Emergency Medical Evacuation Coverage: A Senior's Lifeline

Emergency medical evacuation coverage is crucial for seniors. Learn how it works and why it's essential for international travel. Protect yourself from costly medical transport.

Understanding Emergency Medical Evacuation for Senior Travelers

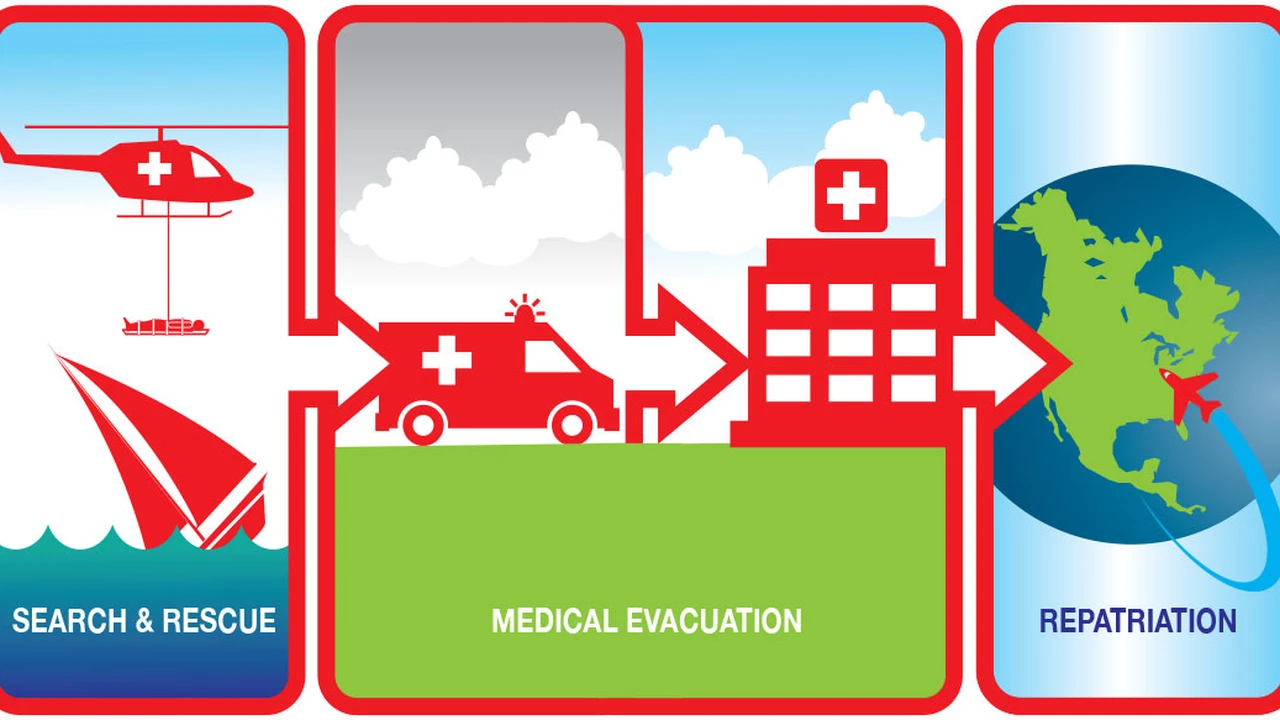

Okay, so you're planning a trip. Awesome! But let's be real, as seniors, we need to think about a few extra things, right? One of the BIGGEST is emergency medical evacuation. It sounds scary, and honestly, it *can* be, but understanding it can save your life and a whole lot of money. Think of it this way: you're enjoying a hike in the Swiss Alps, or maybe you're relaxing on a cruise in the Caribbean, and suddenly, you need serious medical attention. The local hospital might not have the facilities to treat you, or you might need to get back to the US for specialized care. That's where emergency medical evacuation comes in.

It's basically a guarantee that, if you need it, you'll be transported to the nearest adequate medical facility or even back home. We're talking helicopters, air ambulances, the whole shebang. Without it, you could be stuck with a massive bill – we're talking tens, even hundreds of thousands of dollars – for a medevac. And Medicare? Generally, it doesn't cover you outside the US. So, yeah, it's kind of a big deal.

Why Emergency Medical Evacuation is Essential for International Senior Travel

Let's break down why this is *so* important, especially when we're talking about traveling internationally. First, healthcare standards vary WILDLY around the world. A hospital in a remote village in, say, Southeast Asia, might not have the same equipment or expertise as a hospital in New York City. Second, language barriers can make getting proper care a nightmare. Imagine trying to explain your medical history in a language you barely speak while you're in excruciating pain. Third, and this is a big one, the cost of medical care in foreign countries can be astronomical, even in countries with generally lower costs of living. And finally, think about pre-existing conditions. If you have a heart condition, diabetes, or any other chronic illness, you're at a higher risk of needing medical attention while traveling.

Emergency medical evacuation isn't just about getting you to a hospital; it's about getting you to the *right* hospital, the one that can give you the best possible care. It's about having someone who speaks your language and can advocate for you. It's about avoiding financial ruin. It's about peace of mind, knowing that you're protected, no matter what happens.

What Does Emergency Medical Evacuation Coverage Actually Cover Medical Transport Costs

Okay, let's get into the nitty-gritty of what this coverage actually includes. Generally, it covers the cost of transporting you to the nearest appropriate medical facility. This could be a local hospital, or it could be a hospital back in the US. The policy will usually specify the criteria for determining when an evacuation is necessary. This often involves a physician's assessment that you require a level of care that is not available locally. The coverage typically includes transportation by ambulance, helicopter, or air ambulance, depending on the distance and the severity of your condition. It also covers the cost of medical personnel who accompany you during the evacuation to provide necessary care. Some policies even cover the cost of transporting a family member to be with you.

But here's the catch: read the fine print! Policies vary widely. Some might only cover evacuation to the *nearest* adequate facility, which might still be hundreds of miles away. Others might require pre-authorization before an evacuation can take place, which can be difficult to obtain in an emergency. And some might exclude certain activities or destinations. So, do your homework and make sure you understand exactly what your policy covers.

Comparing Emergency Medical Evacuation Insurance Products for Senior Citizens

Alright, let's talk about some specific products. Remember, I'm not a financial advisor, so this isn't financial advice! Do your own research and talk to a professional before making any decisions. But here are a few popular options and some things to consider:

- Allianz Travel Insurance: Allianz offers a range of travel insurance plans with varying levels of emergency medical evacuation coverage. Their plans are generally comprehensive and include coverage for pre-existing conditions (with certain waivers). Pros: Reputable company, good coverage options, decent customer service. Cons: Can be a bit pricey. Price Range: $100 - $500+ depending on coverage and trip length. Look for their "AllTrips Premier" or "AllTrips Executive" plans for robust evacuation coverage.

- World Nomads: World Nomads is a popular choice for adventurous travelers, and they offer emergency medical evacuation coverage as part of their plans. Their policies are generally more affordable than Allianz, but they may have lower coverage limits. Pros: Affordable, flexible, good for adventure activities. Cons: Lower coverage limits, may not be ideal for seniors with complex medical needs. Price Range: $80 - $300+. Their "Explorer" plan usually has better evacuation coverage than their "Standard" plan.

- MedjetAssist: MedjetAssist is a membership program that provides medical transport services. Unlike traditional travel insurance, MedjetAssist doesn't pay for medical bills; it simply arranges and pays for your medical transport to the hospital of your choice. Pros: Guaranteed transport to the hospital of your choice, no pre-authorization required. Cons: Doesn't cover medical bills, can be expensive. Price Range: $295 - $400+ per year for an individual membership.

- Global Rescue: Global Rescue is another membership program that provides medical and security evacuation services. They specialize in high-risk situations and remote locations. Pros: Excellent for adventure travelers and those traveling to remote areas, comprehensive coverage. Cons: Expensive. Price Range: $329 - $699+ per year depending on the level of coverage.

Important Considerations When Comparing:

- Coverage Limits: How much will the policy pay for evacuation? Make sure the limit is high enough to cover potential costs. Look for policies with at least $100,000 in coverage, and preferably more.

- Pre-Existing Conditions: Does the policy cover pre-existing conditions? If so, what are the requirements for obtaining a waiver?

- Exclusions: What activities or destinations are excluded from coverage?

- Pre-Authorization: Is pre-authorization required before an evacuation can take place? If so, how easy is it to obtain?

- 24/7 Assistance: Does the policy offer 24/7 assistance services? This can be invaluable in an emergency.

- Reputation: What is the company's reputation for customer service and claims processing? Read reviews and check with the Better Business Bureau.

Scenarios Where Emergency Medical Evacuation is a Must For US Seniors

Let's paint a picture of when this coverage is absolutely essential.

- Remote Destinations: Traveling to a remote island, a jungle, or a developing country? You NEED evacuation coverage. Medical facilities in these areas are often limited.

- Adventure Activities: Planning to hike, ski, scuba dive, or engage in other adventure activities? The risk of injury is higher, and you'll want to be prepared.

- Pre-Existing Conditions: If you have a pre-existing condition, you're at a higher risk of needing medical attention while traveling. Evacuation coverage is crucial.

- Cruises: Medical facilities on cruise ships can be limited and expensive. Evacuation coverage can get you to a better facility on land.

- Traveling Alone: If you're traveling alone, you'll want to have evacuation coverage in case you need help.

How to Find the Right Emergency Medical Evacuation Plan Medical Needs

Finding the right plan can feel overwhelming, but here are a few tips:

- Talk to Your Doctor: Discuss your travel plans and your medical history with your doctor. They can advise you on the risks and help you choose the right coverage.

- Compare Quotes: Get quotes from multiple insurance providers. Don't just focus on price; compare coverage options and policy limits.

- Read the Fine Print: I know, it's boring, but it's essential! Understand the policy terms, conditions, and exclusions.

- Work with a Travel Insurance Agent: A travel insurance agent can help you navigate the complexities of travel insurance and find the right plan for your needs.

- Consider a Membership Program: If you travel frequently or to remote areas, a membership program like MedjetAssist or Global Rescue might be a good option.

Understanding Policy Limits Deductibles and Exclusions

Let's dive a bit deeper into some key policy features. Policy limits are the maximum amount the insurance company will pay for a covered expense. For emergency medical evacuation, make sure the limit is high enough to cover the potential costs of transportation, which can easily exceed $100,000, especially for long-distance evacuations. Deductibles are the amount you have to pay out-of-pocket before your insurance coverage kicks in. A higher deductible will generally result in a lower premium, but you'll have to pay more if you need to file a claim. Exclusions are specific situations or conditions that are not covered by the policy. Common exclusions include pre-existing conditions (unless a waiver is obtained), injuries sustained while participating in extreme sports, and travel to countries with travel advisories. Understanding these factors is *key* to choosing the right policy.

Real Life Senior Travel Insurance Scenarios Medical Evacuation

Let's look at some hypothetical (but very real) scenarios:

- Scenario 1: A 70-year-old woman with a history of heart problems is on a cruise in the Caribbean. She experiences chest pain and needs to be evacuated to a hospital with cardiac specialists. Without emergency medical evacuation coverage, she could be stuck with a bill of tens of thousands of dollars for the air ambulance.

- Scenario 2: An 80-year-old man is hiking in the Andes Mountains and falls, breaking his leg. He needs to be evacuated by helicopter to the nearest hospital. Without evacuation coverage, he would have to pay for the helicopter transport out of pocket.

- Scenario 3: A 65-year-old woman is traveling in Southeast Asia and contracts a serious infection. The local hospital lacks the facilities to treat her, and she needs to be evacuated back to the US for specialized care. The cost of an international air ambulance can be astronomical.

Protecting Yourself From Costly Medical Transport Senior Advice

The bottom line? Emergency medical evacuation coverage is an absolute must for seniors traveling internationally, especially those with pre-existing conditions or those planning to engage in adventure activities. It's not just about the money; it's about your health, your safety, and your peace of mind. Do your research, compare quotes, read the fine print, and choose a policy that provides adequate coverage for your needs. Don't leave home without it! It's one of the most important things you can do to protect yourself while traveling.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)