Trip Interruption Coverage: What It Covers and When to Use It

Trip interruption coverage can reimburse you for unexpected trip disruptions Learn about covered reasons and how to file a claim Get back on track after unexpected travel delays

Understanding Trip Interruption Insurance for Senior Travelers

So, you've booked your dream vacation – maybe a relaxing cruise to the Caribbean or a historical tour of Europe. You're all set to go, but then… life happens. A sudden illness, a family emergency, a natural disaster – any number of unexpected events can throw a wrench in your plans and force you to cut your trip short. That's where trip interruption insurance comes in handy. It's designed to protect you financially when unforeseen circumstances force you to interrupt your travel plans after they've already begun. Unlike trip cancellation insurance, which covers events *before* your departure, trip interruption coverage kicks in *during* your trip.

What Exactly Does Trip Interruption Cover for Seniors?

Trip interruption insurance covers a range of scenarios, providing reimbursement for expenses incurred due to interrupting your trip. Here's a breakdown of common covered reasons:

- Illness or Injury: If you, a traveling companion, or a close family member becomes seriously ill or injured during your trip, requiring medical attention that prevents you from continuing your travels, trip interruption coverage can help. This is a big one for seniors, as health concerns can arise unexpectedly.

- Death: The death of you, a traveling companion, or a close family member is a covered reason for trip interruption.

- Natural Disasters: Hurricanes, earthquakes, floods, and other natural disasters that make your destination uninhabitable or disrupt transportation can trigger trip interruption coverage.

- Severe Weather: Blizzards, ice storms, and other severe weather events that cause travel delays or cancellations can also be covered.

- Family Emergencies: Unexpected family emergencies, such as a fire at your home or a legal obligation, can be covered reasons for interrupting your trip.

- Airline or Transportation Issues: If your airline goes on strike, or if there are significant delays or cancellations that prevent you from reaching your destination or continuing your trip, trip interruption coverage may apply.

- Mandatory Evacuations: If authorities issue a mandatory evacuation order for your destination, trip interruption coverage can help you get to safety.

When Should Seniors Use Trip Interruption Coverage? Real-Life Scenarios

Let's look at a few real-life scenarios to illustrate when trip interruption coverage can be a lifesaver for senior travelers:

- Scenario 1: You're on a cruise in Alaska when you develop a severe case of pneumonia. The ship's doctor recommends immediate hospitalization. Trip interruption coverage can reimburse you for the unused portion of your cruise, as well as the cost of transportation to a suitable medical facility.

- Scenario 2: You're touring Italy when you receive news that your spouse has been hospitalized back home. Trip interruption coverage can cover the cost of a last-minute flight home to be with your loved one.

- Scenario 3: You're visiting family in Florida when a hurricane hits. Your flight home is canceled, and you're forced to stay in a hotel for several days. Trip interruption coverage can reimburse you for the cost of your hotel stay and meals.

What Expenses Are Typically Reimbursed by Trip Interruption Insurance for Seniors?

Trip interruption coverage typically reimburses you for the following expenses:

- Unused, non-refundable trip costs: This includes prepaid and non-refundable expenses such as hotel accommodations, tours, and transportation.

- Additional transportation costs: This includes the cost of a one-way flight home or to a new destination.

- Reasonable and necessary expenses: This includes the cost of meals and accommodation incurred due to the trip interruption.

Trip Interruption Insurance: Specific Product Recommendations for Seniors

Okay, let's talk specific products. Remember, the best plan for you depends on your individual needs and travel style. It's always a good idea to get quotes from multiple providers and compare coverage details carefully.

1. Allianz Travel Insurance - Prime Plan: Comprehensive Coverage for Seniors

Key Features: Allianz's Prime Plan offers comprehensive trip interruption coverage, including coverage for pre-existing medical conditions (if the policy is purchased within a certain timeframe), emergency medical and dental expenses, and baggage loss or delay. They also have a strong reputation for customer service.

Suitable Scenarios: This plan is great for seniors who want a high level of coverage and peace of mind, especially those with pre-existing medical conditions. It's a good choice for international travel and longer trips.

Cost: Prices vary based on age, trip cost, and destination, but you can expect to pay in the range of $150-$300 for a two-week trip to Europe for a senior.

Comparison: Allianz is generally more expensive than some other options, but they offer more comprehensive coverage and higher policy limits. They also have a good track record for paying claims.

2. World Nomads - Explorer Plan: Adventure Travel Coverage for Active Seniors

Key Features: World Nomads' Explorer Plan is designed for adventurous travelers, including seniors who enjoy activities like hiking, skiing, and scuba diving. It includes trip interruption coverage, as well as coverage for emergency medical expenses, evacuation, and adventure sports.

Suitable Scenarios: This plan is ideal for active seniors who plan to participate in adventure activities during their trip. It's a good choice for travel to remote or high-risk destinations.

Cost: World Nomads can be more expensive than other options, especially for older travelers, due to the higher risk associated with adventure activities. Expect to pay $200-$400 for a two-week trip, depending on the destination and activities.

Comparison: World Nomads is a good option if you need coverage for adventure sports, but it may not be the most cost-effective choice if you're not planning on participating in those activities.

3. Travel Guard - Essential Plan: Budget-Friendly Trip Interruption Coverage for Seniors

Key Features: Travel Guard's Essential Plan offers basic trip interruption coverage at a more affordable price point. It includes coverage for trip interruption due to illness, injury, or death, as well as coverage for baggage loss or delay.

Suitable Scenarios: This plan is a good choice for seniors who are on a budget and don't need comprehensive coverage. It's a suitable option for shorter trips and travel within the United States.

Cost: Travel Guard's Essential Plan is generally one of the more affordable options, with prices ranging from $50-$150 for a two-week trip.

Comparison: The Essential Plan offers less coverage than other plans, so it's important to carefully review the policy details to ensure it meets your needs. Policy limits are lower, and coverage for pre-existing conditions may be limited.

4. InsureMyTrip - Comparison Site: Finding the Best Trip Interruption Insurance for Seniors

Key Features: InsureMyTrip isn't an insurance provider, but a comparison website. It allows you to compare quotes from multiple insurance companies side-by-side, making it easier to find the best plan for your needs and budget. They also offer customer reviews and expert advice.

Suitable Scenarios: This is a great option for seniors who want to compare a wide range of plans and find the best deal. It's also helpful if you're not sure which type of coverage you need.

Cost: Using InsureMyTrip is free. You only pay for the insurance policy you choose to purchase.

Comparison: InsureMyTrip is a valuable tool for research, but it's important to remember that they are a third-party website and don't underwrite the insurance policies themselves. Always read the policy details carefully before purchasing.

Factors Affecting the Cost of Trip Interruption Insurance for Seniors

Several factors can influence the cost of trip interruption insurance:

- Age: Older travelers typically pay higher premiums due to the increased risk of medical issues.

- Trip Cost: The higher the cost of your trip, the more coverage you'll need, and the higher your premium will be.

- Destination: Travel to certain destinations, such as remote or high-risk areas, may result in higher premiums.

- Coverage Limits: Higher coverage limits will result in higher premiums.

- Deductible: A higher deductible will lower your premium, but you'll have to pay more out of pocket if you file a claim.

- Pre-existing Medical Conditions: If you have pre-existing medical conditions, you may need to purchase a policy with a waiver for pre-existing conditions, which can increase the cost.

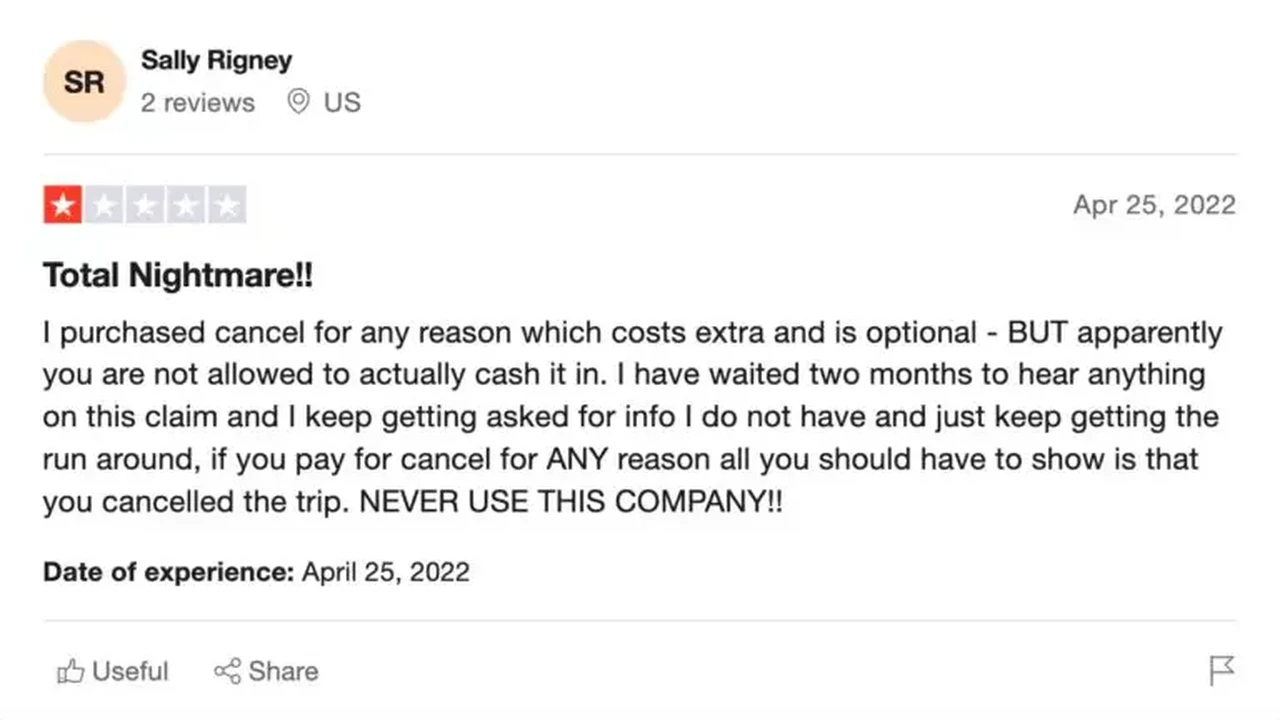

Tips for Filing a Trip Interruption Claim as a Senior

Filing a trip interruption claim can seem daunting, but here are some tips to make the process smoother:

- Contact your insurance provider as soon as possible: Notify your insurance company as soon as you experience a covered event that causes you to interrupt your trip.

- Gather documentation: Collect all relevant documentation, such as medical records, police reports, airline tickets, hotel receipts, and any other proof of your expenses.

- Complete the claim form accurately: Fill out the claim form completely and accurately. Provide all the information requested by the insurance company.

- Submit your claim promptly: Submit your claim as soon as possible after gathering all the necessary documentation.

- Keep copies of everything: Make copies of all documents you submit to the insurance company.

- Follow up with the insurance company: If you haven't heard back from the insurance company within a reasonable timeframe, follow up to check on the status of your claim.

Trip Interruption Insurance vs Other Types of Travel Insurance for Seniors

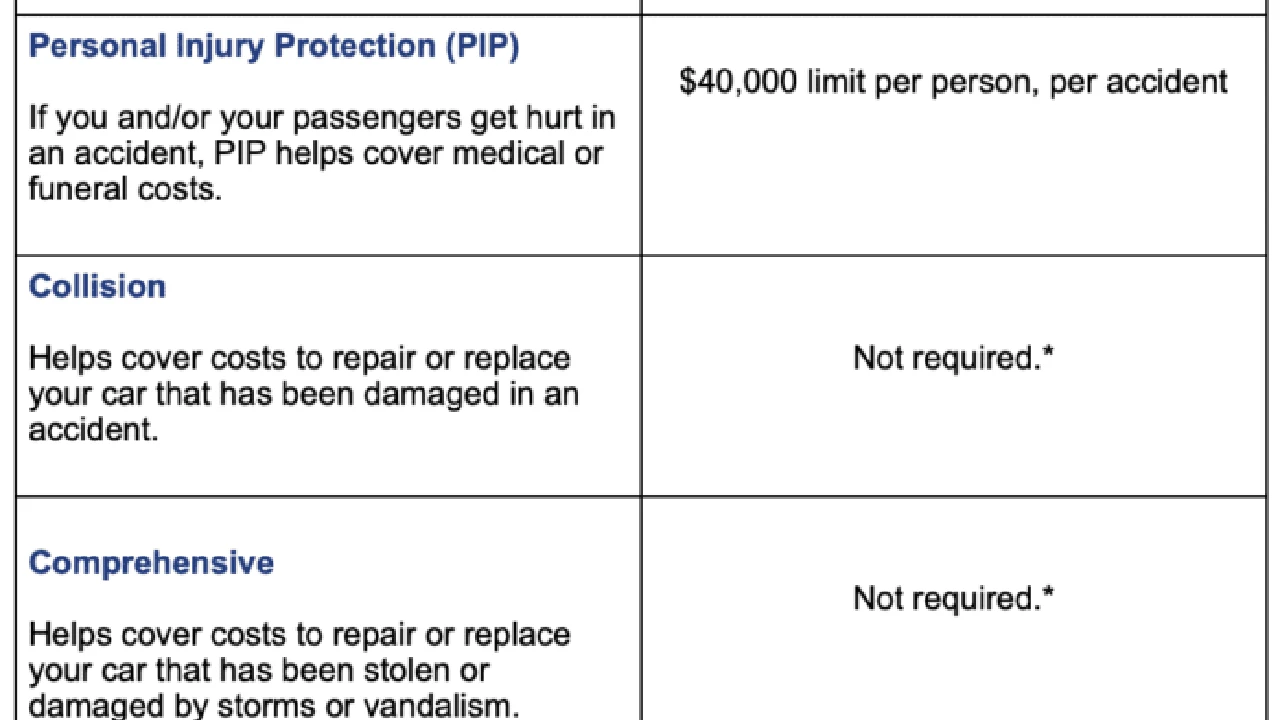

It's important to understand how trip interruption insurance differs from other types of travel insurance:

- Trip Cancellation Insurance: Covers events that occur *before* your trip begins, preventing you from traveling.

- Travel Medical Insurance: Covers medical expenses incurred during your trip.

- Baggage Insurance: Covers lost, stolen, or damaged luggage.

- Emergency Evacuation Insurance: Covers the cost of emergency medical evacuation.

Many comprehensive travel insurance plans include all of these types of coverage, providing a comprehensive safety net for your trip.

Is Trip Interruption Insurance Worth It for Seniors?

Ultimately, the decision of whether or not to purchase trip interruption insurance is a personal one. However, for seniors, the potential benefits often outweigh the cost. The peace of mind that comes with knowing you're protected against unexpected events can be invaluable, especially when traveling far from home. Think about your own risk tolerance, your health situation, and the cost of your trip. If you're concerned about the possibility of having to interrupt your trip due to unforeseen circumstances, trip interruption insurance is a smart investment.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)