Coverage for Unexpected Medical Expenses: Senior Travel Insurance

Unexpected medical expenses can derail your trip. Learn how travel insurance can cover doctor visits, hospital stays, and prescription drugs. Protect your health and your wallet.

Why Seniors Need Travel Insurance for Unexpected Medical Expenses

Okay, let's be real. As we get a little older, our bodies might not be as predictable as they used to be. Aches, pains, and the occasional surprise visit to the doc are just part of the game. When you're traveling, being far from your regular doctors and familiar healthcare system can turn a minor hiccup into a major headache – and a major expense. That's where travel insurance for unexpected medical expenses comes in. It’s your safety net, ensuring a sudden illness or injury doesn't wipe out your travel budget and leave you stranded.

Imagine this: You're enjoying a scenic hike in the Swiss Alps, and suddenly, you twist your ankle. Or maybe you're savoring delicious street food in Thailand and develop a nasty case of food poisoning. Without travel insurance, you're looking at potentially huge medical bills, especially if you need to see a doctor, visit a hospital, or even be evacuated. Travel insurance can cover these costs, giving you peace of mind to enjoy your trip.

What Does Travel Insurance Cover Regarding Medical Issues for Seniors?

So, what exactly does travel insurance cover when it comes to unexpected medical expenses? Here’s a breakdown:

- Doctor Visits: Need to see a doctor for a sudden illness or injury? Travel insurance can cover the cost of consultations.

- Hospital Stays: If you require hospitalization, travel insurance can cover the cost of room and board, tests, and treatments.

- Prescription Drugs: Get reimbursed for the cost of prescription medications you need while traveling.

- Emergency Medical Evacuation: In severe cases, if you need to be transported to a better medical facility, travel insurance can cover the hefty costs of medical evacuation.

- Ambulance Services: The cost of ambulance rides can be surprisingly high, and travel insurance can help cover these expenses.

- Diagnostic Testing: X-rays, blood tests, and other diagnostic procedures can be covered by your travel insurance policy.

Specific Scenarios Where Travel Insurance is a Lifesaver for Healthcare

Let's paint a few pictures to illustrate how crucial travel insurance can be:

- Scenario 1: You're on a cruise in the Caribbean and develop a severe allergic reaction. You need immediate medical attention, including antihistamines and potentially a visit to the ship's doctor. Travel insurance can cover these costs.

- Scenario 2: You're visiting family in Europe and contract a respiratory infection. You need to see a local doctor and get antibiotics. Travel insurance can help cover the consultation fee and the cost of the medication.

- Scenario 3: You're on a hiking trip in the US National Parks and suffer a fall, resulting in a broken arm. You need to be transported to the nearest hospital and receive treatment. Travel insurance can cover the ambulance ride, hospital stay, and medical care.

Key Considerations When Choosing Travel Insurance for Healthcare Needs

When selecting a travel insurance policy, keep these points in mind:

- Coverage Limits: Make sure the policy has adequate coverage limits for medical expenses. Consider your destination and the potential cost of healthcare in that region.

- Deductibles: Understand the deductible amount and how it affects your premium. A lower deductible means higher premiums, and vice versa.

- Pre-Existing Conditions: If you have pre-existing conditions, ensure the policy covers them or offers a waiver.

- Policy Exclusions: Be aware of any exclusions in the policy, such as coverage for extreme sports or activities.

- 24/7 Assistance: Choose a policy that offers 24/7 assistance services, so you can get help anytime, anywhere.

Top Travel Insurance Providers for Medical Coverage for Seniors

Now, let’s talk about some specific travel insurance providers that offer excellent medical coverage for seniors. Remember to always get a quote directly from the provider and compare against other options before making a decision.

1. Allianz Travel Insurance

Overview: Allianz is a well-known and reputable travel insurance provider with a variety of plans to suit different needs. They are known for their robust medical coverage and 24/7 assistance services.

Medical Coverage Highlights:

- Emergency Medical Coverage: Up to $500,000 depending on the plan.

- Emergency Medical Transportation: Up to $1,000,000 depending on the plan.

- Coverage for Pre-Existing Conditions: Available with specific plans and waivers.

Example Plan: Allianz Global Assistance Comprehensive Plan

Typical Cost: Varies depending on age, trip duration, and coverage level, but expect to pay around $150-$300 for a two-week trip.

Ideal Use Case: Seniors traveling internationally who want comprehensive medical coverage and reliable customer support.

2. World Nomads

Overview: World Nomads is popular among adventurous travelers, but they also offer solid medical coverage for seniors. They have two main plans: Standard and Explorer.

Medical Coverage Highlights:

- Emergency Medical Coverage: Up to $100,000 (Standard) or $300,000 (Explorer).

- Emergency Medical Transportation: Included in both plans.

- Coverage for Activities: Covers a wide range of adventure activities.

Example Plan: World Nomads Explorer Plan

Typical Cost: Slightly higher than Allianz, ranging from $200-$400 for a two-week trip, depending on age and destination.

Ideal Use Case: Active seniors who plan to participate in adventurous activities like hiking, skiing, or diving.

3. Travel Guard

Overview: Travel Guard is another reputable provider that offers a range of travel insurance plans, including those with strong medical coverage. They are known for their customizable options.

Medical Coverage Highlights:

- Emergency Medical Coverage: Up to $50,000 or $100,000 depending on the plan.

- Emergency Medical Transportation: Included in most plans.

- 24/7 Travel Assistance: Comprehensive assistance services available.

Example Plan: Travel Guard Preferred Plan

Typical Cost: Similar to Allianz, around $150-$300 for a two-week trip, depending on the chosen coverage levels.

Ideal Use Case: Seniors who want customizable coverage options and reliable medical assistance.

4. GeoBlue

Overview: GeoBlue focuses specifically on international health insurance and travel medical insurance, making them a strong choice for seniors traveling abroad. They offer robust coverage and access to a global network of doctors and hospitals.

Medical Coverage Highlights:

- Emergency Medical Coverage: Up to $1,000,000 or more depending on the plan.

- Emergency Medical Transportation: Included in all plans.

- Direct Billing: GeoBlue often handles direct billing with healthcare providers.

Example Plan: GeoBlue Voyager Choice Plan

Typical Cost: Can be higher than other options, ranging from $250-$500 for a two-week trip, but the extensive coverage and direct billing can be worth it.

Ideal Use Case: Seniors traveling internationally who want the highest level of medical coverage and direct billing capabilities.

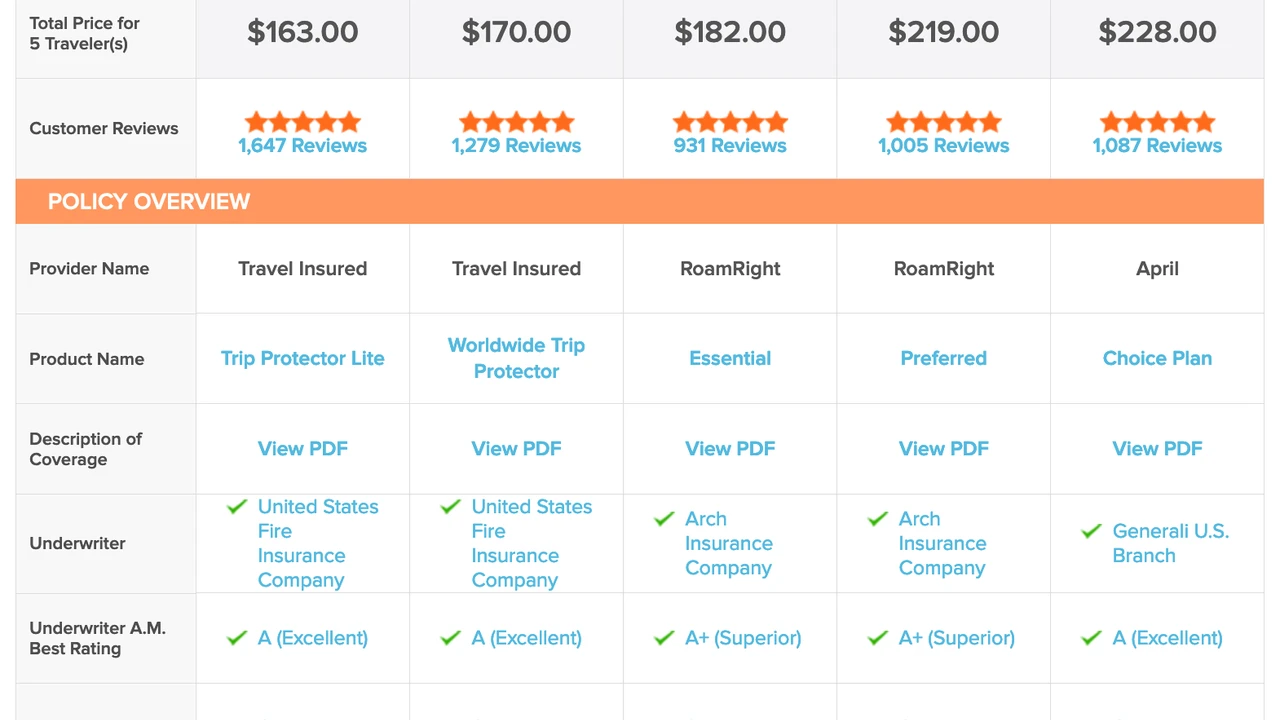

Comparing Travel Insurance Products: A Side-by-Side Look

To make your decision easier, here’s a table comparing the key features of these travel insurance providers:

| Provider | Emergency Medical Coverage | Emergency Medical Transportation | Pre-Existing Conditions Coverage | 24/7 Assistance | Typical Cost (2-week trip) | Ideal Use Case |

|---|---|---|---|---|---|---|

| Allianz | Up to $500,000 | Up to $1,000,000 | Available with some plans | Yes | $150-$300 | International travelers seeking comprehensive coverage |

| World Nomads | Up to $300,000 | Included | Limited coverage | Yes | $200-$400 | Active seniors participating in adventure activities |

| Travel Guard | Up to $100,000 | Included | Available with some plans | Yes | $150-$300 | Travelers seeking customizable coverage options |

| GeoBlue | Up to $1,000,000+ | Included | Limited coverage | Yes | $250-$500 | International travelers desiring extensive coverage and direct billing |

Tips for Maximizing Your Travel Insurance Benefits for Healthcare

Here are a few tips to help you get the most out of your travel insurance policy:

- Read the Policy Carefully: Understand the terms, conditions, and exclusions.

- Keep Documentation: Carry a copy of your insurance policy and contact information.

- Contact the Insurance Company First: If possible, contact the insurance company before seeking medical treatment.

- Keep Receipts: Save all medical bills and receipts for reimbursement.

- File Claims Promptly: File your claim as soon as possible after your trip.

Real-Life Examples of Travel Insurance Helping Seniors with Medical Bills

To further illustrate the value of travel insurance, here are a couple of real-life examples:

Example 1: Mrs. Johnson, a 70-year-old retiree, was traveling in Italy when she experienced a sudden heart issue. She required hospitalization and treatment, which cost over $20,000. Her travel insurance policy covered the entire amount, saving her from a significant financial burden.

Example 2: Mr. Smith, a 65-year-old traveler, fell and broke his hip while on a cruise. He needed emergency medical evacuation to a hospital on shore. The evacuation cost over $50,000, but his travel insurance policy covered the expense, ensuring he received the necessary medical care.

Final Thoughts on Senior Travel Insurance and Healthcare

Traveling as a senior should be a joyful and enriching experience. With the right travel insurance policy, you can protect yourself from unexpected medical expenses and enjoy your trip with peace of mind. Take the time to research and compare different options to find the best coverage for your needs. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)