The Importance of Travel Insurance for Seniors Traveling Abroad

Navigate the complexities of senior travel insurance. Understand policy types, coverage options, and pre-existing condition clauses. This guide helps US seniors find the best protection for their travels.

Why Senior Travel Insurance is a Must for International Trips

Okay, let's face it, traveling abroad is awesome! But as seniors, we need to be extra prepared, especially when it comes to our health and safety. That's where travel insurance comes in. It's not just a nice-to-have; it's a must-have, like your passport and your comfy walking shoes. Think of it as your safety net when you're exploring new cultures, tasting exotic foods, and making memories that will last a lifetime. But why is it so darn important?

Medical Emergencies Abroad: Senior Travel Insurance Coverage

Let's be real, medical emergencies can happen anywhere, anytime. But when you're in a foreign country, things can get complicated really quickly. Your US health insurance might not cover you, and even if it does, navigating foreign healthcare systems can be a nightmare. Travel insurance can cover medical expenses, including doctor visits, hospital stays, and even emergency medical evacuation. Imagine falling and breaking a hip in Italy. Without travel insurance, you could be looking at tens of thousands of dollars in medical bills. That's a vacation killer, right? Travel insurance helps ensure you get the care you need without bankrupting your retirement fund.

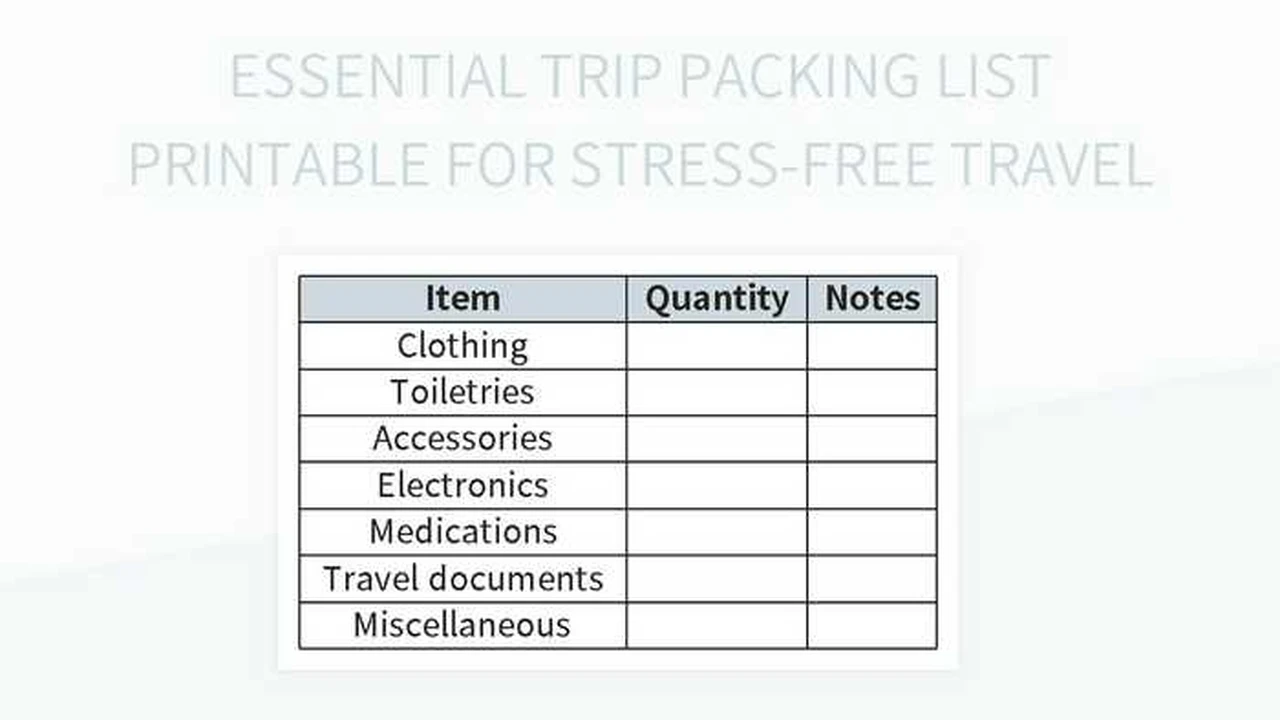

Lost Luggage and Travel Delays: Senior Travel Insurance Benefits

Lost luggage? Delayed flights? These are more than just minor inconveniences; they can throw your entire trip off track. Travel insurance can reimburse you for lost or delayed luggage, helping you replace essential items like medications, clothing, and toiletries. Plus, if your flight is delayed and you miss a connecting flight, travel insurance can cover the cost of accommodation and meals while you wait for the next available flight. No more sleeping in airport terminals!

Trip Cancellations and Interruptions: Protecting Your Senior Travel Investment

Life happens, right? You might have to cancel your trip due to illness, a family emergency, or even a natural disaster. Trip cancellation insurance can reimburse you for non-refundable expenses like flights, hotels, and tours. And if your trip is interrupted due to a covered reason, travel insurance can cover the cost of returning home or continuing your trip. It's like having a backup plan for the unexpected twists and turns of life.

Specific Travel Insurance Recommendations for Seniors

Alright, let's get down to brass tacks. Here are a few travel insurance companies that are popular with seniors, along with some details to help you decide which one might be a good fit:

1. Allianz Travel Insurance: Comprehensive Senior Coverage

Allianz is a big name in travel insurance, and for good reason. They offer a wide range of plans with comprehensive coverage, including medical emergencies, trip cancellations, and lost luggage. They're known for their excellent customer service and their easy-to-understand policies. A popular plan for seniors is the "Allianz Global Assistance Premier" plan. This plan often includes decent medical coverage, trip interruption/cancellation, and baggage loss benefits.

Scenario: Imagine you're on a cruise in the Caribbean, and you suddenly develop a severe stomach bug. Allianz can help you find a local doctor, cover your medical expenses, and even arrange for you to be flown home if necessary.

Pricing: Prices vary depending on your age, destination, trip length, and coverage level. A policy for a 70-year-old traveling to Europe for two weeks could range from $150 to $300.

2. World Nomads: Adventure Travel Insurance for Active Seniors

If you're an active senior who loves hiking, biking, or other adventurous activities, World Nomads might be a good fit. They offer specialized coverage for adventure sports and activities, and they're known for their flexible policies that can be extended or modified while you're on the road. Their "Explorer" plan is generally recommended for those engaging in more adventurous pursuits.

Scenario: Let's say you're hiking in the Swiss Alps and you twist your ankle. World Nomads can cover your medical expenses, including any necessary rehabilitation, and even help you arrange for a helicopter rescue if needed.

Pricing: World Nomads tends to be a bit more expensive than other providers, but their specialized coverage can be worth it for active seniors. A policy for a 65-year-old hiking in Europe for a month could cost around $200 to $400.

3. Travel Guard: Customizable Senior Travel Insurance Plans

Travel Guard offers a variety of customizable plans that allow you to tailor your coverage to your specific needs. They're known for their 24/7 assistance services and their quick claims processing. They offer different tiers of coverage, allowing you to choose the level of protection that best suits your needs and budget. Their "Deluxe" plan is a popular choice for comprehensive coverage.

Scenario: You're on a bus tour in China, and your passport is stolen. Travel Guard can help you report the theft to the local authorities, obtain a replacement passport, and cover any associated expenses.

Pricing: Travel Guard's prices are generally competitive. A policy for a 75-year-old traveling to Asia for three weeks could range from $250 to $450, depending on the level of coverage.

4. Seven Corners: Affordable Senior Travel Insurance Options

If you're on a tight budget, Seven Corners offers some affordable travel insurance options. They provide essential coverage for medical emergencies, trip cancellations, and lost luggage, without breaking the bank. Their "RoundTrip Choice" plan is a good option for those seeking basic coverage at a reasonable price.

Scenario: Imagine you're visiting family in Canada, and you need to see a doctor for a minor illness. Seven Corners can cover the cost of your doctor visit and any necessary prescriptions.

Pricing: Seven Corners is often one of the most affordable options. A policy for a 68-year-old traveling to Canada for a week could cost as little as $50 to $100.

Comparing Travel Insurance Products for Seniors

Choosing the right travel insurance is like picking the perfect pair of shoes for your trip; it depends on where you're going and what you'll be doing. Here's a quick comparison to help you narrow it down:

- Allianz: Best for overall comprehensive coverage and excellent customer service.

- World Nomads: Best for active seniors who enjoy adventure sports and activities.

- Travel Guard: Best for customizable plans and 24/7 assistance services.

- Seven Corners: Best for budget-conscious seniors looking for essential coverage.

Understanding Travel Insurance Policy Costs for Seniors

The cost of travel insurance varies depending on several factors, including:

- Age: Older travelers typically pay more, as they're statistically more likely to need medical care.

- Destination: Traveling to countries with high healthcare costs can increase your premium.

- Trip length: Longer trips require more coverage and will cost more.

- Coverage level: Comprehensive plans with higher coverage limits will be more expensive.

- Pre-existing conditions: If you have pre-existing conditions, you may need to pay extra for coverage.

It's important to get quotes from multiple providers and compare their coverage options and prices before making a decision. Don't just go for the cheapest option; make sure the policy provides adequate coverage for your specific needs.

Pre-Existing Conditions and Senior Travel Insurance

This is a big one for many of us! A pre-existing condition is any health condition you have before you buy travel insurance, such as diabetes, heart disease, or arthritis. Many travel insurance policies exclude coverage for pre-existing conditions, unless you purchase a waiver or a specialized plan. A waiver essentially says that the insurance company will cover your pre-existing condition if it becomes a problem during your trip, as long as the condition is stable and well-managed before you travel. Read the fine print carefully and make sure you understand the policy's terms and conditions regarding pre-existing conditions. Some companies have a "look-back" period (e.g., 60 days, 180 days), during which the pre-existing condition must be stable to be covered.

The Role of Travel Agents and Senior Travel Insurance

Feeling overwhelmed? Don't worry! A travel agent can be a valuable resource. They can help you compare different travel insurance policies, understand the fine print, and find the best coverage for your needs. Plus, they can handle the claims process if something goes wrong. Think of them as your personal travel insurance concierge.

Protecting Yourself from Scams: Senior Travel Insurance Advice

Unfortunately, scams are a reality, even in the world of travel insurance. Be wary of unsolicited offers, high-pressure sales tactics, and policies that seem too good to be true. Always research the insurance company thoroughly before buying a policy, and make sure they're licensed and reputable. If you're unsure, consult with a trusted travel agent or financial advisor.

Senior Travel Insurance: Peace of Mind for Your Adventures

Ultimately, travel insurance is about peace of mind. It's about knowing that you're protected from unexpected events and that you can enjoy your trip without worrying about financial burdens. So, do your research, compare your options, and choose a policy that fits your needs and budget. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)