Travel Insurance and Medicare: What Seniors Need to Know

Medicare typically doesn't cover healthcare costs outside the US. Learn how travel insurance can supplement your coverage and protect you from medical expenses abroad. Understand the limitations of Medicare while traveling.

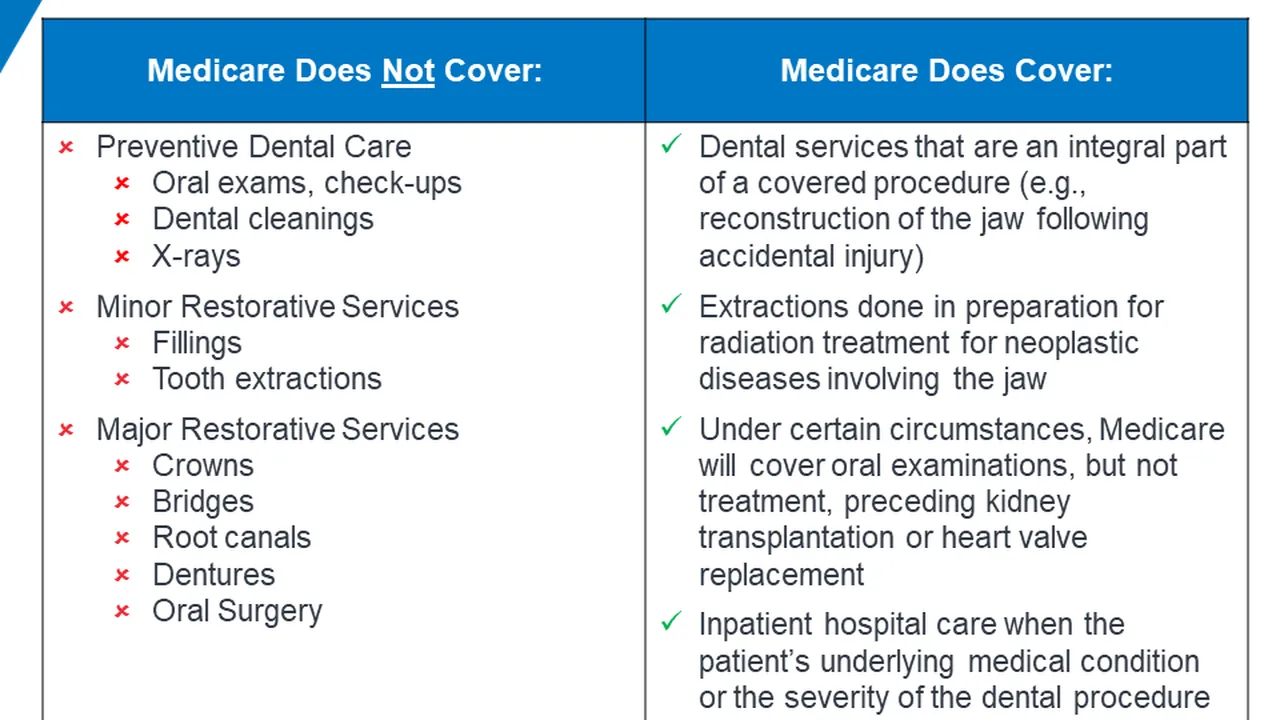

Understanding Medicare's Limitations Outside the US for Senior Travelers

Okay, so you're a senior citizen in the US, and you've got Medicare. That's great! It's a fantastic program that helps millions of Americans afford healthcare. But here's the kicker: Medicare's coverage is pretty much limited to the United States. Once you step outside US borders, Medicare often takes a vacation of its own, leaving you to foot the bill for any medical expenses that might pop up. This is a HUGE concern for seniors planning international trips. Imagine getting sick or injured in a foreign country and having to pay out of pocket for everything – doctor visits, hospital stays, even emergency transportation. That's where travel insurance comes in, acting as a safety net when Medicare doesn't reach.

Why Travel Insurance is Essential When Medicare Falls Short Abroad

Think of travel insurance as a supplement to your Medicare coverage when you're traveling internationally. It fills in the gaps and provides coverage for things that Medicare simply doesn't handle outside the US. This includes:

- Emergency Medical Expenses: This is the big one. If you need to see a doctor or go to the hospital while you're abroad, travel insurance can cover those costs.

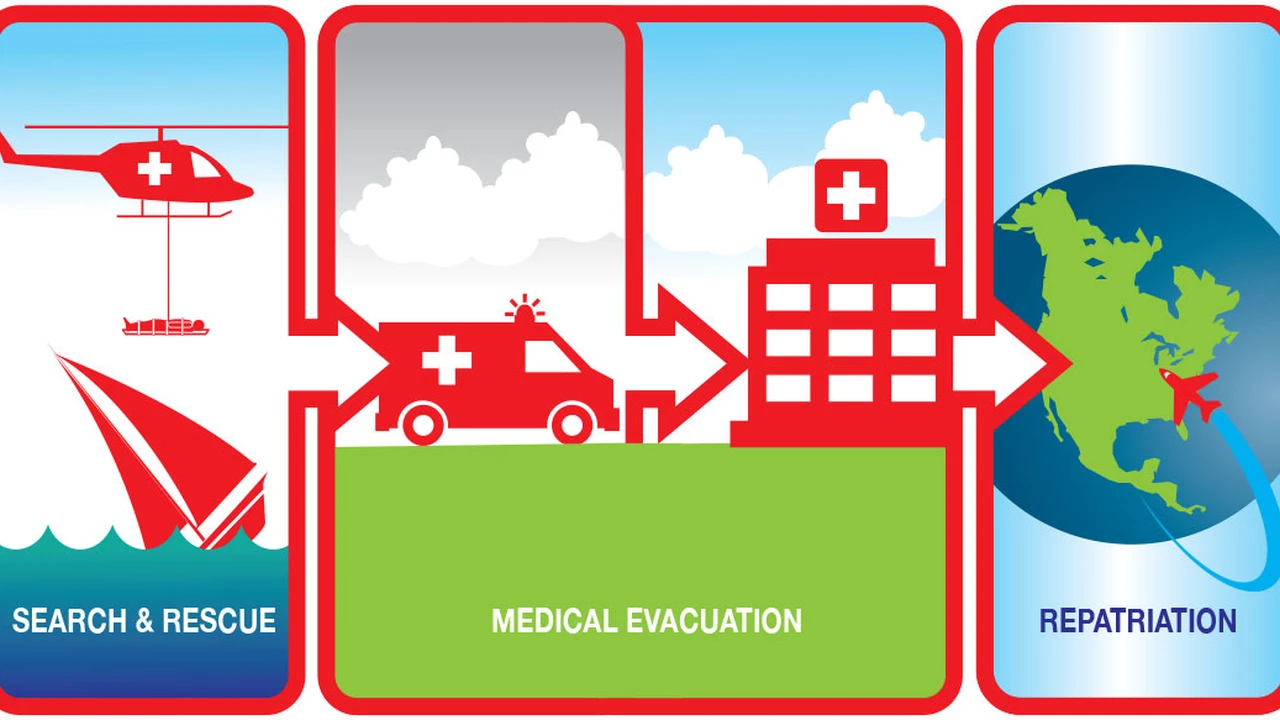

- Medical Evacuation: If you have a serious medical emergency and need to be transported to a better-equipped facility or even back home to the US, travel insurance can cover the often-astronomical costs of medical evacuation.

- Trip Interruption: If you have to cut your trip short due to a medical emergency or other covered reason, travel insurance can reimburse you for your unused travel expenses.

- Lost or Stolen Medications: Running out of medication is a serious concern. Some travel insurance policies will help you get replacement medication or will reimburse you for the cost to replace it.

Basically, travel insurance is your financial shield against unexpected medical costs and travel disruptions when Medicare isn't there to protect you. It's peace of mind in a policy.

Specific Travel Insurance Products for Seniors with Medicare: A Comparison

So, you're convinced you need travel insurance. Now, let's dive into some specific products that are well-suited for seniors with Medicare. Remember, it's always a good idea to get quotes from multiple companies and compare the coverage and prices to find the best fit for your needs.

1. Allianz Travel Insurance: Comprehensive Coverage with Options for Pre-Existing Conditions

Allianz is a well-known and reputable travel insurance provider. They offer a range of plans with varying levels of coverage. Their comprehensive plans are a great option for seniors because they often include coverage for pre-existing conditions (with certain conditions and waivers, of course!), emergency medical expenses, medical evacuation, and trip interruption. They also have 24/7 assistance services, which can be invaluable if you need help while you're abroad.

- Typical Use Case: A senior with a stable pre-existing condition (e.g., well-managed diabetes or hypertension) traveling to Europe for a two-week vacation.

- Pros: Comprehensive coverage, options for pre-existing conditions, 24/7 assistance.

- Cons: Can be pricier than some other options.

- Approximate Price: Varies depending on age, trip length, and coverage level, but expect to pay around $150-$300 for a two-week trip for a senior.

2. World Nomads: Adventure Travel Insurance with High Medical Coverage

While World Nomads is often marketed towards younger backpackers, they also offer excellent coverage for seniors, especially those who are active and adventurous. Their plans typically have high medical coverage limits, which is crucial for international travel. They also cover a wide range of activities, from hiking to scuba diving (check the specific policy details for covered activities).

- Typical Use Case: An active senior planning a hiking trip in the Himalayas or a scuba diving trip in the Caribbean.

- Pros: High medical coverage limits, covers a wide range of activities, relatively affordable.

- Cons: May not be the best option for seniors with significant pre-existing conditions.

- Approximate Price: Expect to pay around $100-$250 for a two-week trip, depending on the plan and coverage level.

3. Travel Guard: Customizable Plans with Excellent Customer Service

Travel Guard is another reputable travel insurance provider that offers customizable plans. This is a great option if you want to tailor your coverage to your specific needs and budget. They also have a reputation for excellent customer service, which can be a big plus if you need to file a claim or have questions about your policy.

- Typical Use Case: A senior who wants to customize their coverage to fit their specific needs and budget.

- Pros: Customizable plans, excellent customer service, good coverage for trip cancellations and interruptions.

- Cons: May not have the highest medical coverage limits compared to some other providers.

- Approximate Price: Prices vary widely depending on the level of customization, but expect to pay around $120-$350 for a two-week trip.

4. Medjet: Medical Transport and Evacuation Membership

Medjet is different from traditional travel insurance. It's a membership program that focuses specifically on medical transport and evacuation. If you have a medical emergency while traveling and need to be transported to a hospital of your choice (within your home country), Medjet will arrange and pay for the transport, regardless of medical necessity. This can be a lifesaver if you want to be treated at your preferred hospital, even if it's far away.

- Typical Use Case: A senior who wants to ensure they can be transported to their preferred hospital in case of a medical emergency, regardless of location.

- Pros: Guarantees transport to your hospital of choice, covers transport costs regardless of medical necessity.

- Cons: Doesn't cover other travel-related expenses like trip cancellations or lost luggage. You'll still need separate travel insurance for those.

- Approximate Price: Annual memberships start around $300-$400.

Travel Insurance Plan Comparison Table for Seniors

To make your decision easier, here's a quick comparison table summarizing the key features of each plan:

| Provider | Key Features | Pros | Cons | Approximate Price (2-week trip) |

|---|---|---|---|---|

| Allianz Travel Insurance | Comprehensive coverage, options for pre-existing conditions | Comprehensive, 24/7 assistance | Can be pricier | $150-$300 |

| World Nomads | High medical coverage, covers adventure activities | High medical limits, affordable | May not be best for significant pre-existing conditions | $100-$250 |

| Travel Guard | Customizable plans, excellent customer service | Customizable, great customer support | Medical coverage limits may be lower | $120-$350 |

| Medjet | Medical transport to hospital of choice | Guaranteed transport, covers regardless of medical necessity | Doesn't cover other travel expenses | $300-$400 (annual membership) |

Factors to Consider When Choosing Travel Insurance for Seniors with Medicare

Choosing the right travel insurance policy can feel overwhelming. Here are some key factors to consider:

- Your Age and Health: Older seniors or those with pre-existing conditions may need more comprehensive coverage and should be prepared to pay a higher premium.

- Your Destination: Healthcare costs vary significantly around the world. If you're traveling to a country with high medical costs (e.g., Switzerland, Norway), you'll want a policy with high medical coverage limits.

- Your Activities: If you plan to participate in adventure activities, make sure your policy covers them.

- Your Budget: Travel insurance is an investment, but you don't want to break the bank. Compare quotes from multiple providers to find the best value for your money.

- Policy Exclusions: Carefully review the policy exclusions to understand what's NOT covered.

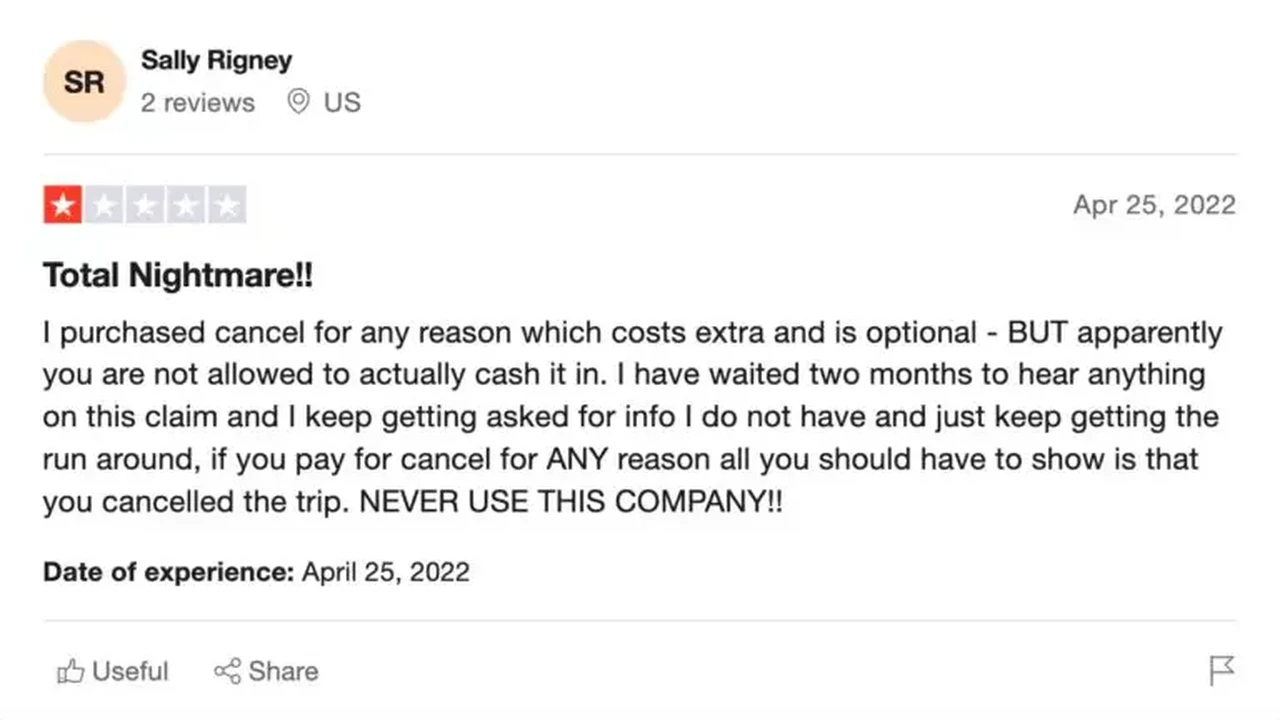

- Customer Reviews: Read reviews from other seniors to get an idea of the provider's customer service and claims process.

Understanding Policy Limits and Deductibles for Senior Travel Insurance

It's crucial to understand the policy limits and deductibles of your travel insurance plan. Policy limits are the maximum amount the insurance company will pay for a covered expense. Make sure the limits are high enough to cover potential medical expenses in your destination. Deductibles are the amount you have to pay out of pocket before the insurance company starts paying. A higher deductible will typically result in a lower premium, but you'll have to pay more if you need to file a claim.

Filing a Claim: What Seniors Need to Know About Travel Insurance Reimbursement

If you need to file a claim, be sure to follow the insurance company's instructions carefully. You'll typically need to provide documentation such as medical bills, receipts, and police reports. Keep copies of all documents for your records. If your claim is denied, you have the right to appeal the decision.

Tips for Saving Money on Travel Insurance for Seniors with Medicare

Here are some tips for saving money on travel insurance:

- Compare Quotes: Get quotes from multiple providers and compare the coverage and prices.

- Choose a Higher Deductible: A higher deductible will lower your premium.

- Consider an Annual Plan: If you travel frequently, an annual plan may be more cost-effective than buying individual policies for each trip.

- Look for Discounts: Some providers offer discounts for seniors, veterans, or members of certain organizations.

- Buy Early: Buying your policy early can protect you from trip cancellation fees if you have to cancel your trip before you leave.

The Importance of Reading the Fine Print in Your Senior Travel Insurance Policy

This cannot be stressed enough! Always, always, ALWAYS read the fine print of your travel insurance policy. Understand the terms, conditions, exclusions, and limitations. This will help you avoid surprises and ensure you're adequately protected.

Staying Safe and Healthy While Traveling: Senior Travel Tips

While travel insurance is essential, it's also important to take steps to stay safe and healthy while traveling:

- Consult Your Doctor: Talk to your doctor before your trip to get any necessary vaccinations or medications.

- Pack a First-Aid Kit: Include essential medications, bandages, and pain relievers.

- Stay Hydrated: Drink plenty of water to avoid dehydration.

- Eat Healthy: Choose healthy foods and avoid street food that may be contaminated.

- Get Enough Rest: Avoid overexertion and get plenty of sleep.

- Be Aware of Your Surroundings: Be aware of your surroundings and take precautions to avoid crime.

Navigating Pre-Existing Condition Coverage with Medicare and Travel Insurance

One of the biggest concerns for seniors is pre-existing condition coverage. Many travel insurance policies have limitations or exclusions for pre-existing conditions. However, some policies offer waivers or riders that can provide coverage for these conditions. Be sure to disclose any pre-existing conditions when you purchase your policy.

Understanding the Claims Process: A Step-by-Step Guide for Seniors with Medicare

Filing a travel insurance claim can seem daunting, but it doesn't have to be. Here's a step-by-step guide:

- Notify the Insurance Company: Contact the insurance company as soon as possible after the incident occurs.

- Gather Documentation: Collect all relevant documents, such as medical bills, receipts, and police reports.

- Complete the Claim Form: Fill out the claim form accurately and completely.

- Submit Your Claim: Submit your claim and all supporting documentation to the insurance company.

- Follow Up: Follow up with the insurance company to check on the status of your claim.

Real-Life Examples: How Travel Insurance Helped Seniors with Medicare Abroad

To illustrate the importance of travel insurance, here are some real-life examples:

- Example 1: A senior traveler fell and broke her hip while on a cruise in the Caribbean. Her travel insurance covered her medical expenses, including surgery and rehabilitation.

- Example 2: A senior traveler had to cancel his trip to Europe due to a sudden illness. His travel insurance reimbursed him for his non-refundable travel expenses.

- Example 3: A senior traveler lost her luggage while flying to Asia. Her travel insurance reimbursed her for the cost of her lost belongings.

Conclusion: Protecting Your Health and Finances While Traveling as a Senior with Medicare

Traveling as a senior with Medicare requires careful planning, especially when it comes to healthcare coverage. Travel insurance is an essential tool for supplementing your Medicare coverage and protecting you from unexpected medical expenses and travel disruptions. By understanding the limitations of Medicare, comparing travel insurance options, and choosing the right policy for your needs, you can travel with confidence and peace of mind. Always remember to read the fine print and understand your coverage. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)