Protecting Your Personal Information: Senior Travel Security Tips

Travel Insurance and Frequent Flyer Miles: Maximizing Rewards

Medicare typically doesn't cover healthcare costs outside the US. Learn how travel insurance can supplement your coverage and protect you from medical expenses abroad. Understand the limitations of Medicare while traveling.

Understanding Travel Insurance and Frequent Flyer Programs

Okay, so you're a savvy senior traveler. You've racked up those frequent flyer miles, and you're ready to jet off on that dream vacation. But what about protecting your trip? Can you somehow combine the magic of travel insurance with your hard-earned miles? The short answer is... it's complicated. You usually can't directly *pay* for travel insurance with frequent flyer miles. But, there are ways to leverage your miles to offset travel costs and make travel insurance more affordable. Let's dive in!

Can You Directly Pay for Travel Insurance with Miles? The Reality Check

Let’s get this out of the way first: most travel insurance companies don’t directly accept frequent flyer miles as payment. Airlines and hotels have loyalty programs that allow you to redeem miles for travel, but insurance companies generally operate differently. Their revenue models are based on cash payments, not point redemptions.

Think about it: travel insurance companies need to pay out claims. They can’t pay a hospital bill in miles! So, while the idea of using a mountain of miles to secure your insurance is appealing, it's generally not an option.

Indirect Ways to Leverage Miles for Cheaper Travel Insurance Costs

Don't despair! There are still some clever ways to use your miles to make travel insurance more accessible and affordable. It's all about thinking outside the box.

Using Miles to Reduce Overall Trip Costs: The Domino Effect

The most effective way to leverage your miles is to use them to reduce your overall trip expenses. This frees up cash that you can then allocate to travel insurance. Here's how:

- Flights: This is the most obvious one. Redeem your miles for flights, especially long-haul international flights, where the cash value is highest. This can save you hundreds or even thousands of dollars.

- Accommodation: Many hotel chains have loyalty programs that allow you to redeem points for free nights. Use your points to cover your hotel stay, freeing up your budget for travel insurance.

- Rental Cars: Some car rental companies partner with airlines and hotel chains, allowing you to redeem miles or points for rentals. Check your loyalty program accounts for these options.

- Experiences and Activities: Certain credit cards and travel portals offer the ability to redeem points for tours, activities, and experiences. This can further reduce your out-of-pocket expenses, making travel insurance more affordable.

By strategically using your miles to cover these major travel expenses, you'll have more cash available to invest in comprehensive travel insurance.

Credit Card Travel Insurance Benefits: A Hidden Gem for Mileage Enthusiasts

Many travel rewards credit cards offer built-in travel insurance benefits as a perk of card membership. If you're already earning miles on your credit card, you might be surprised to find that you're already covered for certain travel mishaps!

Here's what to look for:

- Trip Cancellation/Interruption Insurance: This covers you if you have to cancel or interrupt your trip due to covered reasons like illness, injury, or a family emergency.

- Baggage Delay/Loss Insurance: This reimburses you for expenses incurred due to delayed or lost baggage.

- Emergency Medical Insurance: This covers medical expenses incurred while traveling abroad.

- Rental Car Insurance: Some cards offer primary or secondary rental car insurance coverage.

Important Considerations:

- Read the fine print: Credit card travel insurance benefits often have limitations and exclusions. Understand what's covered and what's not before relying on this coverage.

- Coverage amounts: The coverage amounts may be lower than what you need, especially for medical emergencies. Consider supplementing your credit card coverage with a separate travel insurance policy.

- Activation requirements: Some cards require you to pay for your trip with the card to activate the travel insurance benefits.

Examples of Credit Cards with Travel Insurance Benefits:

- Chase Sapphire Preferred/Reserve: These cards offer comprehensive travel insurance benefits, including trip cancellation/interruption, baggage delay/loss, and emergency medical coverage.

- American Express Platinum: This card offers a variety of travel insurance benefits, including trip cancellation/interruption and baggage insurance.

- Capital One Venture X: This card offers trip cancellation/interruption, baggage delay, and rental car insurance.

Before purchasing separate travel insurance, carefully review the travel insurance benefits offered by your credit cards. You might already have some coverage in place!

Cash Back Rewards and Travel Insurance: A Simple Equation

While you can't directly use miles, some credit cards offer cash back rewards instead of miles. You can then use this cash back to pay for your travel insurance policy. This is a straightforward way to indirectly leverage your credit card rewards for travel protection.

How it works:

- Earn cash back on your everyday purchases.

- Redeem your cash back for a statement credit or direct deposit.

- Use the cash to pay for your travel insurance policy.

Examples of Cash Back Credit Cards:

- Chase Freedom Unlimited: Offers a flat rate of cash back on all purchases.

- Discover it Cash Back: Offers rotating bonus categories with higher cash back rates.

- Capital One Quicksilver: Offers a flat rate of cash back on all purchases.

Choosing the Right Travel Insurance for Senior Travelers

Okay, so you've figured out how to leverage your miles and rewards to make travel insurance more affordable. Now, let's talk about choosing the right policy. As a senior traveler, your needs are different than those of younger travelers. Here's what to consider:

Pre-Existing Conditions: The Most Important Consideration for Seniors

This is the big one. Many travel insurance policies exclude coverage for pre-existing conditions. A pre-existing condition is any medical condition that you've been diagnosed with or treated for in the months leading up to your trip. This can include anything from diabetes to heart disease to arthritis.

How to get coverage for pre-existing conditions:

- Look for a "waiver" of the pre-existing condition exclusion: Some policies offer a waiver if you purchase the policy within a certain timeframe of your initial trip deposit (usually 14-21 days). This means that the insurance company will cover expenses related to your pre-existing condition.

- Consider a policy with a "look-back period": Some policies have a look-back period, which means they'll cover pre-existing conditions if you haven't received treatment for them within a certain period (e.g., 60, 90, or 180 days) before your policy purchase date.

- Be honest and upfront: Don't try to hide your pre-existing conditions. This could invalidate your policy and leave you with no coverage.

Example: John, a 70-year-old with well-managed diabetes, purchased a travel insurance policy with a waiver of the pre-existing condition exclusion within 14 days of booking his cruise. When he experienced a diabetic episode onboard, his travel insurance covered his medical expenses.

Emergency Medical Coverage: High Limits are Key

Medical emergencies can be incredibly expensive, especially abroad. Make sure your policy has high limits for emergency medical coverage. Aim for at least $100,000, and preferably more if you're traveling to a country with high healthcare costs.

What to look for:

- Coverage for hospital stays, doctor visits, and prescription drugs.

- Coverage for emergency medical evacuation: This is crucial if you need to be transported to a hospital or medical facility.

- 24/7 assistance services: Look for a policy that offers 24/7 assistance services, including medical referrals and translation assistance.

Example: Mary, a 65-year-old, fell and broke her hip while hiking in Italy. Her travel insurance policy covered her hospital stay, surgery, and medical evacuation back to the United States, saving her hundreds of thousands of dollars.

Trip Cancellation/Interruption Coverage: Protect Your Investment

As you get older, the risk of needing to cancel or interrupt your trip due to illness or injury increases. Make sure your policy has adequate trip cancellation/interruption coverage to protect your investment.

What to look for:

- Coverage for covered reasons: Common covered reasons include illness, injury, death of a family member, and natural disasters.

- "Cancel For Any Reason" (CFAR) coverage: This allows you to cancel your trip for any reason and receive a partial refund (usually 50-75% of your trip cost). CFAR coverage is more expensive, but it provides the most flexibility.

Example: Robert, a 72-year-old, had to cancel his trip to Japan due to a sudden illness. His trip cancellation insurance reimbursed him for his non-refundable airfare and hotel expenses.

Other Important Coverage Options: Don't Overlook These

- Baggage Loss/Delay: This covers you if your luggage is lost, stolen, or delayed.

- Accidental Death and Dismemberment (AD&D): This provides benefits in case of accidental death or injury.

- Rental Car Insurance: This covers damage to your rental car.

Travel Insurance Product Recommendations for Seniors

Now that you know what to look for, let's take a look at some specific travel insurance products that are well-suited for senior travelers. Remember to always get quotes from multiple providers and compare coverage options before making a decision.

Allianz Travel Insurance: A Reliable Choice

Allianz Travel Insurance is a well-known and reputable provider that offers a variety of plans to suit different needs and budgets. They are known for their comprehensive coverage and excellent customer service.

Key Features:

- Wide range of plans: From basic to comprehensive coverage.

- Coverage for pre-existing conditions: With certain conditions and limitations.

- 24/7 assistance services: Available worldwide.

- Trip cancellation/interruption coverage.

- Emergency medical coverage.

Example Plan: Allianz Global Assistance Premier Plan

- Emergency Medical: Up to $50,000

- Trip Cancellation: 100% of trip cost

- Trip Interruption: 150% of trip cost

- Baggage Loss/Delay: $2,000/$500

- Price: Varies based on age, trip cost, and destination. Expect to pay around $100-$300 for a week-long trip.

- Best Use Case: Comprehensive coverage for international travel, especially for those concerned about medical emergencies and trip cancellations.

World Nomads: Adventure Travel Insurance for Active Seniors

While often marketed towards younger backpackers, World Nomads can also be a good option for active seniors who are planning adventurous trips. They offer coverage for a wide range of activities, including hiking, skiing, and scuba diving.

Key Features:

- Coverage for adventure activities.

- Emergency medical coverage.

- Trip cancellation/interruption coverage.

- Online claims process.

Example Plan: World Nomads Explorer Plan

- Emergency Medical: Up to $100,000

- Trip Cancellation: Up to the trip cost (subject to limitations)

- Trip Interruption: Up to the trip cost (subject to limitations)

- Baggage Loss/Delay: $3,000/$750

- Price: Generally more expensive than Allianz, ranging from $150-$400 for a week-long trip.

- Best Use Case: Adventure travel, hiking, skiing, and other outdoor activities.

Travel Guard: A Trusted Name in Travel Insurance

Travel Guard is another well-established travel insurance provider with a wide range of plans and coverage options. They are known for their reliable customer service and comprehensive coverage.

Key Features:

- Variety of plans to choose from.

- 24/7 assistance services.

- Trip cancellation/interruption coverage.

- Emergency medical coverage.

Example Plan: Travel Guard Preferred Plan

- Emergency Medical: Up to $50,000

- Trip Cancellation: 100% of trip cost

- Trip Interruption: 150% of trip cost

- Baggage Loss/Delay: $1,000/$500

- Price: Similar to Allianz, ranging from $100-$300 for a week-long trip.

- Best Use Case: General travel coverage, good for both domestic and international trips.

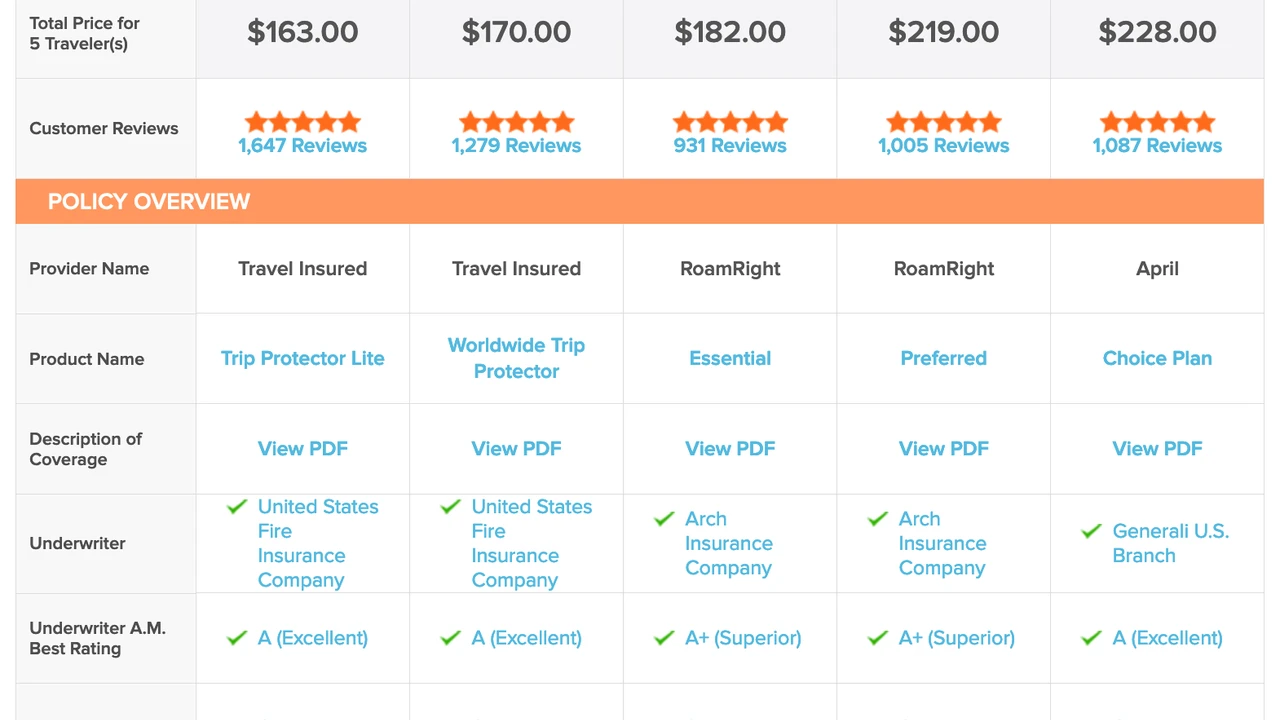

Comparing Travel Insurance Providers: A Quick Guide

Here's a quick comparison table to help you choose the right provider:

| Provider | Key Features | Price Range (Week-Long Trip) | Best Use Case |

|---|---|---|---|

| Allianz Travel Insurance | Comprehensive coverage, pre-existing condition coverage (with limitations), 24/7 assistance | $100-$300 | International travel, medical emergencies, trip cancellations |

| World Nomads | Adventure activities, emergency medical, online claims | $150-$400 | Adventure travel, hiking, skiing |

| Travel Guard | Variety of plans, 24/7 assistance, reliable customer service | $100-$300 | General travel coverage, domestic and international trips |

Final Thoughts: Travel Smart, Travel Protected

Planning a trip as a senior traveler requires careful consideration, especially when it comes to travel insurance. By understanding your needs, leveraging your frequent flyer miles and credit card rewards, and choosing the right policy, you can travel with confidence and peace of mind. Don't leave home without it!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)