InsureMyTrip vs. Squaremouth: Travel Insurance Comparison for Seniors

Compare InsureMyTrip and Squaremouth travel insurance comparison sites. Which platform is easier to use and offers the best deals for seniors? Find the perfect policy for your needs.

Understanding Travel Insurance Comparison Sites for Senior Citizens

Okay, so you're a savvy senior traveler, ready to explore the world! But before you pack your bags, you know you need travel insurance. That's where travel insurance comparison sites come in – they're like online marketplaces where you can see multiple policies side-by-side. Two of the biggest names in this game are InsureMyTrip and Squaremouth. But which one is better for you? Let's dive in!

InsureMyTrip A Deep Dive for Senior Travelers

InsureMyTrip has been around for a while, and they boast a huge selection of travel insurance plans from various providers. Think of it as a superstore for travel insurance. They're based in the US, which can be comforting for some. Here's what you need to know:

Key Features of InsureMyTrip Tailored for Seniors

- Wide Selection: Seriously, they have a ton of plans. This means you'll likely find something that fits your specific needs, even if you have unique requirements or pre-existing conditions.

- Comprehensive Filters: Their filtering system is pretty robust. You can filter by price, coverage types (like medical, cancellation, baggage), provider, and even specific activities you'll be doing on your trip. This is super helpful for narrowing down your options.

- Customer Reviews: They feature customer reviews for each plan, which can give you valuable insights into the real-world experiences of other travelers.

- 24/7 Customer Support: InsureMyTrip offers 24/7 customer support, which is a huge plus in case you have questions or need assistance while you're traveling.

Using InsureMyTrip A Senior's User Experience

The InsureMyTrip website is generally user-friendly, but it can feel a little overwhelming at first due to the sheer volume of information. Take your time and use the filters to your advantage. You'll need to enter your trip details (destination, dates, traveler ages, and trip cost) to get started. Once you've done that, you'll see a list of plans that meet your criteria. Click on each plan to see the details of coverage, exclusions, and price.

InsureMyTrip Pricing and Value for Senior Budgets

Pricing on InsureMyTrip varies widely depending on your trip details and the level of coverage you choose. It's important to compare several plans to find the best value for your money. Keep in mind that the cheapest plan isn't always the best – you need to make sure it provides adequate coverage for your specific needs. Generally, expect to pay anywhere from 5% to 15% of your total trip cost for travel insurance.

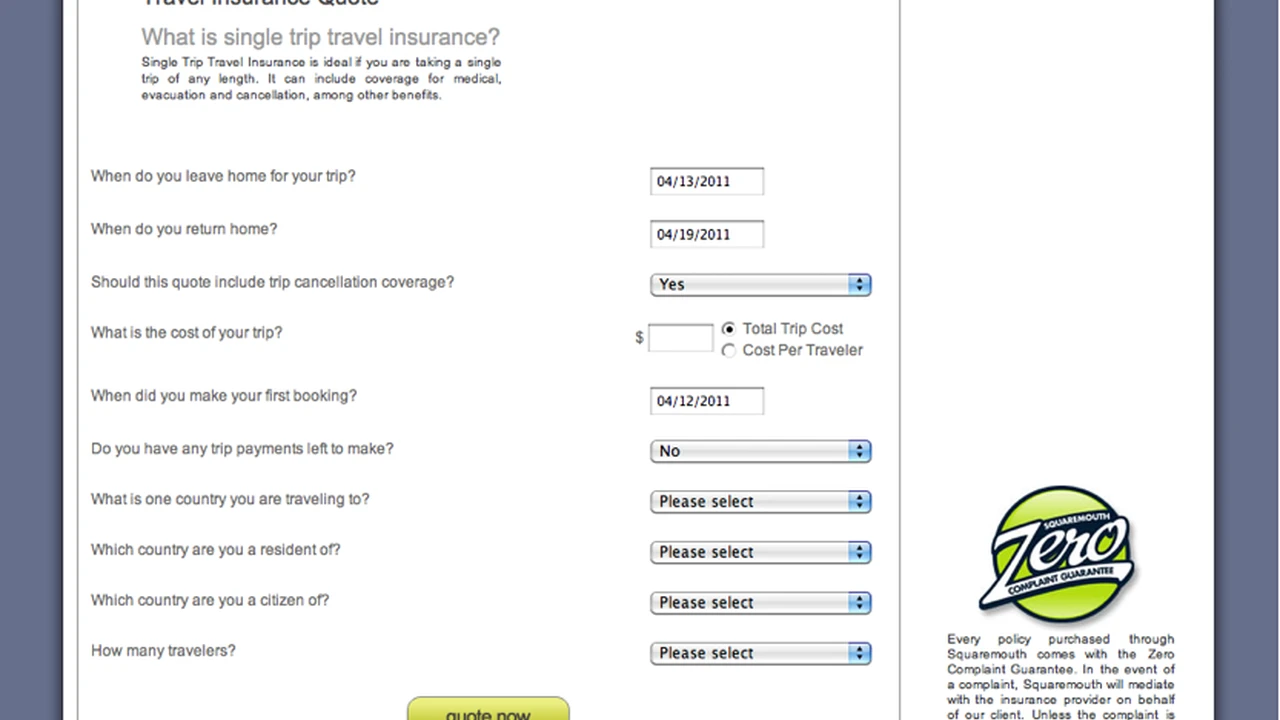

Squaremouth A Streamlined Approach for Senior Needs

Squaremouth takes a slightly different approach. They also offer a wide selection of plans, but they focus on simplicity and transparency. They're known for their "zero complaint guarantee," which means they'll advocate for you if you have a legitimate complaint against an insurance provider.

Key Features of Squaremouth Suited for Senior Travelers

- Zero Complaint Guarantee: This is a big selling point for Squaremouth. It gives you peace of mind knowing that they'll stand behind you if you have a problem with your insurance provider.

- Simplified Interface: Squaremouth's website is clean and easy to navigate. The filtering system is intuitive, and the plan details are presented in a clear and concise manner.

- Real Customer Reviews: Like InsureMyTrip, Squaremouth features customer reviews for each plan.

- "Quote Comparison" Tool: Squaremouth offers a quote comparison tool that allows you to easily compare the key features and benefits of different plans.

Navigating Squaremouth A Senior-Friendly Website

Squaremouth's website is very user-friendly, even for those who aren't particularly tech-savvy. The process is similar to InsureMyTrip – you enter your trip details, and then you'll see a list of plans that meet your criteria. However, Squaremouth's interface is cleaner and less cluttered, making it easier to focus on the information that's most important to you.

Squaremouth Cost and Affordability for Seniors

Squaremouth's pricing is generally competitive with InsureMyTrip. Again, it's important to compare several plans to find the best value. Squaremouth also offers a "best price guarantee," which means they'll match the price of any identical plan found on another website.

Product Recommendations and Use Cases for Senior Travel Insurance

Let's get into some specific product recommendations. Remember, these are just examples, and the best plan for you will depend on your individual needs and circumstances.

Allianz Global Assistance AllTrips Premier Plan

Use Case: Frequent travelers who want comprehensive coverage for multiple trips throughout the year.

Features: Trip cancellation, trip interruption, emergency medical, baggage loss, and rental car coverage. Includes coverage for pre-existing conditions (if certain requirements are met).

Pricing: Varies depending on age and state of residence, but typically ranges from $300 to $600 per year.

World Nomads Explorer Plan

Use Case: Adventurous seniors who plan to participate in activities like hiking, skiing, or scuba diving.

Features: Emergency medical, evacuation, baggage loss, and coverage for adventure activities. Offers higher medical limits than the Standard Plan.

Pricing: Typically more expensive than other plans, ranging from $100 to $300 per trip, depending on the length of the trip and the destination.

Travel Guard Gold Plan

Use Case: Seniors who are concerned about trip cancellation due to illness or other unforeseen circumstances.

Features: Trip cancellation, trip interruption, emergency medical, baggage loss, and 24/7 assistance services. Offers a "cancel for any reason" (CFAR) upgrade (for an additional cost).

Pricing: Mid-range pricing, typically ranging from $80 to $200 per trip.

Using Travel Insurance for Medical Needs and Pre-Existing Conditions Information for Seniors

One of the biggest concerns for senior travelers is medical coverage. Make sure the plan you choose offers adequate coverage for emergency medical expenses, including hospitalization, doctor visits, and prescription drugs. If you have pre-existing conditions, look for a plan that offers a waiver or covers them under certain circumstances. Be sure to read the policy carefully to understand the limitations and exclusions.

Comparing Plans Side-by-Side A Senior's Guide to Choosing the Right Policy

Here's a table comparing some key features of InsureMyTrip and Squaremouth:

| Feature | InsureMyTrip | Squaremouth |

|---|---|---|

| Selection of Plans | Very Wide | Very Wide |

| User Interface | Slightly Complex | Simplified and Clean |

| Customer Support | 24/7 | 24/7 |

| Zero Complaint Guarantee | No | Yes |

| Quote Comparison Tool | Yes, but less prominent | Yes, Easy to use |

| Best Price Guarantee | No | Yes |

Making the Right Choice A Senior's Checklist for Travel Insurance

So, which site is better? It really depends on your personal preferences. If you want the absolute widest selection of plans and don't mind a slightly more complex interface, InsureMyTrip is a good choice. If you value simplicity, transparency, and the "zero complaint guarantee," Squaremouth might be a better fit.

Before you make a decision, here's a checklist to help you choose the right travel insurance plan:

- Determine your needs: What are your biggest concerns? Medical coverage? Trip cancellation? Baggage loss?

- Compare quotes from multiple providers: Don't just settle for the first quote you see.

- Read the fine print: Understand the policy terms, conditions, and exclusions.

- Check customer reviews: See what other travelers have to say about their experiences.

- Consider your budget: Find a plan that offers adequate coverage at a price you can afford.

- Don't wait until the last minute: Buy your travel insurance as soon as you book your trip.

Travel insurance is an investment in your peace of mind. By taking the time to research your options and choose the right plan, you can travel with confidence knowing that you're protected from unexpected events.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)