Senior Traveler's Theft Incident: Travel Insurance Recovery

Read a story about a senior traveler whose belongings were stolen. Learn how travel insurance reimbursed them for their losses and helped them recover.

Okay, so picture this: You've saved up for months, maybe even years, for that dream trip. You're finally there, soaking it all in, and then BAM! Disaster strikes. Your wallet's gone, your camera's vanished, your grandma's antique brooch that you swore you'd keep safe? Poof. Stolen. It's a traveler's worst nightmare, especially when you're a senior and potentially more vulnerable. But here's where travel insurance can be your superhero. Let's dive into a real-life scenario and see how it played out, plus get into some product recommendations and comparisons to help you choose the right coverage.

The Scene: Barcelona, Spain - A Senior Traveler's Theft Experience

Meet Eleanor, a 72-year-old retired teacher from Ohio. Eleanor had always dreamed of visiting Barcelona. She booked a two-week trip, meticulously planned every detail, and packed her bags with excitement. On her third day, while enjoying a coffee at a bustling outdoor cafe near Las Ramblas, Eleanor's purse, which was slung across her chair, was snatched. Gone were her credit cards, cash, driver's license, and, most tragically, her new digital camera filled with photos from the first few days of her trip.

The Immediate Aftermath: Stress and Panic for Senior Citizens

Eleanor was understandably distraught. Beyond the financial loss, she felt violated and vulnerable in a foreign country. She immediately reported the theft to the local police, but knew that recovering her belongings was unlikely. She contacted her credit card companies to cancel her cards and prevent further fraudulent charges. But the thought of navigating the rest of her trip without money, identification, or a way to capture her memories was overwhelming.

Travel Insurance to the Rescue: Filing a Claim for Stolen Items

Luckily, Eleanor had purchased a comprehensive travel insurance policy before her trip. She remembered seeing coverage for theft and loss of personal belongings. After contacting the insurance company's 24/7 assistance line, she was guided through the claims process. She provided the police report, a list of the stolen items with their estimated value, and receipts for some of the newer items. The insurance company’s representative was incredibly helpful and patient, walking her through each step.

The Reimbursement Process: How Senior Travel Insurance Works

The insurance company reviewed Eleanor's claim and, after a few weeks, approved it. She was reimbursed for the value of her stolen items, up to the policy limits. This included the cost of her camera, the cash that was stolen, and the replacement cost for her driver's license and credit cards. While the reimbursement didn't replace the sentimental value of her lost photos, it did alleviate the financial burden and allowed her to continue enjoying her trip.

Key Takeaways: Lessons Learned from Eleanor's Experience for Seniors

Eleanor's story highlights the importance of travel insurance, especially for seniors. Here are a few key takeaways:

- Comprehensive Coverage is Key: Ensure your policy covers theft, loss, and damage to personal belongings.

- Know Your Policy Limits: Understand the maximum amount the insurance company will reimburse for stolen items.

- Keep Records: Keep copies of important documents, such as your passport, driver's license, and credit card numbers, in a separate location from the originals.

- Report Theft Immediately: File a police report as soon as possible after the theft occurs. This is essential for filing a claim.

- Contact Your Insurance Company: Contact your insurance company's 24/7 assistance line for guidance and support.

Travel Insurance Product Recommendations: Top Options for Seniors

Now, let’s get into some specific travel insurance products that offer solid coverage for theft and other potential travel mishaps. Remember to always compare policies and read the fine print to find the best fit for your individual needs.

World Nomads: Adventure Travel Insurance for Active Seniors

Overview: World Nomads is a popular choice for adventurous travelers, including seniors who enjoy active vacations. They offer two main plans: Standard and Explorer. Explorer offers higher coverage limits and includes coverage for more adventurous activities.

Theft Coverage: Both plans offer coverage for theft, loss, and damage to personal belongings. The coverage limits vary depending on the plan and the specific item. For example, there might be a limit on the amount reimbursed for electronics.

Pros:

- Flexible coverage options

- Coverage for a wide range of activities

- 24/7 emergency assistance

Cons:

- Can be more expensive than some other options

- Pre-existing condition coverage may be limited

Pricing: Prices vary depending on the destination, trip length, and coverage options. A two-week trip to Europe for a 70-year-old could range from $100 to $250.

Ideal for: Active seniors who participate in outdoor activities and want comprehensive coverage.

Allianz Travel Insurance: Comprehensive Plans for Senior Travelers

Overview: Allianz offers a variety of travel insurance plans, including single-trip and annual plans. Their plans are known for their comprehensive coverage and customer service.

Theft Coverage: Allianz plans typically include coverage for theft, loss, and damage to personal belongings. The coverage limits are often higher than those offered by other providers.

Pros:

- Comprehensive coverage options

- Excellent customer service

- Option for annual plans

Cons:

- Can be more expensive than some other options

- May require a medical exam for certain pre-existing conditions

Pricing: Prices vary depending on the destination, trip length, and coverage options. A two-week trip to Europe for a 70-year-old could range from $150 to $300.

Ideal for: Seniors who want comprehensive coverage and peace of mind.

Travel Guard: Customizable Insurance Options for Elderly Travelers

Overview: Travel Guard offers customizable travel insurance plans that allow you to tailor your coverage to your specific needs. They offer a variety of add-ons, such as coverage for pre-existing conditions and adventure activities.

Theft Coverage: Travel Guard plans typically include coverage for theft, loss, and damage to personal belongings. The coverage limits can be adjusted based on your needs.

Pros:

- Customizable coverage options

- Option for add-ons

- Competitive pricing

Cons:

- Customer service can be inconsistent

- Claims process can be lengthy

Pricing: Prices vary depending on the destination, trip length, and coverage options. A two-week trip to Europe for a 70-year-old could range from $80 to $200.

Ideal for: Seniors who want to customize their coverage and are looking for a more affordable option.

Comparing Travel Insurance Plans: A Senior's Guide to Choosing the Right Coverage

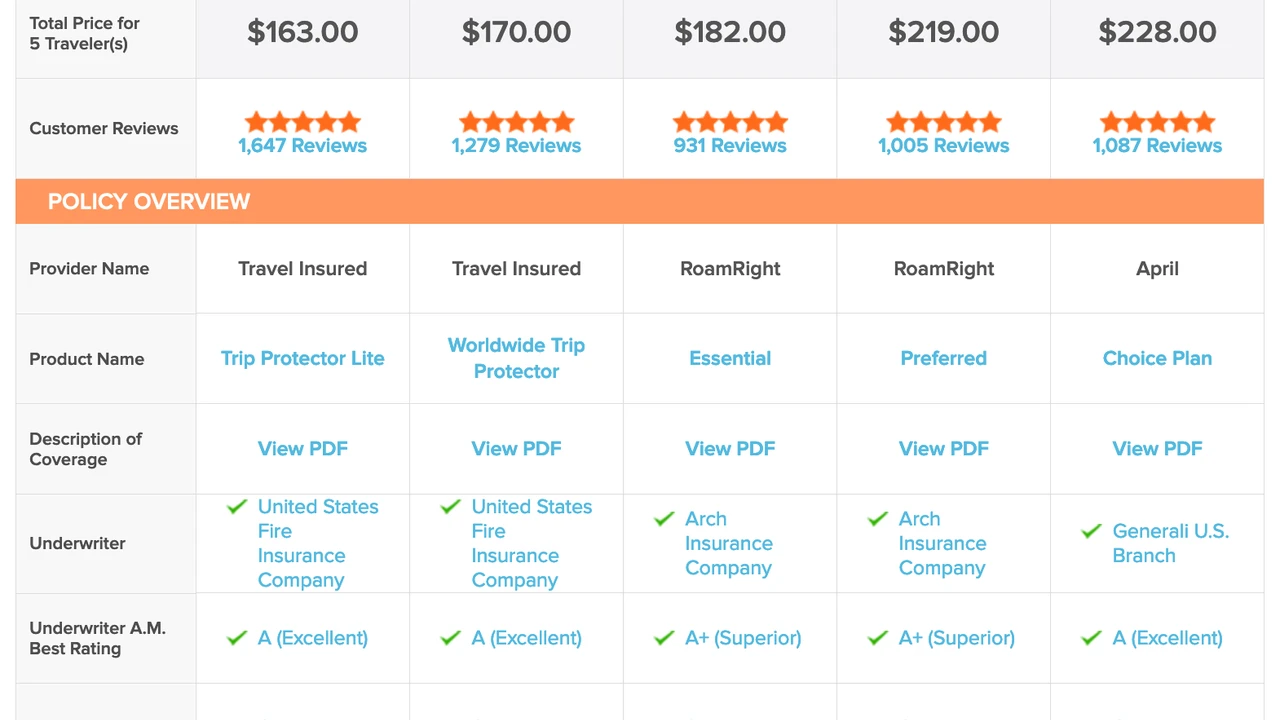

Choosing the right travel insurance plan can be overwhelming, especially with so many options available. Here's a comparison table to help you make an informed decision:

| Feature | World Nomads | Allianz Travel Insurance | Travel Guard |

|---|---|---|---|

| Theft Coverage | Included, limits vary by plan | Included, higher limits | Included, customizable limits |

| Pre-Existing Conditions | Limited coverage | May require medical exam | Add-on available |

| Customer Service | Good | Excellent | Inconsistent |

| Price | Moderate to High | High | Moderate |

| Customization | Moderate | Moderate | High |

| Best For | Active Seniors | Comprehensive Coverage | Customizable Options |

Tips for Preventing Theft While Traveling: Senior Safety First

While travel insurance can provide financial protection in case of theft, it's always best to take precautions to prevent theft from happening in the first place. Here are some tips for staying safe while traveling:

- Be Aware of Your Surroundings: Pay attention to your surroundings and be aware of potential thieves.

- Keep Valuables Hidden: Keep your valuables out of sight and reach. Consider using a money belt or a hidden pocket.

- Don't Flash Cash: Avoid displaying large amounts of cash in public.

- Use a Secure Bag: Use a bag that is difficult to open or steal from, such as a cross-body bag with a zipper closure.

- Be Cautious in Crowded Areas: Be extra cautious in crowded areas, such as markets and public transportation.

- Trust Your Instincts: If something feels wrong, remove yourself from the situation.

- Make Copies of Important Documents: Keep copies of your passport, driver's license, and credit cards in a separate location from the originals.

- Inform Your Bank and Credit Card Companies: Let your bank and credit card companies know your travel dates and destinations.

The Cost of Senior Travel Insurance: Factors Affecting Premiums

The cost of travel insurance for seniors can vary depending on several factors:

- Age: Older travelers typically pay higher premiums due to increased risk of medical emergencies.

- Destination: Travel to certain countries or regions may be more expensive to insure due to higher medical costs or increased risk of theft.

- Trip Length: Longer trips will typically cost more to insure.

- Coverage Options: More comprehensive coverage options, such as coverage for pre-existing conditions or adventure activities, will increase the premium.

- Policy Limits: Higher policy limits will also increase the premium.

- Deductible: A higher deductible will typically lower the premium.

Real-Life Scenarios: Other Types of Travel Insurance Claims for Seniors

While theft is a common concern, travel insurance can also cover a wide range of other unexpected events, such as:

- Medical Emergencies: Travel insurance can cover medical expenses, including doctor visits, hospital stays, and emergency medical evacuation.

- Trip Cancellations: Travel insurance can reimburse you for non-refundable expenses if you have to cancel your trip due to illness, injury, or other covered reasons.

- Trip Interruptions: Travel insurance can reimburse you for expenses if your trip is interrupted due to a covered event, such as a medical emergency or a natural disaster.

- Lost Luggage: Travel insurance can reimburse you for the value of your lost luggage.

- Flight Delays: Travel insurance can reimburse you for expenses incurred due to flight delays, such as meals and accommodation.

Eleanor's experience serves as a powerful reminder that travel insurance is an essential investment for seniors. It can provide financial protection, peace of mind, and access to valuable assistance services when you need them most. By carefully comparing policies, understanding your coverage options, and taking precautions to prevent theft, you can travel with confidence and enjoy your well-deserved adventures.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)