Travel Insurance for Specific Destinations: Senior Travel Advice

Travel insurance needs vary depending on your destination. Learn about specific coverage considerations for different regions and countries. Travel smarter and safer.

Understanding Destination-Specific Travel Insurance Needs for Seniors

Alright, so you're planning a trip! That's fantastic. But before you pack your bags and grab your passport, let's talk about something super important: travel insurance tailored to your destination. Not all travel insurance is created equal, and what works for a quick jaunt to Canada might leave you high and dry in, say, Thailand. The key is recognizing that different regions have different risks and understanding how those risks translate into the kind of coverage you need.

Medical Coverage Considerations for Senior Travelers by Region

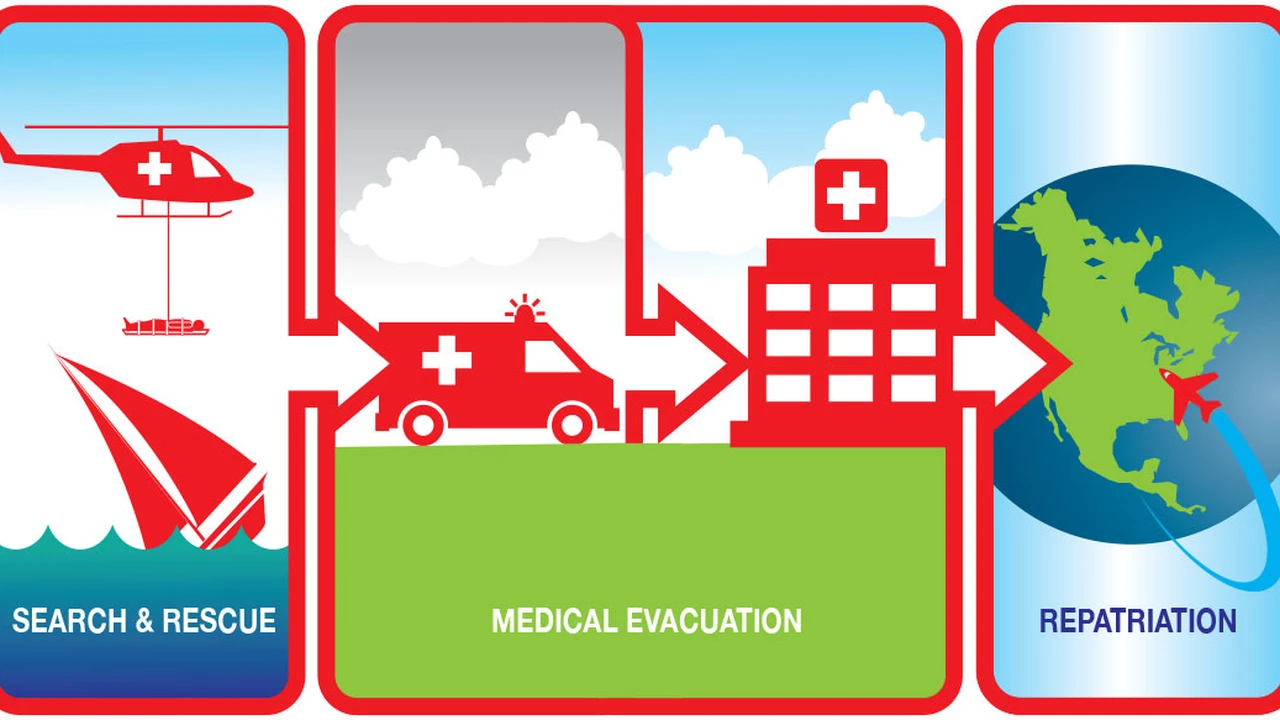

One of the biggest things to consider is medical coverage. Healthcare costs vary wildly from country to country. A simple doctor's visit in the US can be expensive, but a hospital stay without insurance in some European countries can be shockingly pricey. In developing countries, you might be more concerned about the quality of medical facilities and the potential need for medical evacuation.

Example: Let's say you're going to Europe. Many European countries have excellent healthcare systems, but they might not be free for tourists. Your Medicare likely won't cover you there. Therefore, you'll want a policy with a high medical coverage limit – at least $100,000, maybe even more if you're prone to health issues. Conversely, if you're heading to a more remote destination, like a trekking expedition in Nepal, medical evacuation coverage becomes paramount. Think about what could go wrong and how much it would cost to get you to safety and quality medical care.

Trip Cancellation and Interruption Coverage Based on Travel Location

Trip cancellation and interruption coverage is another crucial aspect. Consider the political stability of your destination. Are there any known risks of natural disasters, like hurricanes or earthquakes? A trip to the Caribbean during hurricane season calls for robust trip cancellation coverage. Similarly, if you're planning a trip to a region with potential political instability, make sure your policy covers cancellations or interruptions due to civil unrest.

Example: Imagine you've booked a cruise to the Mediterranean, but a sudden political crisis erupts in one of your ports of call. Will your insurance cover the cost of rerouting your trip or cancelling altogether? Read the fine print to understand what scenarios are covered.

Specific Destination Examples and Travel Insurance Recommendations for Seniors

Let's dive into some specific examples to make this clearer:

Travel Insurance for Europe: Senior Considerations

Europe is a popular destination for seniors, offering rich history, culture, and stunning landscapes. However, healthcare can be expensive, and petty theft is common in tourist areas. Look for policies with:

- High medical coverage (at least $100,000).

- Trip cancellation and interruption coverage.

- Baggage loss and delay coverage.

- Personal liability coverage (in case you accidentally cause damage or injury).

Product Recommendation: Allianz Global Assistance AllTrips Premier. This plan offers comprehensive coverage for medical emergencies, trip cancellations, and baggage loss. It also includes a 24/7 assistance hotline, which can be invaluable if you need help finding a doctor or navigating a foreign healthcare system. Premiums vary depending on your age and trip cost, but expect to pay around $200-$400 for a two-week trip.

Travel Insurance for Southeast Asia: Senior Health and Safety

Southeast Asia offers exotic adventures and stunning scenery, but it also presents unique challenges for senior travelers. Healthcare standards can vary, and medical evacuation can be costly. Consider policies with:

- High medical coverage and evacuation coverage (at least $250,000 for evacuation).

- Coverage for adventurous activities like trekking or scuba diving (if applicable).

- Coverage for pre-existing conditions.

- 24/7 assistance in English.

Product Recommendation: World Nomads Explorer Plan. This plan is designed for adventurous travelers and offers robust medical and evacuation coverage. It also covers a range of activities, including trekking and scuba diving. Premiums are generally higher than standard plans, but the extra coverage is worth it if you're planning adventurous activities. Expect to pay around $300-$500 for a two-week trip.

Travel Insurance for Cruises: Senior Specific Needs

Cruises are a relaxing way to see the world, but medical emergencies can be particularly challenging at sea. Medical facilities on cruise ships are often limited, and evacuation to a land-based hospital can be expensive. Prioritize policies with:

- High medical coverage and evacuation coverage.

- Trip interruption coverage (in case you need to disembark early due to illness or injury).

- Coverage for missed port departures.

- Pre-existing condition coverage.

Product Recommendation: Travel Guard Cruise Plan. This plan is specifically designed for cruise travelers and offers comprehensive coverage for medical emergencies, trip interruptions, and missed port departures. It also includes a 24/7 assistance hotline and coverage for pre-existing conditions. Premiums vary depending on the cruise itinerary and trip cost, but expect to pay around $250-$450 for a seven-day cruise.

Travel Insurance for Canada and Mexico: Senior Border Crossing

While geographically close, Canada and Mexico have different healthcare systems than the US. Medicare typically doesn't extend coverage across these borders. Consider:

- Medical coverage for hospital and doctor visits.

- Prescription drug coverage.

- Trip interruption and cancellation coverage.

- Emergency dental coverage.

Product Recommendation: Seven Corners RoundTrip Choice. This plan is well-suited for travel to Canada and Mexico, offering robust medical and dental coverage along with trip protection benefits. Premiums are competitively priced, typically ranging from $150-$300 for a two-week trip.

Comparing Travel Insurance Products: Key Features and Pricing for Seniors

Choosing the right travel insurance can feel overwhelming, so let's break down some key features and compare a few popular options:

| Feature | Allianz Global Assistance AllTrips Premier | World Nomads Explorer Plan | Travel Guard Cruise Plan | Seven Corners RoundTrip Choice |

|---|---|---|---|---|

| Medical Coverage | Up to $500,000 | Up to $100,000 | Up to $100,000 | Up to $250,000 |

| Medical Evacuation | Up to $1,000,000 | Unlimited | Up to $500,000 | Up to $1,000,000 |

| Trip Cancellation | 100% of trip cost | 100% of trip cost | 100% of trip cost | 100% of trip cost |

| Pre-existing Conditions | Covered with waiver if purchased within 14 days of initial trip deposit | Requires medical assessment | Covered with waiver if purchased within 21 days of initial trip deposit | Covered with stable pre-existing condition clause |

| Activities Covered | Standard travel activities | Adventure activities (trekking, scuba diving) | Cruise-related activities | Standard travel activities |

| Price (approx. for 2-week trip, age 70) | $300 | $400 | $350 (for 7-day cruise) | $250 |

Note: Prices are approximate and may vary depending on your age, trip cost, and specific coverage needs. Always get a quote directly from the insurance provider.

How to Determine the Right Travel Insurance for Your Senior Trip

So, how do you choose the right plan? Here’s a step-by-step guide:

- Identify Your Destination: Where are you going? Research the potential risks and healthcare costs in that region.

- Assess Your Health Needs: Do you have any pre-existing conditions? Do you need high medical coverage?

- Consider Your Activities: Are you planning any adventurous activities? Do you need coverage for specific events like cruises?

- Compare Quotes: Get quotes from multiple providers and compare coverage options and prices.

- Read the Fine Print: Understand the policy terms, conditions, and exclusions before you buy.

Real-Life Example: Senior Traveler in Costa Rica

Let's imagine Mrs. Rodriguez, a 72-year-old from Florida, is planning a two-week trip to Costa Rica for birdwatching. She has well-managed high blood pressure and wants to make sure she's covered for any medical emergencies. She's also concerned about potential trip cancellations due to hurricane season.

Based on her needs, Mrs. Rodriguez should look for a policy with:

- Medical coverage of at least $100,000.

- Medical evacuation coverage.

- Trip cancellation coverage for hurricanes.

- Coverage for her pre-existing condition (high blood pressure).

A plan like the Seven Corners RoundTrip Choice or Allianz Global Assistance AllTrips Premier with the pre-existing condition waiver would be a good fit for Mrs. Rodriguez. She should compare quotes from both providers and choose the plan that best meets her needs and budget.

The Importance of Reading Customer Reviews Before Purchasing Senior Travel Insurance

Before you finalize your decision, take some time to read customer reviews. What are other seniors saying about their experiences with different providers? Were they happy with the claims process? Did they find the customer service helpful?

Websites like Trustpilot and Squaremouth offer customer reviews of travel insurance companies. Keep in mind that every experience is different, but reading reviews can give you a better sense of the overall quality and reliability of a particular provider.

Final Thoughts: Senior Travel Insurance for Peace of Mind

Choosing the right travel insurance for your specific destination is all about understanding the potential risks and finding a policy that provides adequate coverage for your needs. Don't be afraid to shop around, compare quotes, and ask questions. The peace of mind that comes with knowing you're protected is well worth the effort.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)