Travel Insurance Reviews: What Seniors Are Saying About Top Companies

Read travel insurance reviews from other seniors. Learn about their experiences with different providers and policies. Make an informed decision based on real-world feedback.

Understanding the Importance of Senior Travel Insurance Reviews

Choosing the right travel insurance can be daunting, especially with so many options available. Senior travelers have unique needs, making it even more critical to find a policy that fits their specific requirements. That's where travel insurance reviews come in. By reading about other seniors' experiences, you can gain valuable insights into the pros and cons of different companies and policies.

Think of it like this: you wouldn't buy a car without reading reviews, would you? Travel insurance is the same – it's an investment in your peace of mind, and you want to make sure you're making a smart decision. Reviews provide a real-world perspective that goes beyond marketing claims and policy jargon.

What to Look for in Senior Travel Insurance Reviews

When reading reviews, pay attention to the following:

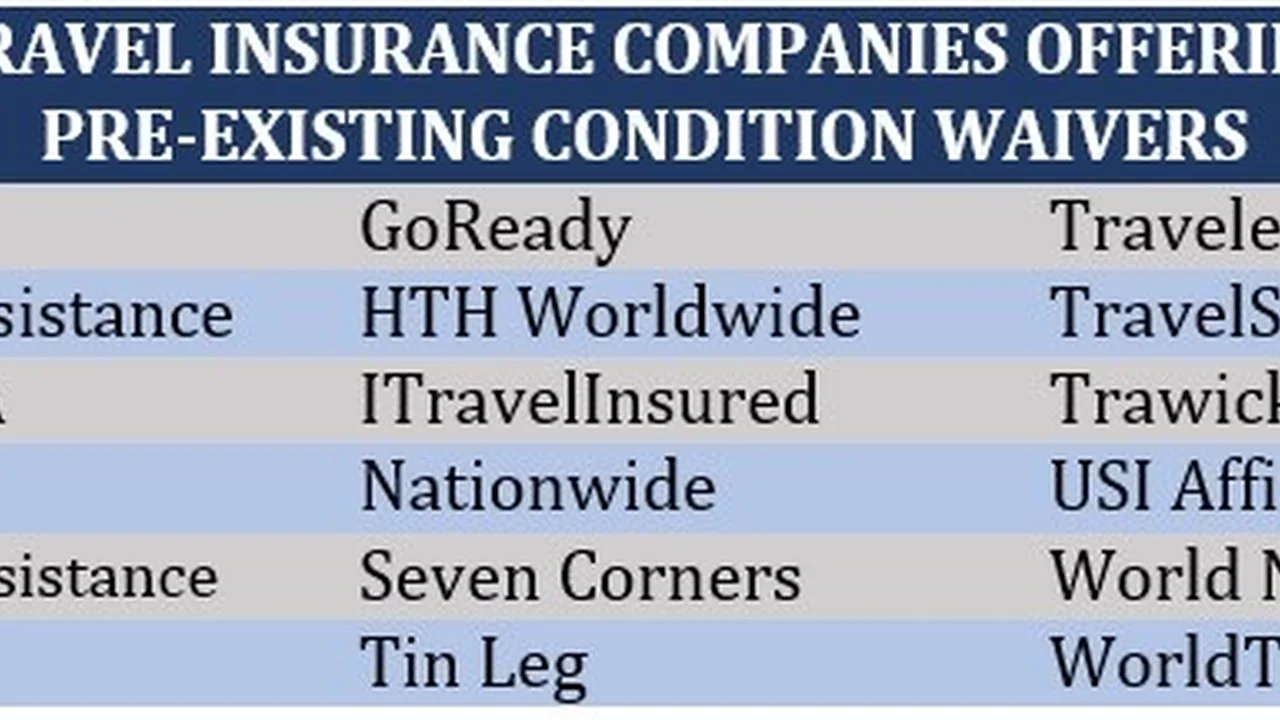

- Coverage for Pre-Existing Conditions: This is a major concern for many seniors. Look for reviews that discuss how well the insurance company handles pre-existing conditions and whether they offer waivers.

- Medical Coverage: Adequate medical coverage is essential, especially when traveling abroad. Reviews should mention the policy's medical limits, deductible, and whether it covers emergency medical evacuation.

- Customer Service: Good customer service is crucial, especially if you need to file a claim while traveling. Look for reviews that mention the company's responsiveness, helpfulness, and ease of communication.

- Claims Process: A smooth claims process is essential. Reviews should mention how easy it is to file a claim, how long it takes to process, and whether the company is fair in its payouts.

- Price: While price shouldn't be the only factor, it's still important. Compare the cost of different policies and see if the coverage justifies the price.

- Specific Needs: Look for reviews from seniors with similar travel plans and health conditions as you. Their experiences will be more relevant to your situation. For example, reviews regarding travel insurance for seniors with diabetes or travel insurance for seniors with heart conditions will be particularly insightful if either applies to you.

Top Travel Insurance Companies: Senior Reviews and Recommendations

Here are some of the top travel insurance companies for seniors, based on reviews and expert recommendations:

Allianz Travel Insurance Senior Reviews

Allianz is a well-known and reputable travel insurance company that offers a wide range of policies. They are known for their comprehensive coverage, including pre-existing conditions, medical expenses, and trip cancellations. Many reviewers praise Allianz for their excellent customer service and easy claims process.

Sample Review: "I've used Allianz for several years and have always been impressed with their coverage. I had to file a claim for a medical emergency while traveling in Europe, and they were very helpful and responsive. I would definitely recommend them to other seniors."

Product Recommendation: Allianz Prime Plan. This plan offers robust coverage, including trip cancellation, interruption, medical expenses, and baggage loss. It also includes coverage for pre-existing conditions with certain conditions met.

Allianz Prime Plan Scenarios: Best suited for overseas trips, cruises, or any trip where medical emergencies are a significant concern. Ideal for seniors with pre-existing conditions looking for comprehensive coverage.

Allianz Prime Plan Pricing: Prices vary based on age, trip duration, and coverage level. A quote for a 70-year-old traveling for two weeks could range from $150 to $300.

World Nomads Senior Travel Insurance Reviews

World Nomads is a popular choice for adventurous travelers, including seniors who enjoy exploring off-the-beaten-path destinations. They offer flexible policies that can be customized to fit your specific needs. However, some reviewers note that their coverage for pre-existing conditions may be limited.

Sample Review: "I used World Nomads for a backpacking trip through Southeast Asia. Their coverage was great, and I felt safe knowing I had medical coverage if something happened. The online claims process was also very easy."

Product Recommendation: World Nomads Explorer Plan. This plan offers higher coverage limits for medical expenses, trip interruptions, and adventure activities. It's a good choice for active seniors who plan to participate in outdoor activities.

World Nomads Explorer Plan Scenarios: Best for adventure travel, such as hiking, skiing, or scuba diving. Ideal for seniors who need higher medical coverage limits.

World Nomads Explorer Plan Pricing: Prices are generally higher than basic plans, ranging from $200 to $400 for a two-week trip for a 70-year-old.

Travel Guard Senior Travel Insurance Reviews

Travel Guard is a well-established travel insurance company that offers a variety of policies to suit different needs and budgets. They are known for their strong customer service and helpful online resources. However, some reviewers have noted that their prices can be higher than other companies.

Sample Review: "I've used Travel Guard for several trips and have always been happy with their service. They are very responsive and helpful, and their website is easy to navigate. I would recommend them to anyone looking for travel insurance."

Product Recommendation: Travel Guard Premium Plan. This plan offers comprehensive coverage, including trip cancellation, interruption, medical expenses, and baggage loss. It also includes 24/7 travel assistance services.

Travel Guard Premium Plan Scenarios: Suitable for any type of trip, especially those requiring a high level of support and assistance. Ideal for seniors who value customer service and comprehensive coverage.

Travel Guard Premium Plan Pricing: Prices are typically in the mid-range, from $180 to $350 for a two-week trip for a 70-year-old.

Travelex Senior Travel Insurance Reviews

Travelex is another popular travel insurance company that offers a range of policies and coverage options. Reviews often highlight their competitive pricing and customizable plans. Some reviews, however, mention that the claims process can sometimes be slow.

Sample Review: "Travelex offered the best price for the coverage I needed. The policy was easy to understand and the website was user-friendly."

Product Recommendation: Travelex Travel Select Plan. This plan allows for customization of coverage limits and add-ons, providing flexibility to tailor the policy to individual needs.

Travelex Travel Select Plan Scenarios: Perfect for travelers who want to customize their coverage and are looking for a balance between price and protection.

Travelex Travel Select Plan Pricing: Offers competitive pricing, potentially ranging from $140 to $320 for a two-week trip for a 70-year-old, depending on customization.

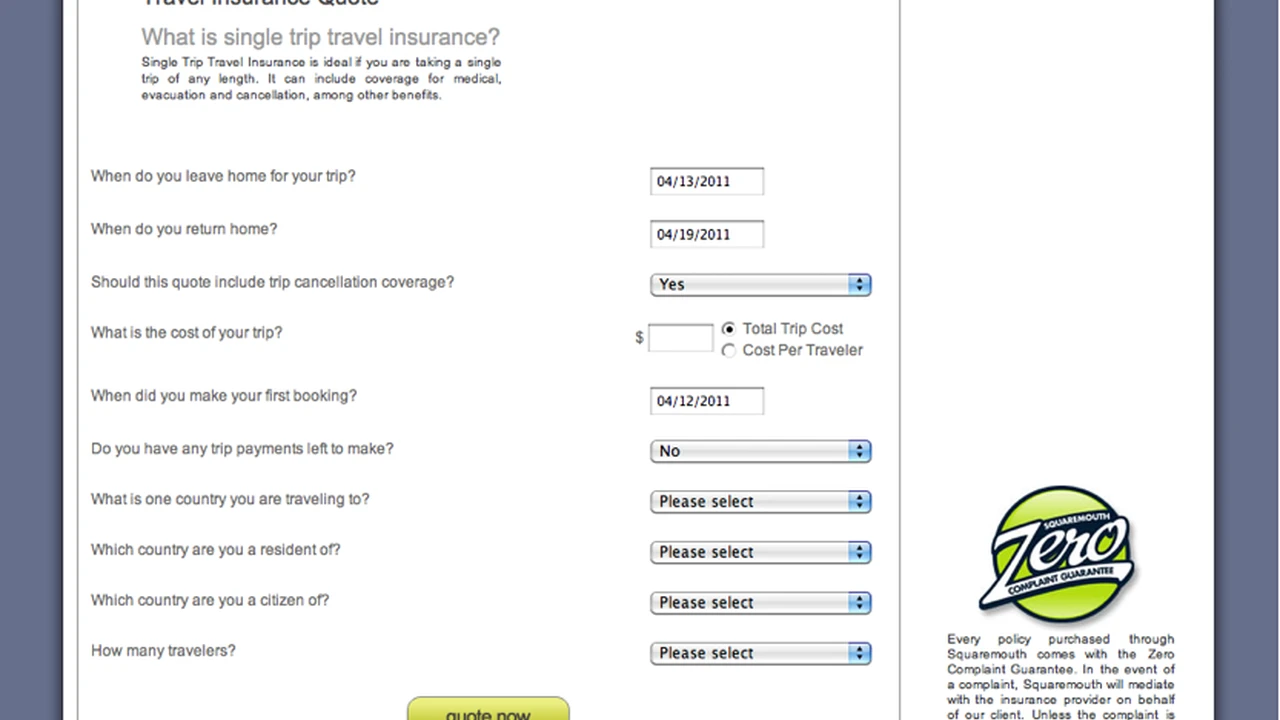

InsureMyTrip and Squaremouth Senior Travel Insurance Comparison Reviews

InsureMyTrip and Squaremouth are online travel insurance comparison websites that allow you to compare policies from multiple providers. These platforms can be helpful for finding the best deals and coverage options. Reviews often praise their ease of use and comprehensive search filters. However, some users prefer dealing directly with insurance companies.

Sample Review (InsureMyTrip): "InsureMyTrip made it easy to compare different policies and find the best coverage for my needs. I would definitely use them again."

Sample Review (Squaremouth): "Squaremouth has a great search filter that allows you to find policies that cover pre-existing conditions. I found the perfect policy for my trip using their website."

InsureMyTrip and Squaremouth Recommendation: Use both platforms to compare quotes and coverage options. Pay attention to the reviews and ratings of each provider before making a decision.

InsureMyTrip and Squaremouth Scenarios: Ideal for seniors who want to compare multiple policies quickly and easily. Best for finding specialized coverage, such as pre-existing condition waivers.

InsureMyTrip and Squaremouth Pricing: These platforms are free to use. The prices of the policies will vary depending on the provider and coverage options.

Specific Product Comparisons for Senior Travelers

Let's dive a bit deeper and compare some specific products based on common senior travel needs:

High Medical Coverage: Allianz Prime vs. World Nomads Explorer

If your primary concern is high medical coverage, both Allianz Prime and World Nomads Explorer are excellent choices. However, they cater to different needs. Allianz Prime offers broader coverage for pre-existing conditions, while World Nomads Explorer is geared towards adventure activities. If you have significant pre-existing conditions, Allianz Prime might be the better option. If you're planning adventurous activities, World Nomads Explorer is likely the better fit.

Cancel For Any Reason (CFAR) Coverage: Travel Guard Premium vs. Travelex Travel Select

CFAR coverage allows you to cancel your trip for any reason and receive a partial refund. Travel Guard Premium and Travelex Travel Select both offer CFAR as an add-on. Travel Guard's CFAR coverage typically refunds a higher percentage of the trip cost, but it's also more expensive. Travelex's CFAR coverage is more affordable but offers a lower refund percentage. Consider your budget and risk tolerance when choosing between these options.

Analyzing Real User Scenarios: Senior Travel Insurance in Action

Reading hypothetical scenarios is helpful, but hearing about real-life experiences can be even more insightful. Here are some common scenarios where travel insurance can be a lifesaver for senior travelers:

Scenario 1: Unexpected Medical Emergency Abroad

Imagine you're traveling in Italy and experience a sudden medical emergency requiring hospitalization. Without travel insurance, you could face tens of thousands of dollars in medical bills. A comprehensive policy like Allianz Prime would cover your medical expenses, including hospital stays, doctor visits, and prescription drugs. It would also provide 24/7 assistance to help you navigate the local healthcare system.

Scenario 2: Lost Luggage and Essential Medications

Losing your luggage can be stressful, especially if it contains essential medications. Travel insurance with baggage loss coverage, like Travel Guard Premium, would reimburse you for the cost of replacing your lost belongings, including your medications. It would also provide assistance in tracking down your luggage.

Scenario 3: Trip Cancellation Due to Illness

If you have to cancel your trip due to a sudden illness, trip cancellation insurance, like Travelex Travel Select with the cancellation add-on, would reimburse you for your non-refundable expenses, such as flights, hotels, and tours. This can save you a significant amount of money and prevent you from losing your entire trip investment.

Tips for Making an Informed Decision on Senior Travel Insurance

Here are some additional tips to help you choose the right travel insurance policy:

- Start Early: Don't wait until the last minute to buy travel insurance. The earlier you buy, the more protection you'll have.

- Read the Fine Print: Carefully review the policy terms and conditions to understand the coverage limits, exclusions, and pre-existing condition clauses.

- Compare Quotes: Get quotes from multiple providers and compare their coverage options and prices.

- Consider Your Needs: Choose a policy that meets your specific needs and travel plans.

- Ask Questions: Don't hesitate to contact the insurance company or a travel insurance agent if you have any questions.

- Check Customer Reviews: Before making a decision, check customer reviews to see what other seniors are saying about the company and its policies.

- Verify Coverage Details: Confirm that the policy covers your specific concerns, such as pre-existing conditions, adventure activities, or specific destinations.

- Understand the Claims Process: Familiarize yourself with the claims process so you know what to do if you need to file a claim.

Navigating Pre-Existing Conditions and Senior Travel Insurance

One of the biggest challenges for senior travelers is finding coverage for pre-existing conditions. Many policies have exclusions or limitations on coverage for these conditions. However, some companies offer waivers or riders that can provide coverage for pre-existing conditions if certain criteria are met. It's crucial to disclose any pre-existing conditions when purchasing travel insurance and to carefully review the policy terms to understand the coverage limitations. Looking for senior travel insurance pre existing conditions covered will help narrow down your search.

The Future of Senior Travel Insurance

The travel insurance industry is constantly evolving to meet the changing needs of travelers. We can expect to see more policies that offer personalized coverage options, increased flexibility, and improved customer service. Technology will also play a role in making it easier to compare policies, file claims, and access assistance while traveling. As the senior travel market continues to grow, we can anticipate even more innovative and tailored travel insurance solutions for older adults.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)