Coverage for Mobility Aids: Travel Insurance for Seniors with Disabilities

Coverage for Unexpected Medical Expenses can derail your trip. Learn how travel insurance can cover doctor visits, hospital stays, and prescription drugs. Protect your health and your wallet.

Why Medical Expense Coverage Matters Senior Travel

Let's face it, nobody *wants* to think about getting sick or injured while on vacation. But reality has a funny way of crashing our best-laid plans. As seniors, we're often more susceptible to health issues, and that's where travel insurance with robust medical expense coverage becomes a real lifesaver. Think of it as your safety net, ensuring that a sudden illness or accident doesn't turn into a financial catastrophe.

Understanding What's Covered Medical Expenses

So, what exactly does "coverage for unexpected medical expenses" mean? It typically includes:

- Doctor's Visits: Got a nasty cold? Need to see a doctor for a sudden ailment? Travel insurance can cover the cost of consultations.

- Hospital Stays: A more serious situation requiring hospitalization? Your policy can cover room and board, tests, and treatments.

- Prescription Drugs: Need a refill of your medication or a new prescription? Coverage can help with the costs.

- Emergency Dental Care: A cracked tooth or sudden toothache can ruin your trip. Some policies offer coverage for emergency dental treatments.

- Diagnostic Testing: X-rays, blood tests, and other diagnostic procedures are often covered.

- Ambulance Services: The cost of ambulance transport can be surprisingly high, especially in foreign countries.

It's crucial to read the fine print of your policy to understand the specific limits and exclusions. Some policies might have sub-limits for certain types of treatment, or exclude coverage for pre-existing conditions (more on that later!).

Pre-Existing Conditions and Medical Coverage Senior Insurance

Ah, the dreaded pre-existing condition clause! This is where things can get a little tricky. Many travel insurance policies have limitations or exclusions for pre-existing conditions. However, there are options available:

- Waivers: Some policies offer waivers for pre-existing conditions if you purchase the insurance within a certain timeframe of booking your trip (usually 14-21 days). This means that your pre-existing condition will be covered.

- Look for Specific Coverage: Some insurers specialize in covering pre-existing conditions. Be prepared to answer detailed questions about your health history.

- Consider a Policy with a "Look-Back Period": Some policies have a "look-back period," meaning they only consider conditions that have been treated within a certain timeframe (e.g., 180 days) before your trip.

Important Note: Always be honest about your pre-existing conditions when applying for travel insurance. Failure to disclose can result in your claim being denied.

Recommended Travel Insurance Plans for Seniors with High Medical Coverage

Allianz Global Assistance AllTrips Premier Plan Comprehensive Coverage

Overview: Allianz Global Assistance is a well-known and reputable provider. Their AllTrips Premier plan offers comprehensive coverage, including high limits for medical expenses and emergency medical evacuation.

Key Features:

- High medical expense coverage limits (up to $500,000).

- Emergency medical evacuation coverage (up to $1,000,000).

- Trip cancellation and interruption coverage.

- Baggage loss and delay coverage.

- 24/7 assistance services.

- May offer pre-existing condition waivers (check specific policy details).

Best For: Seniors who want comprehensive coverage and high limits for medical expenses.

Typical Cost: Prices vary based on age, trip length, and destination, but expect to pay $150-$400 for a two-week trip.

Use Case: Imagine you're on a cruise in the Mediterranean and experience a sudden heart problem. This plan would cover your medical expenses in a foreign hospital and, if necessary, arrange and pay for your medical evacuation back to the US.

World Nomads Explorer Plan Adventure Travel Ready

Overview: While often marketed towards younger adventurers, World Nomads' Explorer Plan can be a good option for active seniors. It offers coverage for a wide range of activities and higher risk scenarios.

Key Features:

- Medical expense coverage (limits vary by country of residence).

- Emergency medical evacuation coverage.

- Coverage for adventure activities (check specific policy details).

- Trip cancellation and interruption coverage.

- Gear coverage (for lost or stolen equipment).

- 24/7 assistance services.

Best For: Active seniors who plan to participate in adventure activities like hiking, skiing, or scuba diving. It's crucial to verify that your specific activities are covered.

Typical Cost: Generally more expensive than standard plans, ranging from $200-$500+ for a two-week trip, depending on the activities covered.

Use Case: You're hiking in the Swiss Alps and twist your ankle, requiring a helicopter rescue. The Explorer Plan would cover the cost of the rescue and your subsequent medical treatment.

Seven Corners RoundTrip Choice Plan Customizable Options

Overview: Seven Corners offers a variety of plans, and the RoundTrip Choice plan is a good mid-range option. It allows you to customize your coverage to some extent.

Key Features:

- Medical expense coverage (limits vary).

- Emergency medical evacuation coverage.

- Trip cancellation and interruption coverage.

- Baggage loss and delay coverage.

- 24/7 assistance services.

- Options to add coverage for pre-existing conditions (check specific policy details and timelines).

Best For: Seniors who want a balance of coverage and affordability and appreciate some flexibility in customizing their policy.

Typical Cost: Expect to pay $100-$300 for a two-week trip, depending on the chosen coverage levels.

Use Case: You're on a road trip across the US and develop a severe allergy requiring a visit to an urgent care clinic. This plan would cover the cost of the visit and any necessary medications.

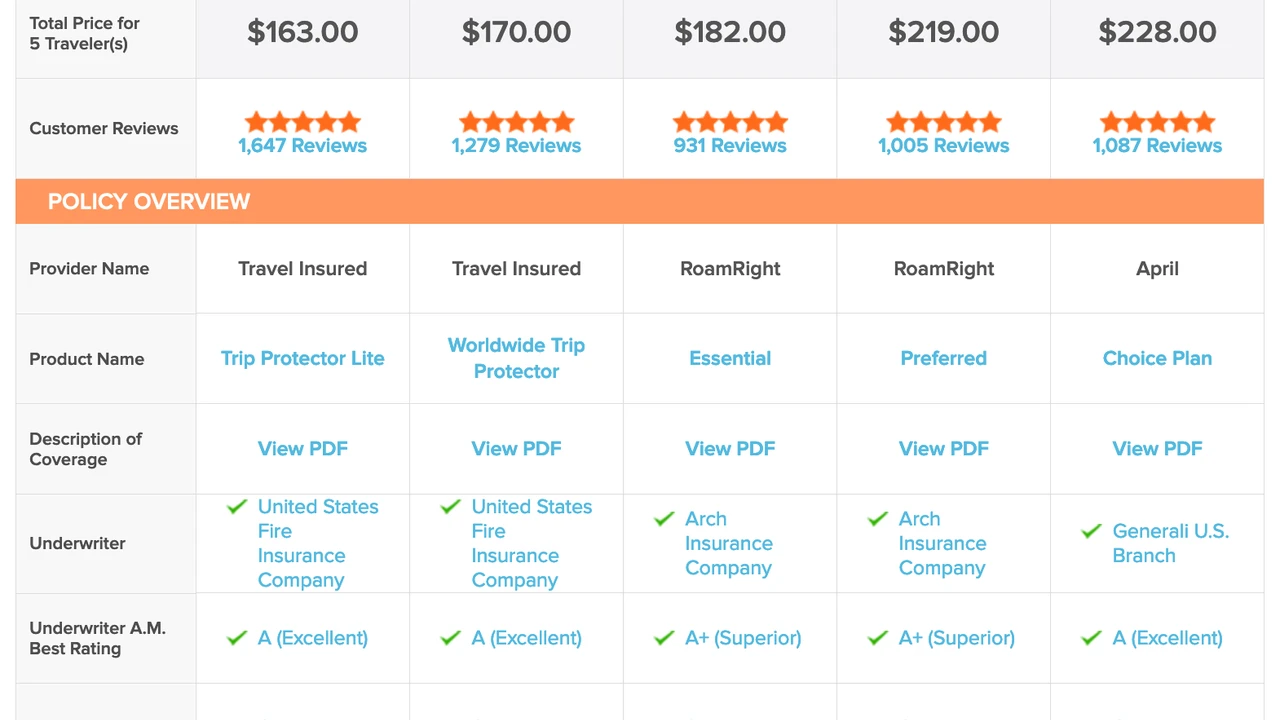

Comparing Travel Insurance Plans for Medical Needs Senior Focus

Choosing the right travel insurance plan is all about finding the best fit for your individual needs. Here's a quick comparison of the three plans mentioned above:

| Feature | Allianz Global Assistance AllTrips Premier | World Nomads Explorer | Seven Corners RoundTrip Choice |

|---|---|---|---|

| Medical Expense Coverage | High limits (up to $500,000) | Varies by country | Varies, customizable |

| Emergency Evacuation | High limits (up to $1,000,000) | Covered | Covered |

| Pre-Existing Conditions | May offer waivers | Limited coverage, check details | Options to add coverage |

| Adventure Activities | Not specifically included | Covered (check specific activities) | Not specifically included |

| Cost | Higher end | Highest | Mid-range |

| Best For | Comprehensive coverage, high limits | Active travelers, adventure activities | Customizable coverage, good value |

Important Considerations When Comparing:

- Deductibles: How much will you have to pay out-of-pocket before your coverage kicks in?

- Policy Limits: What are the maximum amounts the policy will pay for different types of claims?

- Exclusions: What isn't covered by the policy?

- Customer Service: Is the insurer known for good customer service and claims handling?

How to Find the Best Prices on Travel Insurance Senior Discounts

Nobody wants to overpay for travel insurance! Here are some tips for finding the best prices:

- Shop Around: Get quotes from multiple insurers. Comparison websites like Squaremouth and InsureMyTrip can be helpful.

- Look for Discounts: Some insurers offer discounts for seniors, members of certain organizations (like AARP), or for purchasing annual plans.

- Adjust Your Coverage: Consider lowering your coverage limits or increasing your deductible to reduce the premium. But be careful not to sacrifice too much coverage!

- Buy Early: Purchasing your insurance soon after booking your trip may allow you to qualify for pre-existing condition waivers.

Understanding Policy Exclusions Senior Travel Protection

It's essential to understand what your travel insurance policy *doesn't* cover. Common exclusions include:

- Pre-existing conditions (without a waiver): As mentioned earlier, many policies have limitations on pre-existing conditions.

- Acts of War or Terrorism: Coverage may be limited or excluded in areas experiencing war or terrorism.

- Participation in Illegal Activities: If you're injured while engaging in illegal activities, your claim will likely be denied.

- Traveling Against Medical Advice: If your doctor advises you not to travel, and you do so anyway, your coverage may be void.

- Cosmetic Surgery: Elective cosmetic procedures are generally not covered.

- Routine Medical Care: Travel insurance is designed for unexpected medical emergencies, not routine checkups or ongoing treatment.

Filing a Claim for Medical Expenses Step-by-Step Guide

So, you've had a medical emergency and need to file a claim. Here's a general outline of the process:

- Seek Medical Attention: Your health is the top priority! Get the necessary medical care.

- Contact Your Insurer: As soon as possible, contact your travel insurance provider to report the incident. They can provide guidance on the claims process.

- Gather Documentation: You'll need to provide supporting documentation, such as:

- Medical bills and receipts.

- Doctor's reports.

- Prescription details.

- Proof of travel (e.g., airline tickets, hotel reservations).

- Your insurance policy information.

- Complete the Claim Form: Fill out the claim form accurately and completely.

- Submit Your Claim: Submit the claim form and all supporting documentation to your insurer.

- Follow Up: Keep track of your claim status and follow up with the insurer if you haven't heard back within a reasonable timeframe.

The Peace of Mind of Medical Coverage Senior Wellbeing

Ultimately, travel insurance with good medical expense coverage is about more than just money. It's about peace of mind. Knowing that you're protected from unexpected medical costs allows you to relax and enjoy your trip to the fullest. So, do your research, compare your options, and choose a policy that gives you the confidence to explore the world without worry. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)