10 Tips for Finding Affordable Senior Travel Insurance

Emergency medical evacuation coverage is crucial for seniors. Learn how it works and why it's essential for international travel. Protect yourself from costly medical transport.

Understanding Emergency Medical Evacuation Insurance for Senior Travelers

Okay, let's talk about something super important if you're a senior planning a trip – emergency medical evacuation coverage. It might sound a bit scary, but trust me, understanding this can be a lifesaver (literally!). We're talking about those situations where you need to get to a hospital *fast*, maybe even from a remote location, and that ain't cheap. Medicare usually doesn't cover you outside the US, and even some domestic insurance plans have limitations. That's where emergency medical evacuation coverage steps in.

Why Seniors Need Emergency Medical Evacuation Coverage More Than Others

As we get older, our bodies sometimes need a little extra TLC. Things can happen – a sudden illness, an accident, or a flare-up of a pre-existing condition. The chances of needing medical assistance while traveling increase with age. Think about it: you're more likely to need urgent care if you have heart problems, diabetes, or mobility issues. Plus, seniors often travel to more remote or adventurous locations where medical facilities might not be up to par. Emergency medical evacuation coverage ensures you can get to a quality medical facility, no matter where you are.

How Emergency Medical Evacuation Insurance Works Medical Transport Explained

So, how does this magic work? Basically, if you have a medical emergency while traveling and your current location can't provide adequate treatment, your insurance company will arrange and pay for your transportation to the nearest suitable medical facility. This could involve an ambulance, a helicopter, or even a private jet, depending on the situation. The insurance company's assistance team will coordinate everything, from arranging the transport to communicating with the medical team. They'll also handle the logistics of getting you back home once you're stable enough to travel.

Key Benefits of Emergency Medical Evacuation Coverage for International Travel

The benefits are huge. First, it covers the often astronomical costs of medical transportation. We're talking tens of thousands, even hundreds of thousands of dollars, for a single evacuation. Second, it provides peace of mind knowing you can get the best possible care, regardless of your location. Third, it gives your family peace of mind knowing you're protected. Finally, it can literally save your life in a critical situation.

What Does Emergency Medical Evacuation Insurance Cover Medical Emergency Coverage Details

Emergency medical evacuation insurance typically covers the following:

- Transportation to the nearest appropriate medical facility.

- Medical care during transport.

- Coordination of medical transport.

- Repatriation (transport back home) after treatment.

- Sometimes, it also covers travel expenses for a family member to be with you.

Factors Affecting the Cost of Emergency Medical Evacuation Insurance Senior Travel Insurance Costs

The cost of emergency medical evacuation insurance depends on several factors, including:

- Your age.

- Your health.

- Your destination.

- The length of your trip.

- The coverage amount.

Generally, older travelers and those with pre-existing conditions will pay more. Trips to remote or high-risk destinations will also increase the cost. But remember, the cost of the insurance is a small price to pay compared to the potential cost of an un-insured medical evacuation.

Choosing the Right Emergency Medical Evacuation Policy for Seniors Comparing Travel Insurance Plans

When choosing a policy, consider the following:

- Coverage Amount: Make sure the policy has a high enough coverage limit to cover potential evacuation costs. $1 million is a good starting point.

- Pre-existing Conditions: Check if the policy covers pre-existing conditions. Some policies offer waivers for pre-existing conditions if you purchase the insurance within a certain timeframe of booking your trip.

- Exclusions: Be aware of any exclusions in the policy, such as coverage for extreme sports or travel to certain high-risk areas.

- Assistance Services: Look for policies that offer 24/7 assistance services, including medical referrals, translation assistance, and emergency travel arrangements.

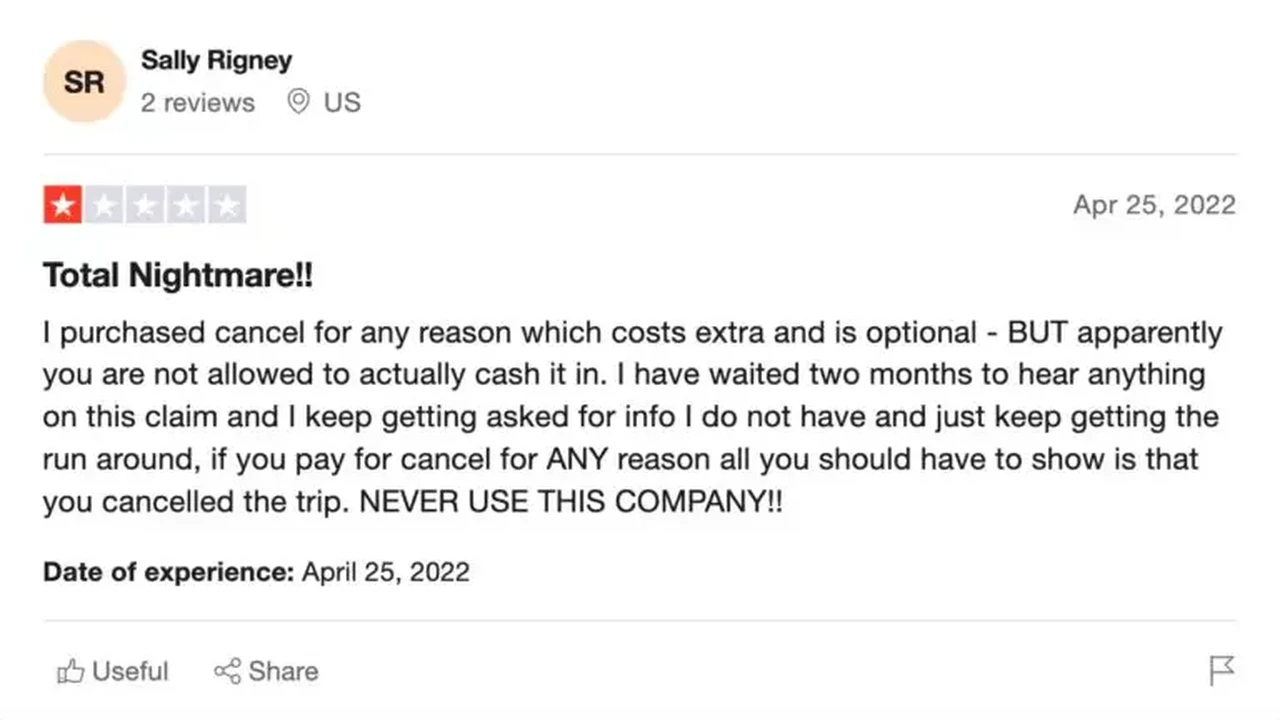

- Reputation: Choose a reputable insurance company with a good track record of paying claims.

Emergency Medical Evacuation Insurance vs Travel Medical Insurance Understanding the Differences

It's important to distinguish between emergency medical evacuation insurance and travel medical insurance. Travel medical insurance covers medical expenses incurred while traveling, such as doctor visits, hospital stays, and prescription drugs. Emergency medical evacuation insurance covers the cost of transporting you to a medical facility. You might need both types of coverage for comprehensive protection.

Specific Emergency Medical Evacuation Insurance Products for Seniors Recommendations and Reviews

Okay, let's get down to brass tacks and talk about some specific products. Remember, prices can change, so always get a quote yourself!

1. MedjetAssist: Premium Membership for Medical Transport

MedjetAssist is a membership program, not insurance, but it provides comprehensive medical transport. Instead of paying for evacuation expenses, MedjetAssist arranges and pays for medical transport to the hospital of your choice *within your home country*. This is a huge benefit if you want to be treated by your regular doctors.

- Usage Scenario: Ideal for seniors who want to be transported to their preferred hospital, regardless of location. Especially valuable for those with complex medical histories.

- Comparison: Unlike traditional insurance, MedjetAssist doesn't have deductibles or co-pays for transport. However, it doesn't cover medical expenses, just transport.

- Price: Individual annual memberships start around $315.

2. Travel Guard Preferred Plan: Comprehensive Coverage with Evacuation

Travel Guard offers a range of travel insurance plans, and their Preferred Plan includes emergency medical evacuation coverage, as well as trip cancellation, trip interruption, medical expenses, and baggage loss. They have a 24/7 assistance hotline and a strong reputation.

- Usage Scenario: A good all-around option for seniors looking for comprehensive travel insurance with solid evacuation coverage.

- Comparison: Travel Guard's Preferred Plan is typically more expensive than basic plans, but it offers significantly more coverage. Compare their evacuation limits and pre-existing condition exclusions carefully.

- Price: Varies depending on age, trip length, and destination, but expect to pay around $150-$300 for a two-week trip.

3. World Nomads Explorer Plan: Adventure Travel with Evacuation

While often associated with younger travelers, World Nomads' Explorer Plan can be suitable for adventurous seniors. It includes emergency medical evacuation coverage and covers a wide range of activities, including hiking, cycling, and even some water sports. Be sure to check the specific activity exclusions.

- Usage Scenario: Best for active seniors who plan to participate in adventurous activities while traveling.

- Comparison: World Nomads' Explorer Plan is generally more expensive than Travel Guard's Preferred Plan, but it offers broader coverage for adventure activities. It might have stricter limitations on pre-existing conditions.

- Price: Expect to pay around $200-$400 for a two-week trip, depending on destination and activities.

4. Allianz Travel Insurance: OneTrip Prime Plan

Allianz is a well-known name in travel insurance, and their OneTrip Prime Plan is a solid option. It includes emergency medical evacuation coverage, trip cancellation/interruption, and baggage protection. They are known for their customer service and ease of filing claims.

- Usage Scenario: Suitable for seniors looking for a reliable and well-established insurance provider with a user-friendly claims process.

- Comparison: Allianz often has competitive pricing. Pay close attention to the policy limits on medical evacuation to ensure they are sufficient for your travel destination.

- Price: A two-week trip could range from $120-$250, depending on the traveler's age and the trip's value.

Tips for Finding the Best Deals on Emergency Medical Evacuation Insurance for Seniors

Here are a few tips to help you find the best deal:

- Shop around: Get quotes from multiple insurance companies.

- Compare coverage: Don't just focus on price; compare the coverage options and policy limits.

- Consider an annual plan: If you travel frequently, an annual plan might be more cost-effective.

- Look for discounts: Some insurance companies offer discounts for seniors, members of certain organizations, or those who purchase the insurance early.

- Read the fine print: Understand the policy terms, conditions, and exclusions before you buy.

Real-Life Scenarios Emergency Medical Evacuation Insurance in Action

Let's look at some real-life scenarios where emergency medical evacuation insurance can make a difference:

- Scenario 1: A senior traveler suffers a stroke while on a cruise in the Caribbean. The ship's medical facilities are limited, and they need to be evacuated to a hospital in Miami. Emergency medical evacuation insurance covers the cost of the helicopter transport and medical care during transport.

- Scenario 2: A senior traveler falls and breaks their hip while hiking in the Himalayas. The local medical facilities are inadequate, and they need to be evacuated to a hospital in Kathmandu. Emergency medical evacuation insurance covers the cost of the helicopter transport and medical care during transport.

- Scenario 3: A senior traveler contracts a serious infection while traveling in a developing country. The local hospitals are overwhelmed, and they need to be evacuated back to the United States for treatment. Emergency medical evacuation insurance covers the cost of the air ambulance transport and medical care during transport.

Protect Yourself from Costly Medical Transport: Senior Travel Planning

Emergency medical evacuation insurance is a must-have for senior travelers, especially those traveling internationally or to remote locations. It provides peace of mind knowing you can get the best possible care in a medical emergency. Don't leave home without it!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)