Senior Traveler's Evacuation: The Importance of Medical Evacuation Coverage

Emergency medical evacuation coverage is crucial for seniors. Learn how it works and why it's essential for international travel. Protect yourself from costly medical transport.

Okay, so you're planning a trip. Awesome! But before you pack your bags and dream of sunny beaches or historical landmarks, let's talk about something crucial: medical evacuation coverage. Specifically, why it's a total game-changer for senior travelers. Trust me, this isn't the most exciting topic, but it could be the most important decision you make before your trip. Let's dive in!

Understanding Medical Evacuation Insurance for Senior Travelers

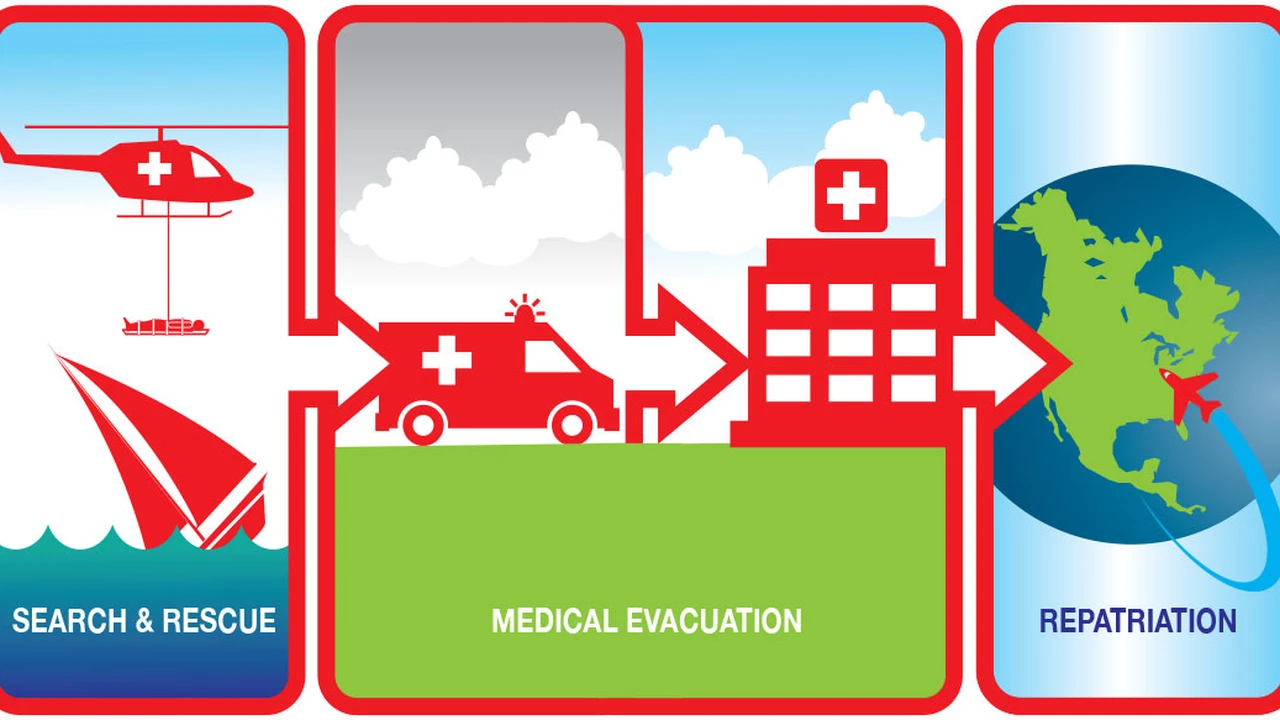

Medical evacuation insurance, often called "medevac" coverage, is designed to get you to adequate medical care if you experience a serious illness or injury while traveling. Think of it as your emergency lifeline when you're far from home and your regular doctors.

It's much more than just a trip to the nearest hospital. It covers the often-astronomical costs of transporting you, usually by air ambulance, to a facility that can provide the specialized treatment you need. This could be back home, to a larger city with better medical facilities, or even just a hospital equipped to handle your specific condition.

Why is this so important for seniors? Well, as we get older, the risk of health complications increases. Pre-existing conditions, mobility issues, and simply the stress of travel can all contribute to unexpected medical events. And let's face it, nobody wants to think about these things happening on vacation, but being prepared is key.

Why Medical Evacuation Coverage is Essential for Senior Travel

Here's the deal: standard travel insurance might cover some medical expenses, but it often falls short when it comes to evacuation. Here's why you absolutely need dedicated medevac coverage:

- Cost: Medical evacuations are ridiculously expensive. Think tens of thousands, even hundreds of thousands of dollars. A flight back to the US from a remote island in the Caribbean? You're looking at a hefty bill. Without insurance, you're on the hook.

- Location, Location, Location: If you're traveling to a remote area, a developing country, or even a cruise ship, access to quality medical care may be limited. Medevac ensures you get to the best possible care, regardless of where you are.

- Pre-Existing Conditions: Many standard travel insurance policies have strict limitations or exclusions for pre-existing conditions. Medevac coverage can be a critical supplement to ensure you're protected, even if your underlying health issues flare up.

- Peace of Mind: Let's not underestimate the value of peace of mind. Knowing you're covered in a worst-case scenario allows you to relax and enjoy your trip without constant worry.

Real-Life Scenario: A Senior's Medical Evacuation Story

Let's talk about a hypothetical, but very realistic, scenario. Imagine Mrs. Peterson, a 70-year-old woman with a history of heart problems, is on a cruise in the Mediterranean. She starts experiencing chest pain. The ship's doctor determines she needs specialized cardiac care that isn't available on board.

Without medical evacuation coverage, Mrs. Peterson would be stuck relying on the limited facilities at the next port, which might not be equipped to handle her condition. The cost of a private air ambulance back to the US could easily exceed $100,000. But because she had a comprehensive travel insurance policy with medevac coverage, she was safely transported to a top-notch cardiac center in the States, and the insurance company took care of the bill.

Key Features to Look for in Senior Medical Evacuation Insurance

Not all medical evacuation policies are created equal. Here's what to look for to ensure you're adequately protected:

- Coverage Amount: Don't skimp! Aim for at least $100,000, ideally $500,000 or even $1,000,000, depending on your destination. Medical transport can be shockingly expensive.

- Pre-Existing Condition Waiver: If you have any pre-existing conditions, make sure the policy offers a waiver. This means the insurance company won't deny coverage based on your health history (as long as you meet their requirements, usually purchasing the policy within a certain timeframe of booking your trip).

- "Medical Necessity" Clause: Understand what triggers a medical evacuation. The policy should cover evacuation when it's deemed "medically necessary" by a qualified physician, not just when you *want* to be evacuated.

- Transportation Method: Does the policy cover air ambulance, ground ambulance, or both? Air ambulance is usually the quickest and most efficient way to get you to the right medical facility.

- Destination Coverage: Make sure the policy covers the specific countries or regions you'll be visiting. Some policies have geographical limitations.

- 24/7 Assistance: Look for a policy that offers 24/7 emergency assistance. This means you can call a dedicated hotline anytime, day or night, to get help coordinating your evacuation.

- Repatriation of Remains: This is a somber but important consideration. In the unfortunate event of death, the policy should cover the cost of returning your remains home.

Comparing Medical Evacuation Insurance Providers and Plans for Seniors

Okay, let's get down to brass tacks. Here are a few reputable travel insurance companies that offer solid medical evacuation coverage for seniors. Remember to always get quotes from multiple providers and compare the fine print before making a decision.

- MedjetAssist: MedjetAssist is a membership program, not technically insurance, but it provides comprehensive medical transport services. If you require hospitalization more than 150 miles from home, they will arrange and pay for medical transport to the hospital of your choice, regardless of medical necessity. Membership fees vary based on age and coverage duration. A one-year individual membership for someone in their 70s can range from $300-$400.

- Global Rescue: Global Rescue offers a range of medical and security evacuation services. They will dispatch medical personnel to your location and provide transport to the nearest appropriate medical facility or your home hospital. Membership fees vary based on coverage area and duration, but generally start around $329 per year.

- Allianz Global Assistance: Allianz offers a variety of travel insurance plans that include medical evacuation coverage. Their plans can be customized to meet your specific needs and budget. Prices vary depending on your age, trip duration, and coverage options. A quote for a 70-year-old traveling for two weeks could range from $200-$500.

- World Nomads: While often associated with younger travelers, World Nomads offers some plans suitable for seniors, especially those seeking adventure activities. Their Explorer plan includes medical evacuation coverage. Prices are generally competitive, but be sure to carefully review the policy details.

Important Note: These prices are estimates and can vary significantly based on your individual circumstances. Always get a personalized quote from each provider before making a decision.

Using Medical Evacuation Insurance: What You Need to Know

So, you've got your policy. Now what? Here's what to do if you need to use your medical evacuation coverage:

- Contact the Insurance Company ASAP: As soon as you experience a medical emergency, contact the insurance company's 24/7 assistance hotline. They will guide you through the process and help coordinate your evacuation.

- Follow Their Instructions: The insurance company will work with medical professionals to determine the best course of action. Follow their instructions carefully.

- Keep Detailed Records: Keep copies of all medical records, receipts, and other documentation related to your medical emergency. You'll need these when you file a claim.

- Understand the Claim Process: Familiarize yourself with the insurance company's claim process. Ask questions if you're unsure about anything.

The Cost of Peace of Mind: Is Medical Evacuation Insurance Worth It?

Let's be honest, travel insurance can feel like an unnecessary expense, especially when you're already paying for flights, hotels, and activities. But medical evacuation coverage is one area where you really shouldn't skimp. The potential financial burden of an uninsured medical evacuation is simply too great.

Think of it this way: you're investing in your health and safety, and in the peace of mind that allows you to fully enjoy your trip. For seniors, medical evacuation coverage is not just a nice-to-have, it's a must-have.

So, before you book that dream vacation, take the time to research and purchase a comprehensive travel insurance policy with adequate medical evacuation coverage. You'll be glad you did.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

.webp)

Coverage: Senior Protection.webp)