Allianz vs. World Nomads: Which is Better for Senior Travelers?

Compare Allianz and World Nomads travel insurance. Which provider offers better coverage and value for senior travelers? Evaluate policy options and choose the right plan.

Introduction Choosing the Right Travel Insurance for Seniors

Hey there fellow travelers! If you're a senior looking to explore the world, you know how important it is to have the right travel insurance. It’s not just about ticking a box; it's about protecting yourself from unexpected medical bills, lost luggage, and other travel hiccups. Two popular choices are Allianz and World Nomads, but which one is the better fit for you? Let's dive in and compare these two heavyweights in the travel insurance arena, specifically with seniors in mind. We'll break down their coverage, pricing, and suitability for different types of travel.

Allianz Travel Insurance Coverage Options for Seniors

Allianz is a well-established name in the insurance world, and their travel insurance offerings are quite comprehensive. They offer a variety of plans, from basic trip protection to more robust options that include medical coverage, trip cancellation, and baggage protection. Here’s a closer look at what they offer:

Allianz Trip Cancellation Coverage for Senior Citizens

Allianz offers strong trip cancellation benefits. If you have to cancel your trip due to illness, injury, or other covered reasons, they can reimburse your non-refundable trip costs. This is particularly important for seniors who might be more susceptible to health issues that could force them to cancel their travel plans.

Allianz Emergency Medical Coverage for Senior Travelers

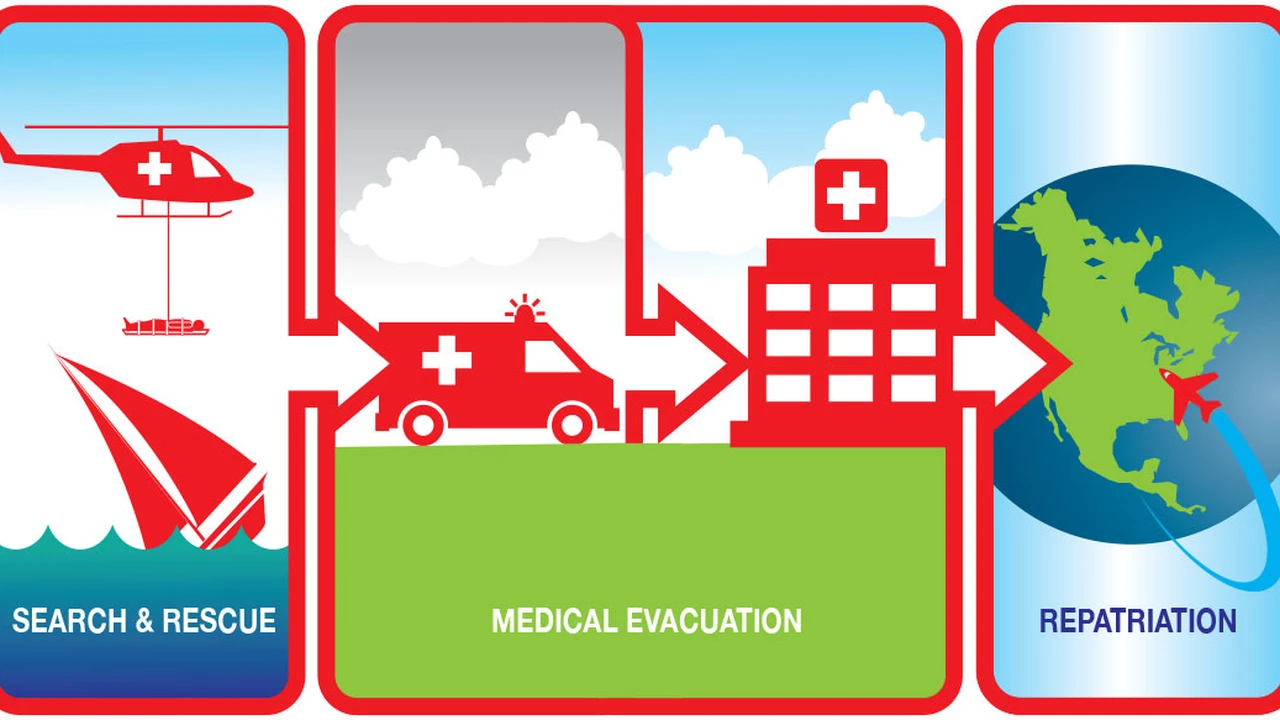

Medical coverage is a biggie, especially for seniors. Allianz plans typically include coverage for emergency medical expenses, including hospital stays, doctor visits, and prescription medications. Some plans also offer medical evacuation coverage, which can be crucial if you need to be transported to a better medical facility.

Allianz Baggage Protection for Senior Travelers Peace of Mind

Lost or delayed luggage can be a real headache. Allianz provides coverage for baggage loss, damage, and delay, helping you replace essential items if your luggage goes missing or is delayed.

Allianz Pre-Existing Conditions Coverage for Seniors Understanding the Options

This is a critical factor for many seniors. Allianz offers waivers for pre-existing conditions under certain circumstances. Typically, you need to purchase the policy within a specific timeframe after booking your trip and be medically fit to travel when you buy the policy. Always read the fine print to understand the specifics.

World Nomads Travel Insurance Coverage Options for Seniors

World Nomads is known for catering to adventurous travelers, but they also offer solid coverage options for seniors. While their plans might seem more basic than Allianz at first glance, they can be a great fit for certain types of trips. Here’s what you need to know:

World Nomads Trip Cancellation Coverage for Senior Travelers

World Nomads offers trip cancellation coverage, although it might not be as extensive as Allianz. They cover cancellations due to specific events, such as illness, injury, or natural disasters. It’s important to review the policy details to see what’s covered.

World Nomads Emergency Medical Coverage for Senior Citizens

Medical coverage is a key feature of World Nomads plans. They offer coverage for emergency medical expenses, including hospital stays, doctor visits, and emergency dental treatment. Medical evacuation coverage is also included in many plans.

World Nomads Baggage Protection for Senior Travelers

World Nomads provides coverage for baggage loss, damage, and delay. They can reimburse you for the cost of replacing essential items if your luggage is lost or delayed.

World Nomads Pre-Existing Conditions Coverage for Seniors What You Need to Know

World Nomads typically has stricter rules regarding pre-existing conditions. They generally don’t cover pre-existing conditions unless they are stable and well-managed. Be sure to carefully review the policy details and consider a more comprehensive plan if you have significant health concerns.

Allianz vs World Nomads A Detailed Comparison for Senior Travelers

Let's get down to the nitty-gritty. Here’s a side-by-side comparison of Allianz and World Nomads to help you make an informed decision:

Coverage Depth Allianz vs World Nomads

Allianz generally offers more comprehensive coverage with a wider range of benefits. They have more options for trip cancellation, interruption, and specific situations. World Nomads, while solid, tends to be more streamlined.

Price Comparison Allianz vs World Nomads

Pricing can vary depending on your age, destination, trip length, and coverage needs. Generally, World Nomads tends to be more affordable for shorter trips and younger seniors. Allianz might be more cost-effective for longer trips or seniors who need more extensive coverage.

Customer Service Allianz vs World Nomads

Allianz has a well-established customer service infrastructure. They offer phone support, online chat, and a comprehensive website with FAQs and policy information. World Nomads also has decent customer service, primarily through online channels.

Flexibility Allianz vs World Nomads

World Nomads is known for its flexibility. You can often extend your policy while you’re already traveling, which is great if you decide to prolong your adventure. Allianz offers some flexibility, but it might not be as straightforward.

Adventure Activities Allianz vs World Nomads

If you’re an adventurous senior who enjoys activities like hiking, skiing, or scuba diving, World Nomads might be a better fit. They often cover a wider range of adventure activities than Allianz. However, be sure to check the policy details to confirm that your specific activities are covered.

Recommended Products and Scenarios for Seniors Choosing Travel Insurance

Let’s look at some specific scenarios and recommended products from both Allianz and World Nomads:

Scenario 1 A Relaxing Cruise for Seniors

Scenario: You're planning a relaxing cruise in the Caribbean. You want coverage for trip cancellation, medical emergencies, and lost luggage.

Recommendation: Allianz Prime Plan.

Why: The Allianz Prime Plan offers comprehensive coverage for trip cancellation, medical expenses, and baggage protection. It also includes benefits like trip interruption and travel delay coverage. This plan is ideal for cruises because it provides peace of mind in case of unexpected events at sea.

Price: Approximately $150 - $300 for a 7-day cruise, depending on age and coverage options.

Scenario 2 An Adventurous Hiking Trip for Senior Travelers

Scenario: You're planning a hiking trip in the Rocky Mountains. You need coverage for medical emergencies, evacuation, and potential injuries from outdoor activities.

Recommendation: World Nomads Explorer Plan.

Why: The World Nomads Explorer Plan is designed for adventurous travelers. It covers a wide range of activities, including hiking, and provides coverage for medical emergencies and evacuation. This plan is perfect for seniors who enjoy outdoor adventures and need robust protection.

Price: Approximately $80 - $160 for a 7-day hiking trip, depending on age and coverage options.

Scenario 3 A Long-Term Stay Abroad for Senior Citizens

Scenario: You're planning a 3-month stay in Europe. You need comprehensive medical coverage, trip interruption benefits, and coverage for pre-existing conditions.

Recommendation: Allianz AllTrips Premier Plan.

Why: The Allianz AllTrips Premier Plan is an annual plan that offers comprehensive coverage for multiple trips throughout the year. It includes benefits like trip cancellation, medical expenses, and coverage for pre-existing conditions (with a waiver). This plan is ideal for seniors who travel frequently and need long-term protection.

Price: Approximately $400 - $800 per year, depending on age and coverage options.

Scenario 4 A Budget-Friendly Trip for Seniors

Scenario: You're planning a short, budget-friendly trip to visit family. You need basic coverage for medical emergencies and trip cancellation.

Recommendation: World Nomads Standard Plan.

Why: The World Nomads Standard Plan offers basic coverage for medical emergencies, trip cancellation, and baggage protection. It’s a more affordable option for seniors who don’t need extensive coverage but still want peace of mind.

Price: Approximately $50 - $100 for a 7-day trip, depending on age and coverage options.

Comparing Specific Products Allianz vs World Nomads for Seniors

Let's dive into a more detailed comparison of specific products from Allianz and World Nomads:

Allianz Prime Plan vs World Nomads Explorer Plan

- Allianz Prime Plan: Offers robust coverage for trip cancellation, medical emergencies, and baggage protection. Includes benefits like trip interruption and travel delay coverage.

- World Nomads Explorer Plan: Designed for adventurous travelers, covering a wide range of activities and providing coverage for medical emergencies and evacuation.

- Key Differences: Allianz Prime is better for comprehensive coverage and trip-related issues, while World Nomads Explorer is better for adventure activities and medical emergencies.

Allianz AllTrips Premier Plan vs World Nomads Long Term Coverage

- Allianz AllTrips Premier Plan: An annual plan offering comprehensive coverage for multiple trips throughout the year, including trip cancellation, medical expenses, and coverage for pre-existing conditions (with a waiver).

- World Nomads Long Term Coverage: World Nomads doesn't have a specific "long term" plan but allows you to extend your policy while traveling. This can be suitable for long trips, but it's not an annual plan.

- Key Differences: Allianz AllTrips Premier is ideal for frequent travelers needing annual coverage, while World Nomads' flexibility is better for those who want to extend their policy on the go.

Pricing Details and Factors Affecting Costs for Senior Travel Insurance

The cost of travel insurance can vary widely depending on several factors. Here’s what you need to consider:

- Age: Older travelers typically pay more for travel insurance due to the higher risk of medical issues.

- Destination: Traveling to countries with high medical costs (like the United States) can increase your premium.

- Trip Length: Longer trips usually result in higher premiums.

- Coverage Options: More comprehensive coverage, such as higher medical limits or trip cancellation benefits, will increase the cost.

- Pre-Existing Conditions: If you have pre-existing conditions, you might need to pay extra for coverage or opt for a plan with a pre-existing condition waiver.

Real-Life Examples and Testimonials from Senior Travelers

Let’s hear from some real senior travelers who have used Allianz and World Nomads:

Example 1 Allianz Customer Testimonial

“I had to cancel my cruise due to a sudden illness. Allianz reimbursed me for all my non-refundable expenses. Their customer service was excellent, and the process was straightforward.” – Mary, 72.

Example 2 World Nomads Customer Testimonial

“I fell and broke my arm while hiking in Europe. World Nomads covered all my medical expenses and arranged for my medical evacuation. I’m so grateful for their support.” – John, 68.

Final Considerations for Senior Travel Insurance

Choosing the right travel insurance is a personal decision. Consider your travel style, health needs, and budget. Read the policy details carefully and don’t hesitate to contact the insurance provider if you have any questions.

Key Takeaways Allianz vs World Nomads for Seniors

- Allianz offers more comprehensive coverage and is suitable for seniors who need robust trip cancellation, medical, and baggage protection.

- World Nomads is more affordable for shorter trips and adventurous seniors who need coverage for outdoor activities.

- Consider your specific travel needs and budget when making your decision.

- Always read the policy details carefully to understand what’s covered and what’s not.

Happy travels, and stay safe out there!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)