consider a Higher Deductible: Choosing a higher deductible can lower your premium.

- Look for Discounts: Ask about discounts for seniors, AARP members, or other affiliations.

- Buy Early: As we've discussed, buying early can unlock valuable benefits and potentially save you money.

- Read the Fine Print: Before you buy, be sure to read the fine print of the policy to understand the coverage limitations and exclusions.

The Importance of Reading Reviews and Doing Your Research

Before you make a final decision, take the time to read reviews from other seniors and do your own research. This will help you get a better understanding of the different policies available and choose the one that's right for you. Look for reviews on sites like Trustpilot, Consumer Reports, and the Better Business Bureau.

Final Thoughts: Protecting Your Trip Investment

So, when's the best time to buy travel insurance for your senior trip? The answer is: as soon as possible! Buying early can unlock valuable benefits, protect your trip investment, and give you peace of mind. Don't wait until the last minute. Start shopping for travel insurance today and enjoy your trip with confidence!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)