Travel Insurance Broker vs. Direct Provider: Which is Best for Seniors?

Compare InsureMyTrip and Squaremouth travel insurance comparison sites Which platform is easier to use and offers the best deals for seniors Find the perfect policy for your needs

Understanding Travel Insurance Comparison Sites for Senior Citizens

Okay, so you're a senior looking for travel insurance. You've probably realized there are *tons* of options out there. That's where comparison sites come in. Think of them as your personal travel insurance shoppers. They let you see quotes from multiple companies at once, saving you time and effort. Two of the biggest names are InsureMyTrip and Squaremouth. But which one is right for *you*?

InsureMyTrip A Deep Dive into Features and Senior-Specific Benefits

InsureMyTrip is a well-established player in the travel insurance comparison game. They boast a huge selection of plans from various providers. Let's break down what they offer specifically for seniors:

- Vast Selection: They have a massive inventory of policies. This means you're likely to find something that fits your specific needs, whether it's comprehensive coverage for a European tour or basic protection for a quick trip to visit family.

- Extensive Filtering: Their filtering system is pretty robust. You can filter by age, destination, trip cost, and even specific coverage needs like pre-existing condition waivers or adventure sports coverage. This is *super* helpful for seniors who might have more specific requirements.

- Customer Reviews: InsureMyTrip features customer reviews for each plan. While you should always take reviews with a grain of salt, they can provide valuable insights into the claims process and customer service experience.

- 24/7 Assistance: They offer 24/7 travel assistance, which is a huge plus if you run into trouble while you're away. Imagine needing help in the middle of the night in a foreign country – knowing you have someone to call is a huge comfort.

- "Anytime Advocates": InsureMyTrip has a dedicated team called "Anytime Advocates" to assist with claims issues. This can be a valuable resource if you encounter difficulties with your insurance provider during the claims process.

Squaremouth Travel Insurance Simplifying the Search for Senior Coverage

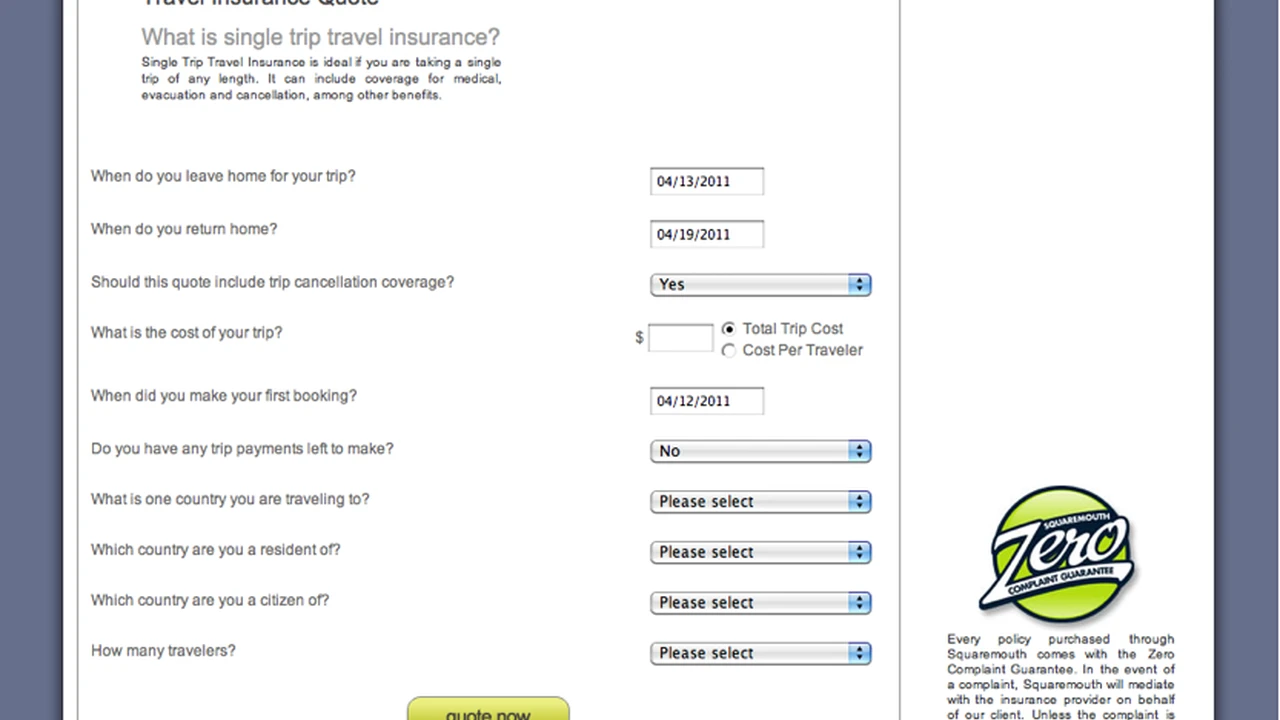

Squaremouth takes a slightly different approach. They focus on transparency and simplicity. Here's what sets them apart, especially for senior travelers:

- Zero Complaint Guarantee: This is a big one. Squaremouth promises to resolve any complaint to your satisfaction, or they'll refund your premium. That's a pretty bold statement and shows they're confident in the quality of their providers.

- Simplified Interface: Their website is clean and easy to navigate. This is a major benefit for seniors who might not be as comfortable with complex websites. It's straightforward and intuitive.

- "Real People" Reviews: Squaremouth verifies that reviews are from actual customers who purchased policies through their site. This helps ensure the reviews are genuine and reliable.

- Comprehensive Plan Information: They provide detailed information about each plan, including coverage limits, exclusions, and deductibles. They make it easier to understand what you're *actually* getting.

- Comparison Tool: Squaremouth offers a side-by-side comparison tool that allows you to easily compare multiple plans based on key features and coverage. This is extremely useful for making informed decisions.

Side-by-Side Feature Comparison InsureMyTrip vs Squaremouth for Senior Needs

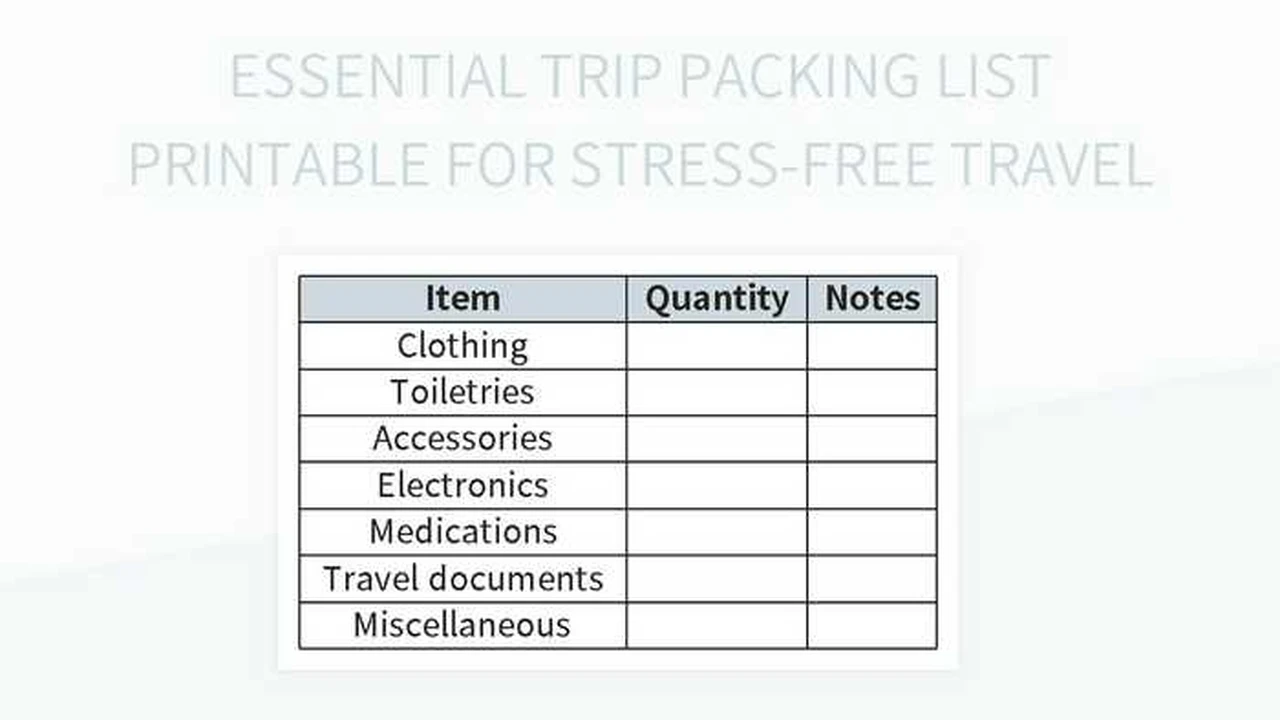

Let's get down to the nitty-gritty. Here's a table summarizing the key differences and similarities between InsureMyTrip and Squaremouth, focusing on what matters most to seniors:

| Feature | InsureMyTrip | Squaremouth |

|---|---|---|

| Plan Selection | Very Large | Large |

| Filtering Options | Extensive | Comprehensive |

| Customer Reviews | Yes | Yes (Verified) |

| 24/7 Assistance | Yes | Yes |

| Complaint Resolution | "Anytime Advocates" | Zero Complaint Guarantee |

| Website Interface | Slightly More Complex | Simpler, More Intuitive |

| Pre-Existing Condition Filters | Yes | Yes |

| Cancel For Any Reason (CFAR) Filter | Yes | Yes |

Specific Travel Insurance Products Recommended for Seniors

Okay, let's talk about some *actual* insurance plans you might find on these sites. Remember, prices can vary wildly based on your age, destination, trip length, and coverage needs. These are just examples to give you an idea.

- Allianz Global Assistance AllTrips Premier: Often found on InsureMyTrip. This is a comprehensive annual plan that's great if you travel multiple times a year. It includes coverage for trip cancellation, interruption, medical emergencies, and baggage loss. Look for this if you want overall peace of mind for frequent trips. *Estimated Price: $400 - $600 per year (varies greatly by age)*

- World Nomads Explorer Plan: Available on both sites, but often highlighted on Squaremouth. This is a popular choice for adventurous seniors. It covers a wide range of activities, including hiking, skiing, and even some extreme sports. It's a good option if you're planning an active vacation. *Estimated Price: Varies significantly based on trip length and destination, but expect to pay $80 - $200 for a 2-week trip.*

- TravelSafe Classic Plan: Frequently found on InsureMyTrip. This is a more budget-friendly option that still provides essential coverage for trip cancellation, medical expenses, and baggage loss. It's a good choice if you're looking for basic protection without breaking the bank. *Estimated Price: $50 - $100 for a 1-week trip.*

- Seven Corners RoundTrip Choice: Available on both platforms. A well-rounded plan with good medical coverage, trip interruption benefits, and options to add Cancel For Any Reason (CFAR) coverage. A solid choice for those wanting flexibility and comprehensive protection. *Estimated Price: $75 - $150 for a 1-week trip.*

Understanding Travel Insurance Costs for Senior Travelers

Keep in mind that travel insurance costs are highly personalized. Several factors influence the price you'll pay:

- Age: Older travelers generally pay more due to a higher risk of medical issues.

- Destination: Trips to countries with high healthcare costs (like the US) will typically be more expensive to insure.

- Trip Length: Longer trips require more coverage and therefore cost more.

- Coverage Level: Comprehensive plans with high coverage limits will be pricier than basic plans with lower limits.

- Pre-Existing Conditions: If you have pre-existing conditions, you may need to pay extra for a waiver or a policy that covers them.

Pro Tip: Get quotes from both InsureMyTrip and Squaremouth to compare prices and coverage options. Don't just settle for the first quote you see!

Real-World Scenarios Choosing the Right Platform Based on Your Needs

Let's look at some examples to help you decide which platform might be a better fit for your specific situation:

- Scenario 1: You're an 80-year-old with a pre-existing heart condition planning a 3-week trip to Italy. You want comprehensive medical coverage and a pre-existing condition waiver. Recommendation: Both platforms are good, but use *InsureMyTrip's* extensive filtering to find policies that specifically offer pre-existing condition waivers. Compare those plans carefully on both sites for price and reviews.

- Scenario 2: You're a 70-year-old planning a short, budget-friendly trip to visit family in Florida. You primarily need basic trip cancellation and medical coverage. Recommendation: *Squaremouth* might be a better option due to its simpler interface and focus on transparency. The Zero Complaint Guarantee is also a nice bonus.

- Scenario 3: You are a 65-year-old active senior planning a hiking trip in the Swiss Alps. You need coverage for adventurous activities and potential medical emergencies. Recommendation: Start with *Squaremouth* and filter for plans like World Nomads Explorer. Then, cross-reference the same plan on InsureMyTrip to compare pricing and read additional customer reviews.

Navigating the User Interface Ease of Use for Senior Travelers

Let's face it, not everyone is tech-savvy. Website usability is crucial, especially for seniors. Here's a breakdown of the user experience on each platform:

- InsureMyTrip: The website has a lot of information and filtering options, which can be overwhelming for some. However, the extensive filtering is a plus once you get the hang of it.

- Squaremouth: The website is cleaner and more intuitive. The simplified design makes it easier to navigate and find the information you need.

Recommendation: If you're not comfortable with complex websites, start with Squaremouth. If you're willing to spend a little time learning the interface, InsureMyTrip offers more advanced filtering capabilities.

The Importance of Customer Reviews and Ratings for Senior Travelers

Customer reviews can provide valuable insights into the quality of a travel insurance plan and the provider's customer service. Pay attention to reviews that mention:

- Claims Process: Was it easy to file a claim? Was the claim processed quickly and fairly?

- Customer Service: Was the customer service team helpful and responsive?

- Coverage: Did the policy cover the expenses that were expected?

Squaremouth's verified reviews are a plus, as they ensure the reviews are from actual customers. However, don't dismiss reviews on InsureMyTrip – just be aware that they may not all be verified.

Making the Right Choice Selecting Travel Insurance for Your Senior Trip

Ultimately, the best travel insurance comparison site for you depends on your individual needs and preferences. Both InsureMyTrip and Squaremouth offer valuable tools and resources for seniors looking for travel insurance. Take the time to compare quotes, read reviews, and understand the coverage options before making a decision.

Final Thoughts Before You Buy Your Senior Travel Insurance

Before you click "buy," remember these key takeaways:

- Read the Fine Print: Always read the policy details carefully to understand what's covered and what's not.

- Consider Your Needs: Choose a plan that meets your specific needs and budget.

- Compare Quotes: Get quotes from multiple providers to find the best deal.

- Don't Wait: Buy travel insurance as soon as you book your trip to protect yourself from unexpected events.

By following these tips, you can find the right travel insurance plan to protect yourself and your investment on your next senior adventure. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)