Travel Insurance for Pre-Existing Conditions: Comparing Top Providers

Compare travel insurance providers that cover pre-existing conditions. Find the right policy to protect your health and travel plans. Don't let your health concerns hold you back.

Understanding Pre-Existing Conditions and Travel Insurance for Seniors

Okay, let's talk about something super important if you're a senior with a pre-existing condition planning a trip: travel insurance. It can feel like navigating a minefield, right? You're probably thinking, "Will they even cover me? What if something happens while I'm away?" Don't worry, we're going to break it down. A pre-existing condition, in travel insurance terms, is any health issue you've received medical advice, diagnosis, or treatment for before buying your policy. This includes everything from diabetes and heart conditions to arthritis and even well-managed high blood pressure. The key is disclosure! Always, always be upfront with your insurance provider about your medical history. Hiding something can invalidate your policy, leaving you on the hook for potentially massive medical bills.

Why Travel Insurance with Pre-Existing Condition Coverage Matters

Imagine this: You're on a dream vacation in Italy, and your chronic back pain flares up, requiring a visit to a local doctor. Without the right travel insurance, you could be facing hundreds or even thousands of dollars in medical expenses out-of-pocket. That's where pre-existing condition coverage comes in. It can cover medical expenses related to your condition, trip interruptions if your condition worsens before your trip, and even emergency medical evacuation if necessary. It's not just about the money; it's about peace of mind. Knowing you're covered allows you to relax and enjoy your trip without constantly worrying about your health.

Key Features to Look for in Travel Insurance for Pre-Existing Conditions

So, what should you be looking for when shopping for travel insurance that covers pre-existing conditions? Here's a checklist:

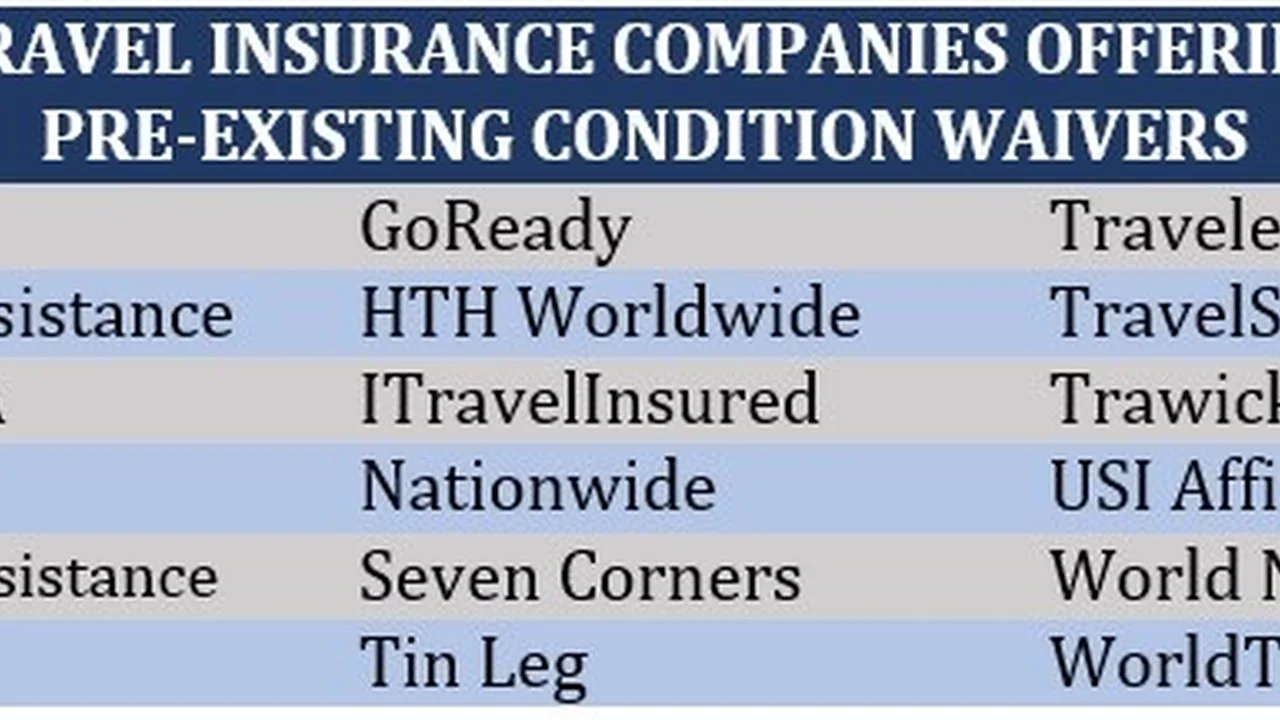

- Waiver for Pre-Existing Conditions: This is gold! A waiver means the insurance company won't deny coverage for claims related to your pre-existing condition if you meet certain requirements (usually purchasing the policy within a specific timeframe after booking your trip).

- Look-Back Period: Pay attention to the "look-back period." This is the timeframe the insurance company will review your medical history. A shorter look-back period (e.g., 60 days) is generally better than a longer one (e.g., 180 days).

- Adequate Medical Coverage: Make sure the policy offers sufficient medical coverage for your destination. Medical costs can vary significantly from country to country.

- Emergency Medical Evacuation: This is a must-have, especially for international travel. Medical evacuation can be incredibly expensive, and you want to be sure you're covered if you need to be transported to a hospital or back home.

- Trip Interruption Coverage: This covers you if your pre-existing condition flares up before or during your trip, forcing you to cancel or cut your trip short.

- 24/7 Assistance: A good travel insurance policy will offer 24/7 assistance services, so you can get help anytime, anywhere.

Comparing Top Travel Insurance Providers for Pre-Existing Conditions

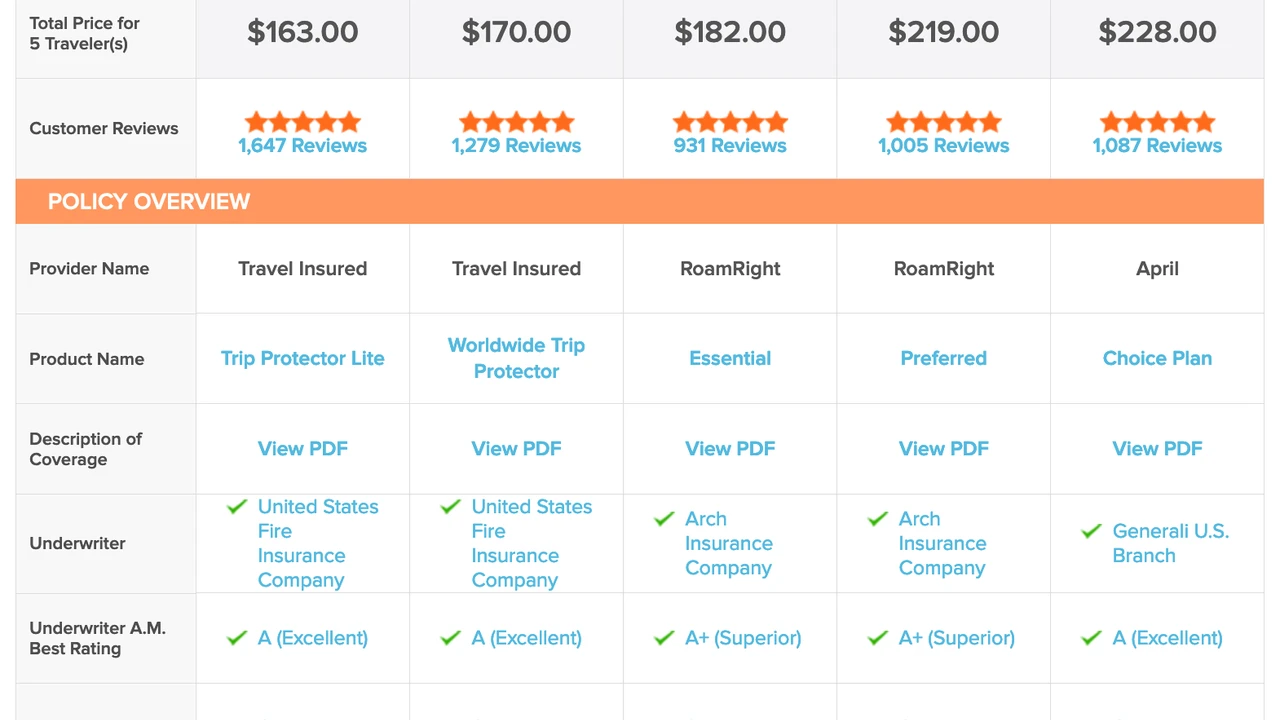

Alright, let's get down to the nitty-gritty. Here are some of the top travel insurance providers that offer coverage for pre-existing conditions, along with some specific product recommendations:

1 WorldTrips Atlas America

Overview: WorldTrips is known for its comprehensive medical coverage, including coverage for pre-existing conditions with a waiver if certain conditions are met. Their Atlas America plan is popular among US travelers.

Coverage Highlights:

- Emergency medical coverage up to \$2,000,000.

- Coverage for pre-existing conditions with a waiver (must purchase within 14 days of initial trip deposit, be medically able to travel at the time of purchase, and insure the full trip cost).

- Emergency medical evacuation.

- Trip interruption coverage.

Use Case: Ideal for seniors traveling internationally who want high medical coverage and the possibility of a pre-existing condition waiver.

Pricing: Varies based on age, trip length, and coverage options. Expect to pay around \$100 - \$300 for a two-week trip for a senior, depending on the specifics.

2 Seven Corners RoundTrip Choice

Overview: Seven Corners offers a variety of travel insurance plans, and their RoundTrip Choice plan is a good option for seniors looking for comprehensive coverage, including pre-existing condition coverage.

Coverage Highlights:

- Emergency medical coverage up to \$500,000.

- Pre-existing condition coverage (must purchase within 21 days of initial trip deposit).

- Trip cancellation and interruption coverage.

- Baggage loss and delay coverage.

Use Case: Suitable for seniors who want a balance of coverage and affordability, with a decent pre-existing condition coverage option.

Pricing: Generally more affordable than WorldTrips. A two-week trip for a senior might cost around \$80 - \$250.

3 Allianz Global Assistance

Overview: Allianz is a well-known and reputable travel insurance provider. They offer a variety of plans, some of which include pre-existing condition coverage if specific requirements are met.

Coverage Highlights (Specific Plan Dependent - e.g., AllTrips Premier):

- Emergency medical coverage up to \$50,000 (can vary by plan).

- Pre-existing medical condition exclusion waiver (typically requires purchasing the plan within 14 days of the initial trip payment and insuring the full trip cost).

- Trip cancellation and interruption coverage.

- 24-hour hotline assistance.

Use Case: Good for seniors who want the security of a well-established brand and are able to purchase their policy soon after booking their trip to qualify for the pre-existing condition waiver. AllTrips Premier is a solid choice for frequent travelers.

Pricing: Can range from \$120 - \$400+ for a two-week trip, depending on the chosen plan and coverage levels.

4 Travel Guard

Overview: Travel Guard (an AIG company) is another major player in the travel insurance market. They offer a range of plans with varying levels of coverage, including options for pre-existing conditions.

Coverage Highlights (Specific Plan Dependent):

- Emergency medical coverage (amount varies by plan).

- Pre-existing medical condition exclusion waiver available (requirements vary but often include purchasing within a specific timeframe and insuring the full trip cost).

- Trip cancellation and interruption coverage.

- Baggage loss and delay coverage.

Use Case: A good option for seniors who want customizable coverage and the flexibility to choose a plan that fits their specific needs and budget. Consider their Gold or Platinum plans for more comprehensive coverage.

Pricing: Pricing is highly variable depending on the plan and options selected. Expect a range of \$90 - \$350+ for a two-week trip.

5 MedjetAssist

Overview: MedjetAssist is a membership program that focuses primarily on medical transportation. It's not technically travel insurance, but it's worth considering, especially if you're concerned about medical evacuation.

Coverage Highlights:

- Medical transport to the hospital of your choice (within your home country) if you become hospitalized while traveling more than 150 miles from home.

- No claim forms or deductibles.

- 24/7 medical transport coordination.

Use Case: Best for seniors who are primarily concerned about getting home to their preferred hospital in case of a serious medical emergency. It complements traditional travel insurance well.

Pricing: Annual memberships range from \$295 to \$399, depending on the membership type.

Comparing Specific Products: A Scenario-Based Approach

Let’s look at a few scenarios to illustrate how these different plans might work in practice:

Scenario 1: Diabetes Management on a Cruise

The Situation: A 70-year-old with well-managed diabetes is taking a cruise to the Caribbean. They want coverage in case their blood sugar becomes unstable and they need medical attention.

Recommended Options:

- Allianz AllTrips Premier: Provides a solid pre-existing condition waiver if purchased within the required timeframe. Cruise-specific coverage is also a plus.

- Seven Corners RoundTrip Choice: Offers pre-existing condition coverage and is generally more affordable than Allianz.

Why: Both plans offer coverage for medical expenses related to diabetes flare-ups, but it's crucial to ensure the policy is purchased within the required timeframe to activate the pre-existing condition waiver.

Scenario 2: Heart Condition and European Tour

The Situation: An 80-year-old with a history of heart problems is planning a three-week tour of Europe. They are most concerned about emergency medical evacuation and high medical costs.

Recommended Options:

- WorldTrips Atlas America: Offers high medical coverage limits and potential for a pre-existing condition waiver. The strong focus on medical evacuation is ideal.

- MedjetAssist (in addition to travel insurance): Ensures transport to a hospital of their choice back home if needed.

Why: Given the higher risk profile and potential for significant medical expenses in Europe, a plan with high medical coverage and emergency evacuation is paramount. MedjetAssist provides an extra layer of security for getting back home.

Scenario 3: Arthritis Flare-Up on a Road Trip

The Situation: A 65-year-old with arthritis is planning a cross-country road trip in the US. They want coverage in case their arthritis flares up and they need to see a doctor or physical therapist.

Recommended Options:

- Travel Guard Gold or Platinum: Offers customizable coverage options and can be tailored to include coverage for arthritis flare-ups.

- Seven Corners RoundTrip Choice: Provides a balance of coverage and affordability for domestic travel.

Why: While domestic medical costs are generally lower, having coverage for doctor visits, physical therapy, and prescription medications is still important. Travel Guard offers more flexibility in customizing coverage, while Seven Corners provides a more budget-friendly option.

Understanding Policy Limitations and Exclusions

Okay, it's crucial to remember that even the best travel insurance policies have limitations and exclusions. Here are a few common ones to be aware of:

- Stability Clauses: Some policies require your pre-existing condition to be "stable" for a certain period (e.g., 60 or 90 days) before your trip. This means there haven't been any changes in medication or treatment.

- Exclusions for Specific Activities: If you plan to participate in risky activities like extreme sports, your policy may not cover injuries related to those activities.

- Mental Health Coverage: Travel insurance policies often have limited coverage for mental health issues.

- Pregnancy-Related Issues: Coverage for pregnancy-related issues may be limited or excluded.

- Acts of War or Terrorism: Most policies exclude coverage for events related to acts of war or terrorism.

Always read the policy documents carefully to understand what's covered and what's not.

Tips for Finding the Best Deal on Senior Travel Insurance with Pre-Existing Condition Coverage

Finding affordable travel insurance with pre-existing condition coverage can be challenging, but here are a few tips to help you save money:

- Shop Around: Get quotes from multiple providers and compare coverage options and prices.

- Buy Early: Purchasing your policy soon after booking your trip can help you qualify for pre-existing condition waivers.

- Consider a Higher Deductible: A higher deductible will lower your premium but means you'll have to pay more out-of-pocket if you file a claim.

- Look for Discounts: Some providers offer discounts for seniors, members of certain organizations, or those who purchase annual plans.

- Work with a Broker: A travel insurance broker can help you compare policies from multiple providers and find the best coverage for your needs.

The Bottom Line: Protecting Your Health and Your Trip

Traveling with pre-existing conditions doesn't have to be stressful. By understanding your coverage options, comparing providers, and being upfront about your medical history, you can find the right travel insurance policy to protect your health and your trip investment. So, do your research, get quotes, and travel with peace of mind!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)